- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Does Citi DC SP CLI use score on site?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does Citi DC SP CLI use score on site?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does Citi DC SP CLI use score on site?

When Citicard DoubleCash processes a soft-pull CLI request, does it use the score that's posted on the site, or does it use a freshly updated score?

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

Hi SJ.

I think a fairly accurate indicator for their SP's might be found after making the request and thereafter checking your credit reports for signs of a SP, specifically EQ?

If it's run from some internal scoring formula they use for that than a SP may not even show. Then again they "may" use both.

Very good question this poses because I don't remember it being confirmed per say like other lender's KNOWN pulls.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

My personal theory is that they do use the last SP. My reason for that is when I get denied each time for "too many recent accounts," it is always an instant denial with no consideration period. When I had a CO on my report, I got the same instant denial. The assumption is based on the fact that the denials stayed instant when my report went clean, but the reason changed right after the monthly SP. I'm fairly certain that 20 years from now, my DC will still be $800 ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@Anonymous wrote:My personal theory is that they do use the last SP. My reason for that is when I get denied each time for "too many recent accounts," it is always an instant denial with no consideration period. When I had a CO on my report, I got the same instant denial. The assumption is based on the fact that the denials stayed instant when my report went clean, but the reason changed right after the monthly SP. I'm fairly certain that 20 years from now, my DC will still be $800

Thanks for the thoughtful analysis, Noxqs, I'm tending to think you're right, so I'm going to wait for their next SP, when my score will be 73 points higher ![]()

But I'm fairly certain that 20 years from now, my DC will still be $2600, the same as it was when I first got the card almost 2 years ago ![]() That is if I still have the card then.

That is if I still have the card then.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@SouthJamaica wrote:

@Anonymous wrote:My personal theory is that they do use the last SP. My reason for that is when I get denied each time for "too many recent accounts," it is always an instant denial with no consideration period. When I had a CO on my report, I got the same instant denial. The assumption is based on the fact that the denials stayed instant when my report went clean, but the reason changed right after the monthly SP. I'm fairly certain that 20 years from now, my DC will still be $800

Thanks for the thoughtful analysis, Noxqs, I'm tending to think you're right, so I'm going to wait for their next SP, when my score will be 73 points higher

But I'm fairly certain that 20 years from now, my DC will still be $2600, the same as it was when I first got the card almost 2 years ago

That is if I still have the card then.

I'm crossing my fingers for you SJ! I love this card and it is one of my oldest, but the CLIs feel impossible most days! I'll be hoping after the SP too. My score is 100+ points higher than when I got it, but all I can do now is wait for them to take me out of the "too many new accounts" category.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

Hey at least my fico on the website jumped a Steph Curry special to 636 this month. weeeeeeee

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

I think I've pretty much answered my own question by reviewing the denial letter from my soft pull CLI request. It referred to an event which had disappeared from my Equifax report weeks before the CLI request. So it is clear to me that when I make the soft pull CLI luv button request on Citi's site, they're going to go with the old report referenced on the site as my FICO score.

So I've just got to wait for that score to update, and then I'll pull the lever again. Hopefully the soft pull language will still be there when I do.

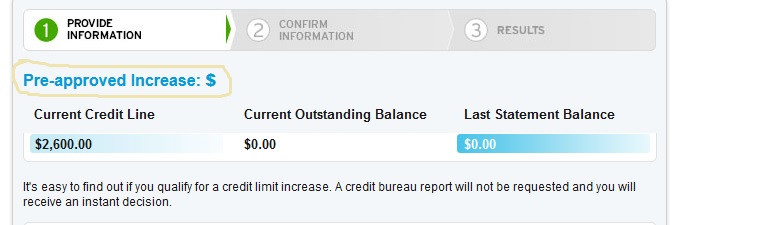

BTW I've noticed the language "Pre-Approved Increase: $"... I never noticed that before. Has that always been there when the soft pull language was in place?

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673