- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Did I ruin my Capital One Venture chances?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Did I ruin my Capital One Venture chances?

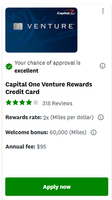

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I ruin my Capital One Venture chances?

About a week ago, I called Capital One to ask if I had any upgrades on my (2) cards with them. They told me that my existing Platinum card could be upgraded into a Quicksilver so I upgraded that one. They also told me that my 2nd card which was already a Quicksilver had a available upgrade into the Venture One so I upgraded the second card as well. Both accounts have been open for about 4-5 years. I called this week to possibly upgrade my Venture One into a Venture and they said my cards had no available upgrades on them yet and I should wait before asking again. On the Capital One website, I'm pre-approved for the Venture and Venture X as well as on Credit Karma. My question to myFICO is why? Why don't I have any available upgrades even though I am pre-approved for the cards? How long do I have to wait before getting a possibly product change? Did I ruin my chances of getting the Venture card as a upgrade as I just upgraded to the Venture One?

Any advice will be greatful, thank you myFICO!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

Ruin-? Nah.

Those 2 upgrades that you got were granted internally without any HPs. Applying for the Venture or the X will be a new application with HPs.

It is highly unlikely that you would be able upgrade to the Venture or the X from the cards you had.

Thus, don't look back and let the community know if you try for either of those.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

Being offered an upgrade to the new X for sure isn't happening. Being offered an upgrade to the Venture is also highly unlikely. I believe I've only seen it happen once on here. So no, you didn't ruin anything. Ignore CK's pre approvals. As for Capital One's pre-approval, it's pretty solid, but yea, they usually would rather you open up a new account versus upgrading you.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

I'm pretty sure that Cap One had some type of wait period after making a change to an account. I vaguely remember from a few years ago when I was doing a PC, the rep was reading some disclosures on the phone and he said that I wouldn't be eligible for any upgrades or changes to the same account for the next 6 months (or something like that).

So, after upgrading your cards, they became ineligible for another change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

@OmarGB9 wrote:Being offered an upgrade to the new X for sure isn't happening.

I have a DP that explicitly contradicts that. Card that started as a Venture, then VentureOne, then QS, it was eligible for VentureX. Since I got rejected on an application I bit down hard and took it and now have a VentureX (a friend using an application link to get their own has soothed a little of the pain at missing the SUB).

But yeah... C1 only lets you do a product change every 6 months or so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

It was my understanding that another Capital One card can only be upgraded to Venture/Venture X if is is a Visa.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

Another thing to keep in mind is the Venture has to have at least a 10k limit in order to be eligible for the Venture X as it is a Visa Infinite. Did you get the QS during rebuilding? If so, I would recommend just opening up a new card as PC'ing into a new product will still have the same rates/CL as the previous card. Also keep in mind, there are currently no Venture X prequalify on their website. As for Credit Karma's "recomendations", I would ignore that as they are mostly advertising. Before applying for the Venture X, make sure your profile is strong enough for a 10k limit card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

@imaximous Makes sense guess that means I have to wait a few months before applying, I'll try to use it often and hope for a PC in a few months.

@notmyrealname23 Good to know! Thank you.

@jcooks Good to know! That's something that I definitely didn't know. I got the QS out of high school and have been using it since. Thanks for the advice but I don't want to open a new card as I already have (2) capital one cards open and wouldn't really like another one. I'm looking at going from Venture One --> Venture rather than the Venture X for now because I don't think I would be eligible for that as what you said in the beginning that it would need at least a 10k limit which I do not have atm. Hoping to get a PC into a Venture in a few months when it is possible I guess.

Message for thread:

I probably should of made it clearer in the thread, I'm looking to go from Venture One --> Venture through a PC not the Venture X.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

What bearing would the product change from the Quicksilver to the Venture One has on how old the card is considered to be? I'm not talking in the context of how the card is reported to the CRAs (i.e. the original opening date of the Quicksilver should be retained) but in the context of when the card would legally be considered eligible to be upgraded.

Remember that in the US it's illegal for an issuer to upgrade a card that is less than a year old to another one with a higher AF, which would apply if going from the no-AF Venture One to either a Venture or Venture X.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Did I ruin my Capital One Venture chances?

@coldfusion wrote:What bearing would the product change from the Quicksilver to the Venture One has on how old the card is considered to be? I'm not talking in the context of how the card is reported to the CRAs (i.e. the original opening date of the Quicksilver should be retained) but in the context of when the card would legally be considered eligible to be upgraded.

Remember that in the US it's illegal for an issuer to upgrade a card that is less than a year old to another one with a higher AF, which would apply if going from the no-AF Venture One to either a Venture or Venture X.

I don't think the CARD act would have any effect on this as the account is older than 12 months. The interest rates cannot be increased within 12 months of opening an account. Since a PC isn't a new account, it wouldn't apply. Even if they were to increase the interest rates, they just have to notify within 45 days before going into effect as well as giving the option to cancel prior to the increase of rates. I don't think the card act has anything directly with the annual fee.