- myFICO® Forums

- Types of Credit

- Credit Cards

- Elan Max Cash Preferred cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Elan Max Cash Preferred cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Elan Max Cash Preferred cards

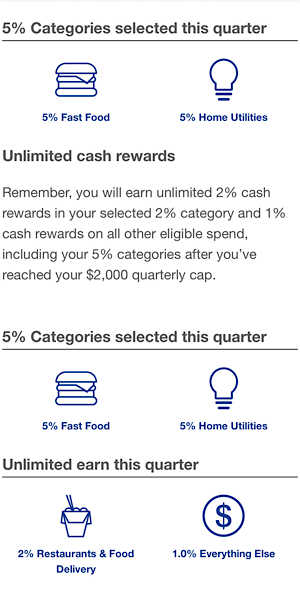

So I noticed when looking for cards to give cash back on utlilities that there is a series of credit cards which basically are all the same rewards system (and underwriters? not sure) from Elan Financial Services. Various banks and credit unions (Harborstone, gateway, etc) all called the "Max Cash Preferred" cards. This also seems to be the case for the US Bank Cash+ Visa. So I have some questions

1. US bank and Elan seem to be closely linked from what I could gather snooping around the net. US bank denied me because I had just apped for the State Farm visa to get cash back on my car insurance and they gave me a 9K limit, and the denial stated that they had extended the maximum amount of credit they were willing to extend at that time on the SF card. Since elan and US Bank seem to be linked - does this make any elan card a no go as well? I seemed to meet all other underwriting requirements as that was the only reason given.

2. Are there any data points for what elan/the issuing bank is looking for? Like Chase's 5/24 rule?

3. Is there any bank that's "the easiest" to get this type of card through? Or do they all have the same underwriting requirements

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

Very recent thread on this, with more links to the older stuff

Elan Max Cash Preferred - Master List of Banks/Cre... - myFICO® Forums - 6523458

Basically, Elan is owned by US Bank, so not just a close relationship. In general, you don't need a relationship with any of the FI who issue the card. The only advantage is if you want to deposit the rewards in a bank account (rather than statement credit), you will need an account at that institution. Underwriting is really through Elan, so same requirements for all.

As noted in that thread, there now seem to be a few exceptions, where to apply for the card at institution X, you need an account there. Still seems to be very unusual though

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

Elan is generally more generous than US Bank. US Bank likes no more than 1/12, though they sometimes approve people with more new accounts, so it isn't a hard rule. Elan is more lenient in that regard. As far as I know, Elan manages all the cards, so they all have the same underwriting requirements.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

Thanks! I guess that leaves just 2 questions

1. Is Elan's "pool" of credit treated different from US Bank's? Because as noted above, US Bank denied my app for the Cash+ and the reason given was they had extended the maximum amount credit they were willing to extend with the 9K State Farm visa (Which was majorly disappointing considering I don't need NEARLY that much to pay my car insurance, Im not going to use it for anything else and US bank doesnt do credit reallocations or product changes from co-branded cards)

2. What credit bureau does Elan pull? The reason I ask is because my "backup" was my original plan until I discovered the Elan CBP cards: The BMO Harris Cash back card (5% on streaming) + The Venmo credit card (3% back on utlities) both pull TU which I only have 2 inquiries on. Trying to determine which app to pull the triggers on first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

@g8tor89 wrote:Thanks! I guess that leaves just 2 questions

1. Is Elan's "pool" of credit treated different from US Bank's? Because as noted above, US Bank denied my app for the Cash+ and the reason given was they had extended the maximum amount credit they were willing to extend with the 9K State Farm visa (Which was majorly disappointing considering I don't need NEARLY that much to pay my car insurance, Im not going to use it for anything else and US bank doesnt do credit reallocations or product changes from co-branded cards)

2. What credit bureau does Elan pull? The reason I ask is because my "backup" was my original plan until I discovered the Elan CBP cards: The BMO Harris Cash back card (5% on streaming) + The Venmo credit card (3% back on utlities) both pull TU which I only have 2 inquiries on. Trying to determine which app to pull the triggers on first.

They pulled Experian for me and I'm afraid I don't know the answer to #1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

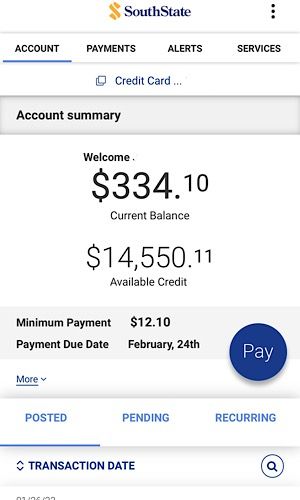

I have this Elan card and two US Bank Cash+ cards from family. The Elan card is really bad to use. I have stopped using it.

It has a totally separate web site. Its interface is just bad and hard to use. Everything there is different.

I use a payment processor to pay utility bills to avoid payment fees. US Bank cards have no problem. But Elan card does not recognize the payment as utility. That defeats the whole purpose of having this Elan card.

A mistake on my part, not knowning all fact of the Elan cards. In the same group of bad cards of Apple, Target and Best Buy cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

@BronzeTrader wrote:I have this Elan card and two US Bank Cash+ cards from family. The Elan card is really bad to use. I have stopped using it.

It has a totally separate web site. Its interface is just bad and hard to use. Everything there is different.

I use a payment processor to pay utility bills to avoid payment fees. US Bank cards have no problem. But Elan card does not recognize the payment as utility. That defeats the whole purpose of having this Elan card.

A mistake on my part, not knowning all fact of the Elan cards. In the same group of bad cards of Apple, Target and Best Buy cards.

NJ - Elan pulled TU on all my apps, 2 personal cards an 1 business.

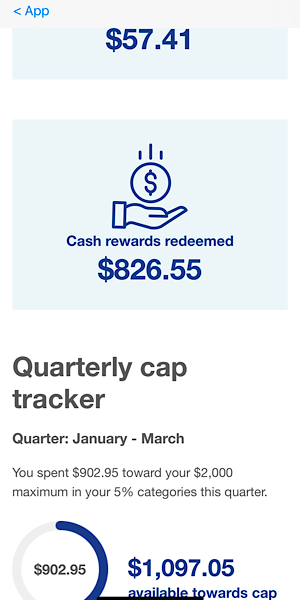

I have two Elan MCP cards and love them, so much so I'm going after a third later. The cashback opportunity, for me, is incredible. As recommended on the forum (link below), I use Paypal Billpay to pay utilities and avoid service fees. I have not had any problems with the payments not being recognized as utilities and earning the 5% cashback. So guess it's a YEMV.

If you're on Paypal maybe try that system?

Link to the thread:

https://ficoforums.myfico.com/t5/Personal-Finance/PayPal-Bill-Pay-Credit-Card-Rewards/td-p/6506586

TCL $678.5K: Personal $562.5K, Business $116K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

@g8tor89 wrote:Thanks! I guess that leaves just 2 questions

1. Is Elan's "pool" of credit treated different from US Bank's? Because as noted above, US Bank denied my app for the Cash+ and the reason given was they had extended the maximum amount credit they were willing to extend with the 9K State Farm visa (Which was majorly disappointing considering I don't need NEARLY that much to pay my car insurance, Im not going to use it for anything else and US bank doesnt do credit reallocations or product changes from co-branded cards)

2. What credit bureau does Elan pull? The reason I ask is because my "backup" was my original plan until I discovered the Elan CBP cards: The BMO Harris Cash back card (5% on streaming) + The Venmo credit card (3% back on utlities) both pull TU which I only have 2 inquiries on. Trying to determine which app to pull the triggers on first.

I'll start with your 2nd question.

It's a YMMV as to which CRA would get pulled but one of the determining factors appears to be your state of residence. The thread https://ficoforums.myfico.com/t5/General-Credit-Topics/Which-Report-Will-They-Pull-Part-2/td-p/63797... includes crowdsourced data points for Elan applications broken down by state and CRA.

As for the pool of credit I don't know the answer but we did have a former member at one point report being told that the same team of US Bank underwriters evaluates and renders decisionc for both US Bank and Elan applications Take that as you may.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

We have 3 Elan MCP cards that earn us around $1000 per year in cash back, so we love them. The is Elan app is definitely not most high tech app we have, but it works and the cash rewards portion is pretty good.

My only real complaint with the Elan app is that make you do a manual log about every 6 or 8 weeks. It's a little annoying, but not enough to call it bad.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan Max Cash Preferred cards

@ocheosa wrote:

@BronzeTrader wrote:I have this Elan card and two US Bank Cash+ cards from family. The Elan card is really bad to use. I have stopped using it.

It has a totally separate web site. Its interface is just bad and hard to use. Everything there is different.

I use a payment processor to pay utility bills to avoid payment fees. US Bank cards have no problem. But Elan card does not recognize the payment as utility. That defeats the whole purpose of having this Elan card.

A mistake on my part, not knowning all fact of the Elan cards. In the same group of bad cards of Apple, Target and Best Buy cards.

NJ - Elan pulled TU on all my apps, 2 personal cards an 1 business.

I have two Elan MCP cards and love them, so much so I'm going after a third later. The cashback opportunity, for me, is incredible. As recommended on the forum (link below), I use Paypal Billpay to pay utilities and avoid service fees. I have not had any problems with the payments not being recognized as utilities and earning the 5% cashback. So guess it's a YEMV.

If you're on Paypal maybe try that system?

Link to the thread:

https://ficoforums.myfico.com/t5/Personal-Finance/PayPal-Bill-Pay-Credit-Card-Rewards/td-p/6506586

That is exactly the problem. My Elan Max cash card does not like the Paypal layer. So it does not recognize it as utility payments. I'm not going to contact Elan about it. My Cash+ cards have no such issues.

If I do not use Paypal, I pay like $2 or $4 fee for each payment. Before, I slip one month and pay two bills together. No interest charged.