- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Derogatory marks with high credit score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Derogatory marks with high credit score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Anonymous wrote:Ok, So i had a bunch of negatives from 2009. Filed BK in april 2010. Discharged Jan 2011. 4 more late payments in 2012. Same account first was 30 and then became 60, 90, and finally 120. I paid it off and closed the account in oct 2012. Perfect history since then. I have over 130k in available credit, 11 percent utilization, 4 new chase cards all in the last 6 months. . 29, 15, 13 inquires. People love pulling experian but I dont think inquiries really mean anything. My ficos are 741, 748, 758. I just got approved for a new bmw over the weekend with top tier credit. The highest any of my scores have reached so far is 761, but I think I will beat that soon when I lower the utilization with the two dollar trick. I think 800 is possible for me, even with the bk and 4 lates showing on my profile.

Well you can say they don't mean anything but I just had 2 inquiries age to a year on my EX and my score went up 10 pts from 793 to 803. That's may not be a huge difference but it can be the difference of Good or Very Good in terms of credit score categories. In my case it went from Very Good to Exceptional. That can mean a lot when applying for a mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@EdMan63 wrote:

@Anonymous wrote:Ok, So i had a bunch of negatives from 2009. Filed BK in april 2010. Discharged Jan 2011. 4 more late payments in 2012. Same account first was 30 and then became 60, 90, and finally 120. I paid it off and closed the account in oct 2012. Perfect history since then. I have over 130k in available credit, 11 percent utilization, 4 new chase cards all in the last 6 months. . 29, 15, 13 inquires. People love pulling experian but I dont think inquiries really mean anything. My ficos are 741, 748, 758. I just got approved for a new bmw over the weekend with top tier credit. The highest any of my scores have reached so far is 761, but I think I will beat that soon when I lower the utilization with the two dollar trick. I think 800 is possible for me, even with the bk and 4 lates showing on my profile.

Well you can say they don't mean anything but I just had 2 inquiries age to a year on my EX and my score went up 10 pts from 793 to 803. That's may not be a huge difference but it can be the difference of Good or Very Good in terms of credit score categories. In my case it went from Very Good to Exceptional. That can mean a lot when applying for a mortgage.

Inquiries often do affect score. However, they are not a "negative event".

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Anonymous wrote:

@Credit_hawk wrote:A 30,60,90 day late IS a derogatory. They're one in the same. I think it's just semantics.

It is semantics, but late payments are considered delinquencies not derogatories. The presense of delinquencies however can give you a derogatory score card, as evidenced by T. Thumb's image posted above. Not that the language really matters as they are both obviously negative items that adversely impact score.

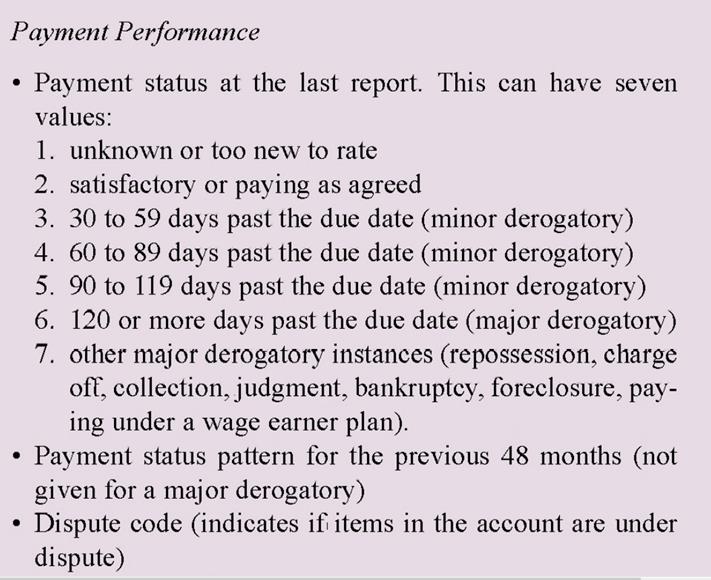

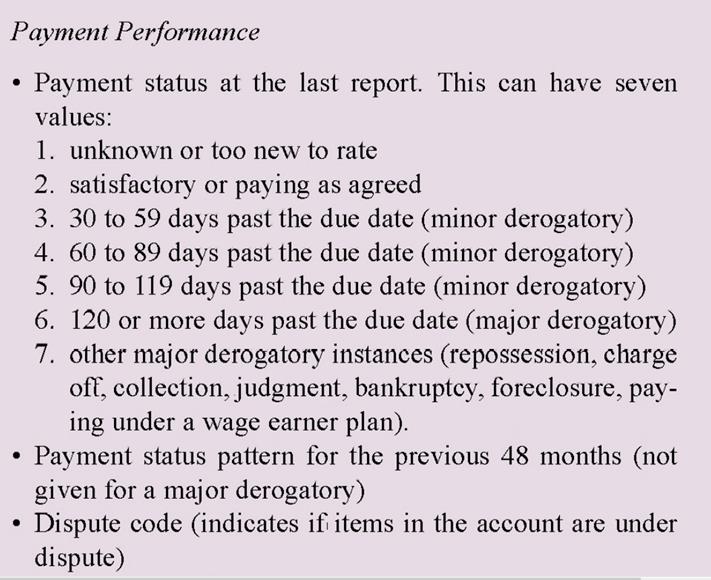

Pasted below is a classification summary of lates and other negative events from the Feds [link provided for those wanting further info]. Lates are delinquencies by definition that the Fed also defines as derogatories. The Fed uses minor and major to identify severity. Interestingly lates are not considered major until 120 days.

Fico used mild and serious to classify lates. I suspect this may done to avoid any conflict with the Fed. Certainly Fico views 90 day lates, and to a lesser degree 60 day lates, as serious as evidenced by impact on score.

http://www.federalreserve.gov/pubs/bulletin/2003/0203lead.pdf

Here is a link to an interesting article from John Ulzheimer, an Ex Fico employee.

https://www.creditsesame.com/blog/debt/will-paying-off-delinquent-debts-improve-my-credit-score/

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

Do major derogs also hurt less over time (as the article states) or do they significantly hurt a score for the full 7 years they're on it (as the "not given for major derogatory" infers from the Fed doc)? This has caused me some consternation as I have seemed to have hit a glass ceiling at 750-775 (my worst baddie is a 150 day late from 2012), but I also find it hard to believe I'm going to wake up one morning in 2019 to a 50+ point jump into the mid 800s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

Believe me a score isnt everything if a bad Mark is doing you in to not get credit for a loan you want or relationship with new lenders.

It's hard to swim in the muck of credit advice because most is geared toward the people trying to achieve a 700 score. once you are there it isn't a guessing game with many avenues to increase status but more like just copying what someone else has going on for their score. They have one mortgage One car loan and a credit card almost paid off that's pretty much it. 15 sky high limit redit cards almost paid off won't do it, one car loan with 58 payments left won't do it and so on

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@iced wrote:Do major derogs also hurt less over time (as the article states) or do they significantly hurt a score for the full 7 years they're on it (as the "not given for major derogatory" infers from the Fed doc)? This has caused me some consternation as I have seemed to have hit a glass ceiling at 750-775 (my worst baddie is a 150 day late from 2012), but I also find it hard to believe I'm going to wake up one morning in 2019 to a 50+ point jump into the mid 800s.

If you have one or two derogs and get them removed score can jump instantly. Inverse had a couple liens in his file that held is Fico 08 scores down to the 745 to 755 range. Definite ceiling as everything else in his file was clean and optimized. When he got the liens removed his scores.jumped to 840/845/850 for the three CRA scores. The reports below 850 and one or two inquiries under 12 months age.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Credit_hawk wrote:I could be wrong but I don't think it's possible to get your credit above 750 with derogatory marks. Though I suppose anything is possible. I mean if it's near falling off I guess you could have high 700s with derogatory marks.

My TU and EQ are 774 and 769 respectively with an old Verizon "collection" that I paid in full. That one account reports in the 5-6 year ago range. The one single time it got me a denial was for a CLI with Citi (and quite honestly the rep I spoke with on the recon call was at a loss for words that they used that as the reason for the denial). Everything else I have applied for has resulted in instant approvals.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@awp317 wrote:I have a 30 day late payment from Diners club from last December and im still in the 780s. I was at 848 prior to the late though so I guess it just depends on how high up you are that how far you fall matters less when you get the baddie. Nobody has mentioned it to me in any of the new shopping I have done, and thats cars, mortgage, and credit cards. Never came up. It shows up as a "reason for your score" on all the fico sites though.

It's possible to have 750+ scores with baddies. I have a few 30 days lates that are 3+ years old. Focus on the things you can do now. Make a plan that includes short and long term goals. You will get there. Pace yourself. Avoid app sprees. Before you make any decisions refer to your goals. Best of luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@awp317 wrote:I have a 30 day late payment from Diners club from last December and im still in the 780s. I was at 848 prior to the late though so I guess it just depends on how high up you are that how far you fall matters less when you get the baddie. Nobody has mentioned it to me in any of the new shopping I have done, and thats cars, mortgage, and credit cards. Never came up. It shows up as a "reason for your score" on all the fico sites though.

Ditto. As my/your lates age OP, they will have less and less impact on your credit profile. I assume they will be listed as a factor that impacts your score until they age off your credit profile completely. Until then, follow your plan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Derogatory marks with high credit score

@Thomas_Thumb wrote:

@Anonymous wrote:

@Credit_hawk wrote:A 30,60,90 day late IS a derogatory. They're one in the same. I think it's just semantics.

It is semantics, but late payments are considered delinquencies not derogatories. The presense of delinquencies however can give you a derogatory score card, as evidenced by T. Thumb's image posted above. Not that the language really matters as they are both obviously negative items that adversely impact score.

Pasted below is a classification summary of lates and other negative events from the Feds [link provided for those wanting further info]. Lates are delinquencies by definition that the Fed also defines as derogatories. The Fed uses minor and major to identify severity. Interestingly lates are not considered major until 120 days.

Fico used mild and serious to classify lates. I suspect this may done to avoid any conflict with the Fed. Certainly Fico views 90 day lates, and to a lesser degree 60 day lates, as serious as evidenced by impact on score.

http://www.federalreserve.gov/pubs/bulletin/2003/0203lead.pdf

Here is a link to an interesting article from John Ulzheimer, an Ex Fico employee.

https://www.creditsesame.com/blog/debt/will-paying-off-delinquent-debts-improve-my-credit-score/

Good read Thomas. Thanks for the information!