- myFICO® Forums

- Types of Credit

- Credit Cards

- Discover - Can't get a CLI, but I just got a promo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover - Can't get a CLI, but I just got a promo APR...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover - Can't get a CLI, but I just got a promo APR...

Hello everybody,

I have had an interesting relationship with Discover. It was my second card in early 2017 with a $3,000 limit, which my wife and I found useful when we moved into our current home and needed furniture.

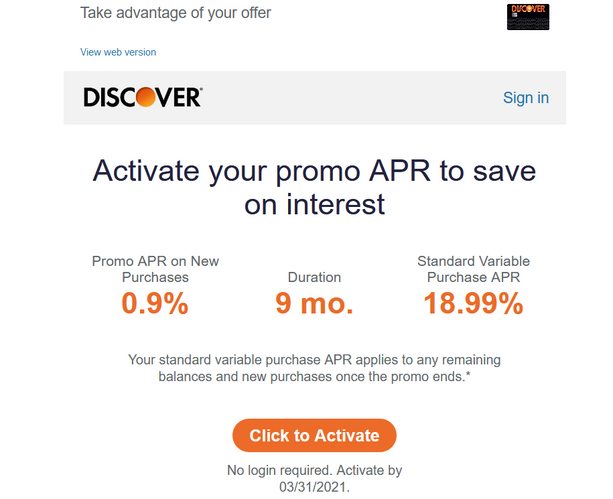

I have a $6,000 limit now and haven't had a CLI in almost 2 years (I try about once a month and have scores well into the 700s across the board and a high household income.). I was about to close this card when I got an Email offering a promo APR of 0.9% for the next 9 months. OK, so I won't close it just yet. I have cards with much higher limits and APRs under 10%, but I'll hold on to this one.

Let's see who else gets this Email.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

Got the same email offer. Card is from 2017 with a $2500 SL. They never gave me an CLI, either automatically or requested. My scores are in the upper 700's. I find it funny.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

Why close it just because they won't give you a CLI? Maybe I'm in the minority here, but to me this card is specifically designed to be used as much as possible within the first year and then only for $1,500 per quarter in their bonus categories.

My limit with them is $23,000 and all I think when I look at it is "wow, this card would be fine if I had a $2,000 limit" because the moment I hit $1,500 bonus category it's no longer an option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

@Anonymous wrote:Why close it just because they won't give you a CLI? Maybe I'm in the minority here, but to me this card is specifically designed to be used as much as possible within the first year and then only for $1,500 per quarter in their bonus categories.

My limit with them is $23,000 and all I think when I look at it is "wow, this card would be fine if I had a $2,000 limit" because the moment I hit $1,500 bonus category it's no longer an option.

I get people only want to use the card for rotating cats after dcb but it can still be used for everyday spend. Sure wont get heavy rewards but regular usage or bts can lead to more cli than just periodic use imo.

@bizarrocreditworld i havent gotten any cli in quite awhile and have zero bt options in forever so i could be that guy and close just because lol but id prefer having a good lender where i know ill get a customer service rep who iseasy to understand and who often entertains 0% promos even after received such. One day ill earn a AJC Special again and i can charge happy![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

I haven't had an increase since I opened the card last year and just got the email about the promo APR

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

Same...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

While I am sure Discover has a whole team of people who believe they've created a great and logical system, and I'm sure they plug in actual variables and do actual math to make decisions, the effect is about like using a groundhog to predict the weather. It is incomprehensible and often seems at odds with facts and data. Because of this, there is no advice anyone can give to help get a CLI other than pay your bill on time (or for that matter, to hurt your odds of getting a CLI other than don't pay your bill on time). I am not even positive about the on time thing. The main advice would be about whether you want to keep the card or not. JMO.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

I got a higher but still decent offer (2.9% APR for 9 mo.) by email today. I accepted it after first making sure it was legit with CSR by phone, who assured me it was indeed. I was suspicious because I had just asked for and received an APR reduction last month, from 17.99% to 16.24%. At that time I was told I would have to wait 6 more months until I could ask for a further reduction.

Some data points:

- this is my second Discover It card, 14 months old, SL $5200.

- I'm only using my first card for 0% APR balance transfers (first card is 30 months old, SL $1000, current CL $7000)

- the second card was heavily used for purchases at 0% in the first year, plus cashback match.

- at the 3-month point, I asked for CLI but was told nope, not until the card is a year old.

- tried again via luv button at 11 months... boom, instant $2500, bringing it to $7700.

So this new APR today is another nice surprise. I should also add that I had the usual frustrating time with Disco for the first couple years, but things look better atm. I've never paid a penny interest on either card, only BT fees.

Also... last month I took up an offer of 1.9% APR for 9 mo. on my Amex BCE.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - Can't get a CLI, but I just got a promo APR...

When I first opened the card, it was at 2500, then 6 months down the line I only got 600 CLI automatically, for no reason. It doesn't bother me cause I only use it to get cashback anyway. I guess it's good if you want your ult rate to be low.