- myFICO® Forums

- Types of Credit

- Credit Cards

- Discover revised terms notice, effective July 2019

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover revised terms notice, effective July 2019

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

@gdale6 wrote:I got notified by email yesterday as well, I then lambasted them via SM.. Basically said I carry near 800 fico, never been late, pay before statement event cuts and you have the huevos to change my terms that I would let them know if I would continue to do business with them... Got back sorry we failed you expectations in this and its because of comments like yours that we can evaluate our policies.......

You're taking it too personally IMO. This is just Discover making decisions to try and enhance thier profits. That's all it is, a business decision, and has nothing to do with the crediworthiness (or lack thereof) of a customer. A business decision that is in no way personal; don't take it as anything else. Lambasting them via SM won't do anything since this is a blanket policy chance.

I don't really see the major issue as I'm sure BT offers will still exist, just the generic BT rate can be up to (note they said maximum, so some may be lower) 5%, which is not unheard of. I've seen many banks offer 5% BT fees. Bottom line is if you need a BT you will probably be seeking out a specific product for it, and perhaps Discover won't be the ideal anymore. Life goes on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

@Anonymous wrote:In my mind, Discover has slowly been eliminating about everything you can drop as benefits and now a BT Fee increase. Wondering about there financials? In reading around the WWW there feels a change in lenders has slowly been creeping in. A little tighter credit environment comes to mind yet, MyFico'ers seem to do well on credit limits?!

No kidding. They dropped a few major benefits (purchase/price/return protection/extended warranty, rental/flight insurance), then gutted the Discover Deals portal, and now this. Not to mention they've steadfastly refused to increase my CL beyond 5k, when even Sir Barclays (!) agreed to a 3x CLI from 5k to 15k. At this point Disco will not get a single penny of non-5% spend from me grrrrr.

Closed:

6/8/20:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

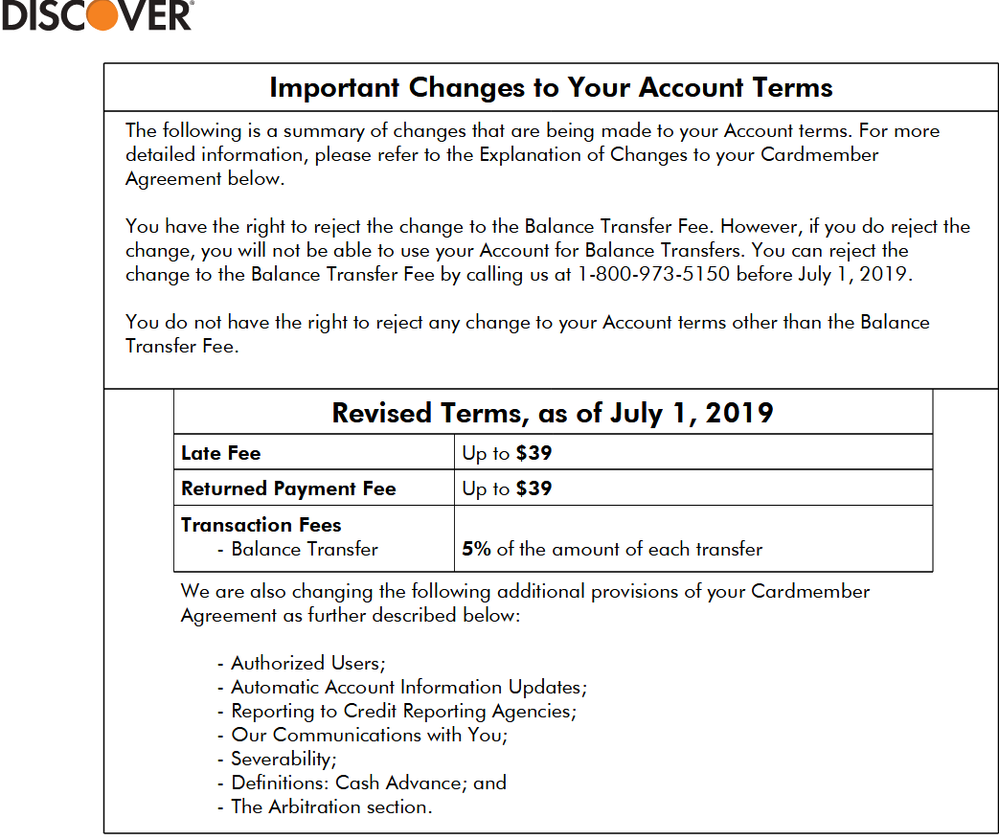

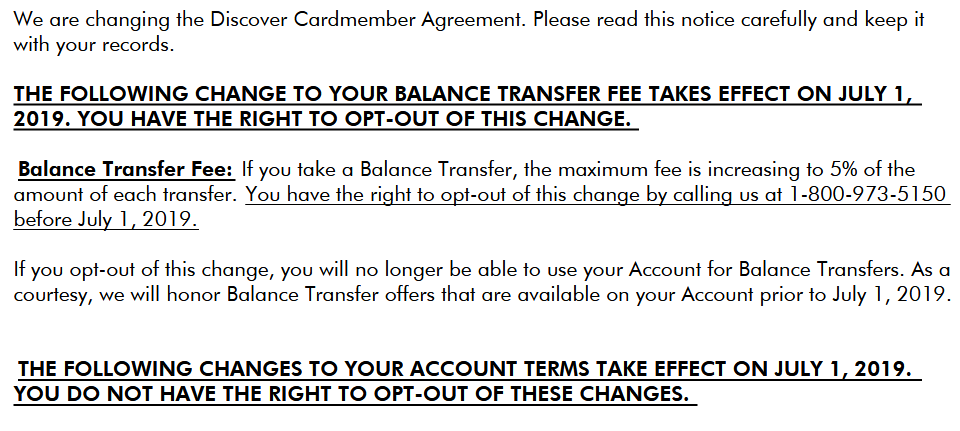

@Benzman wrote:Was talking to two friends today who have gotten notices of revised terms effective 7/1. Bal trans fees at 5%, late fees of $39, online gambling considered cash advance, etc. I have two cards with Disc and no such notices yet as of today, but wondering if this is for all cardholders or just some? Has anyone else received notices?

I read mine. For those wondering, yes it will apply to everyone.

Now, shall we actually clarify the terms?

The late fee, the first time you are late, is zero.

The late fee, if you have not been late in the last 6 months, is $28.

Thus, if you are late three times in 6 months, the late fee goes to $39.

The fee if you go 6 more months, then are late again (not late in the last 6 months), $28 fee.

You STILL didn’t learn to pay on time, and paid late a second time in a 6 month period? $39 fee again.

Similar with returned payment fee. First time it is $28. If you have a returned payment a second time in 6 months, the fee is $39. Difference is, no first time free returned payment fee.

Should I have sympathy for someone who reaches the $39 fee level on Discover?

The max 5% BT fee is a bit of a disappointment. Won’t know if they change the 4.99% No Fee 18 month offers until these go into effect July 1. With BECU and PenFed, the BT landscape at Credit Unions could still be an option. Banks in general seem to be raising these fees, so 3% is getting quite rare. The AMEX Plan It fees look better and better.

Does anyone think “online gambling” should not be a similar cash advance as lottery tickets? With the growth of online gambling availability, it only makes sense to include this in a terms update.

Discover’s changes are not personal.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

@Anonymous wrote:

@Dinosaur, if anyone is going to continue to thrive with CLIs and approvals in a tightening credit world, it’ll be MyFICO members. We are credit nerds basically. Average consumers do not break down lending/increase terms, behaviors, and factors to try and figure out banks’ methodologies, and they don’t experiment with reporting to try and crack the FICO Da Vinci code. If anyone will continue getting huge limits and CLIs, it’ll be members of this forum.

Yes, but before we get too happy, there's also a portion here who get swept up into credit excitement, over-app and get into some trouble. And IMO, quite a lot of misplaced focus: the whole "growing" thing way above what is actually needed, APR reductions on every card etc, instead of focusing on maximizing value and strategic selection of cards. So not quite the perfect credit experts!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

@AverageJoesCredit wrote:

Some may still see 3% fees. Not the end of the world. If we want to borrow money from them just the price of doing so. Always good to have a card that you CAN use as a bt without having to app a new card. The allure of Miss Disco continues

Also, a couple of us have had Discover offer 2% Fees for BTs ... so Discover likes to change it up with varying offers. Took advantage of two 2% offers recently. Suspect some form of magic and a person's profile decide who get's offers (anotherwords YMMV)?!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

Finally came for my IT account, nothing yet for Miles. Maybe my email is different, but it says the BT fee WILL BE 5%, not just up to that amount.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover revised terms notice, effective July 2019

Yes it’s 5% but they run offers that tend to be less.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover - More nerfs coming

See subject more nerfs coming. Discover is honestly killing themselves IMO. Are they in some financial troubles as don't follow their stocks? these are huge nerfs IMO. So much for 3% BT fee, make that 5% and if someone is not smart enough and don't pay on time they will get a piece of that action as well now ![]() . Now only one thing card is good for is the 5% cats, not even a worthwhile BT card anymore

. Now only one thing card is good for is the 5% cats, not even a worthwhile BT card anymore

https://www.doctorofcredit.com/discover-to-change-fees-on-july-1st-2019/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover - More nerfs coming

The BT fee is getting in line with other banks at 5%. Open question whether the no-fee 4.99% BT remains.

The late fees are not onerous, they only escalate if the cardholder is incorrigible.

So I don’t see these as noticeable nerfs.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765