- myFICO® Forums

- Types of Credit

- Credit Cards

- Discover

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover

I have a Discover I opened in Jun 2019 with a $2k limit. Should I get another one? I heard you can have 2 cards. Is it easier to get after having 1? I started out with a secured card and graduated to unsecured

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

I got a second card at my 1 year mark but unfortunately I only got another 2k limit. I hope to combine them some day if I can ever get a CLI on the new one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

Was it easy to get since you were already established with them?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

@Jdman wrote:I have a Discover I opened in Jun 2019 with a $2k limit. Should I get another one? I heard you can have 2 cards. Is it easier to get after having 1? I started out with a secured card and graduated to unsecured

Try to prequalify and see what comes up

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

@Jdman wrote:I have a Discover I opened in Jun 2019 with a $2k limit. Should I get another one? I heard you can have 2 cards. Is it easier to get after having 1? I started out with a secured card and graduated to unsecured

So here is my $.0.02's worth..

I think having a 2nd card is a great idea. It was not until I found myFICO forums, that I learned you could have (2) Discover cards.

Getting a second card you get "CA$H back match" for another year!

I do not combine my (2) cards into (1) .. because some Quarters, I can max (2) cards for that quarter.

Also if you have a BT or 0% intro/promotional rate, you can continue to use the other card as a normal card.

While not affecting the card with the BT/Promotional purchase APR.

As @Aim_High say's it so well, "what may work for one person, may or may not work for another."

As "most" of us have different spend/lifestyles. ... all JMHO

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

@Jdman wrote:I have a Discover I opened in Jun 2019 with a $2k limit. Should I get another one? I heard you can have 2 cards. Is it easier to get after having 1? I started out with a secured card and graduated to unsecured

Should you get another one..... Are you maxing out the 5% category every quarter and need another? Are you not getting CLIs on your current one and are hoping another will be higher? Do you want another year of the first-year cashback match? All of the above? There could be other reasons, but I'm just curious, since you are asking if you should get another one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

I am trying to get better cards honestly. I have FP and Credit One. I like my Discover and didn't know if it was easy to get or not

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

@TSlop wrote:

@Jdman wrote:I have a Discover I opened in Jun 2019 with a $2k limit. Should I get another one? I heard you can have 2 cards. Is it easier to get after having 1? I started out with a secured card and graduated to unsecured

Should you get another one..... Are you maxing out the 5% category every quarter and need another? Are you not getting CLIs on your current one and are hoping another will be higher? Do you want another year of the first-year cashback match? All of the above? There could be other reasons, but I'm just curious, since you are asking if you should get another one.

Getting double cash back again might be sufficient for many of us. I dont ever max out a quarter but that doesnt make me a bad user nor is it not a reason to not get a second card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

@Jdman wrote:I am trying to get better cards honestly. I have FP and Credit One. I like my Discover and didn't know if it was easy to get or not

@Jdman if you tell these nice people a bit more about your profile, like scores, negatives, any lenders you burned, they might be able to help you in picking your next card because you definitely want to get rid of FP as soon as you can

(Credit one is slightly less bad, but also should be replaced as soon as one can).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover

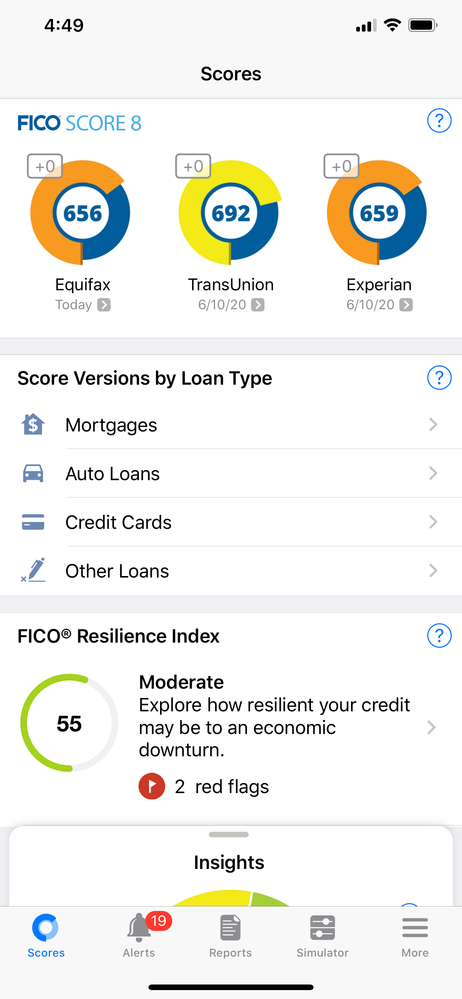

Here are my scores. I have 1 or 2 medical collections. I have 2 open auto loans, 2 installment loans and 3 CC and 3 AU totalling $7350 in revolving credit. I haven't been late on any of them