- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Does it hurt to have a balance on a closed car...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hurt?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@SouthJamaica wrote:

@Anonymous wrote:It will only hurt if Synchrony reports the closed card with a $0 limit. If they continue to report the original limit, your utilization will stay the same until you pay it off.

Actually the utilization would not stay the same, because the card's limit has been removed from available credit limits.

For scoring purposes, the card is treated exactly the same as if it were open if the limit does not show $0. If the limit is reported the same as the new balance (balance chasing) each month the card will be treated the same as a card with 100% utilization. If the limit is reported as $0, the balance will be used in aggregate utilization metrics and the card would have the same 100% individual utilization penalty.

In most cases, the original limit is still reported and Synchrony is one of those lenders. When this happens the card's balance and limit are treated exactly the same as if the card were still open until the balance reaches $0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@SouthJamaica wrote:

@Remedios wrote:@Anonymous it wont hurt

It's a myth that refuses to die.

Most accounts that were closed (without being charged off) will report limit and balance.

In fact, some people will close cards when lender announces future changes (such as APR increase) to preserve terms.

Even when the lender does report the correct limit, it still hurts, because the balance is still there in the numerator, but the credit limit has now disappeared from the denominator, in computing aggregate utilization percentage.

No. That is how it works if the credit limit is $0. When a limit is reported, a closed card with a balance is treated the same as an open card for aggregate utilization calculations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@SouthJamaica wrote:

@Remedios wrote:@Anonymous it wont hurt

It's a myth that refuses to die.

Most accounts that were closed (without being charged off) will report limit and balance.

In fact, some people will close cards when lender announces future changes (such as APR increase) to preserve terms.

Even when the lender does report the correct limit, it still hurts, because the balance is still there in the numerator, but the credit limit has now disappeared from the denominator, in computing aggregate utilization percentage.

Nope.

Limit will report as zero only if account has been charged off, in which case, the limit is truly $0.00.

In any case, if that were true, OPs utilization would have instantly changed when accounts reported as closed.

That didnt happen, so it's safe to say that limit on the closed account is being taken into consideration.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

Very interesting and something that I've been interested in learning about. @NRB525 did some threads on it I believe, as well. I think I'll add this thread to the Primer on the subject.

Also really trying to figure out how this CO utilization works, cuz its not just maxed out as old wisdom says. Any insight hit me up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@K-in-Boston wrote:

@SouthJamaica wrote:

@Anonymous wrote:It will only hurt if Synchrony reports the closed card with a $0 limit. If they continue to report the original limit, your utilization will stay the same until you pay it off.

Actually the utilization would not stay the same, because the card's limit has been removed from available credit limits.

For scoring purposes, the card is treated exactly the same as if it were open if the limit does not show $0. If the limit is reported the same as the new balance (balance chasing) each month the card will be treated the same as a card with 100% utilization. If the limit is reported as $0, the balance will be used in aggregate utilization metrics and the card would have the same 100% individual utilization penalty.

In most cases, the original limit is still reported and Synchrony is one of those lenders. When this happens the card's balance and limit are treated exactly the same as if the card were still open until the balance reaches $0.

Bank of America closed 2 cards of mine with sizable limits, each of which had a significant balance. I have not rushed to pay off either balance because each has some substantial time left with a 0% promotional rate, so I have had a long long time to watch and learn how they are treated (7 months so far and counting). Although the limits are reported correctly in the data, they both disappeared immediately from the total of credit limits. Meanwhile each balance has remained in the total of balances owed.

So I am talking from personal experience.

The limits were removed from the denominator, but the balances stayed in the numerator, the effect of which is to increase revolving utlization percentage.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@Anonymous wrote:

SJ, Are you talking about what the front end is telling you?

Examples:

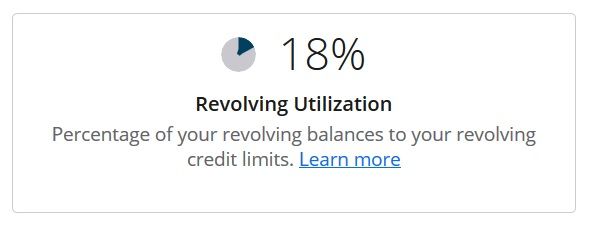

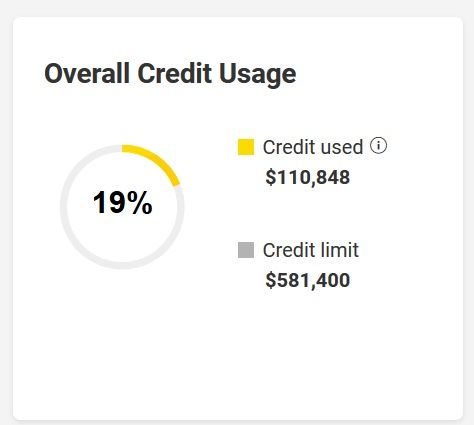

In MyFICO:

In experian.com:

These numbers include my Bank of America balances but exclude my Bank of America limits.

If you have reason to think that the algorithm is working with different numbers than those, I'd sure like to see your evidence.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

That's fluffy puff CMS puts there for the masses. Last place you should use to determine your utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt to have a balance on a closed card? Does owing $1,000 on a $0 limit closed card hu

@Remedios wrote:That's fluffy puff CMS puts there for the masses. Last place you should use to determine your utilization.

Evidence, please.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687