- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Elan "Max Cash" -vs- US Bank Cash+

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Elan "Max Cash" -vs- US Bank Cash+

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@1GaDawg85 wrote:I am really hoping it isn't about not having a relationship with the particular bank. I am curious about their denial reasons now.

I'm sorry for your denial - but I do appreciate you sharing it. Your profile seems similar to mine - I'm 2/12 and acquired my AOD card 7 months ago and 3 months ago for my NFCU More Rewards. I think it might be best to hang out in garden for a while and let these cards age.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@JNA1 wrote:

@ChargedUp wrote:

@1GaDawg85 wrote:

@Aim_High wrote:

@PullingMeSoftly wrote:

@Curious_George2 wrote:@PullingMeSoftly: Provident CU uses Elan, right? Can you PC your Provident card to Max Cash?

@Curious_George2 You had my hopes up for a moment, but unfortunately Provident is still their same stubborn selves with the same mediocre product lineup. If they had Elan run their card division that would be an upgrade. The same ole 1.5% cashback card stays in the SD and their travel card is lame, so no PC options

Another factor is the cards offered by the agent that a particular lender chooses to put in their lineup. Although they are often the same, I have seen some variations. I noticed a few Elan providers in my search that still had the "old" Elan lineup prior to Max Cash Preferred. That lineup included the $95 AF AMEX co-branded card with the 4-3-2-1 rewards structure. It appears on the Elan lineups I've seen WITH the Max Cash, those lenders have phased out the AMEX 4-3-2-1 card. Just my casual observation from researching the topic. Maybe in time, all Elan providers will offer identical cards again.

I would love to try for one of these Elan cards that are in Georgia since we have a couple of banks that offer them except there isn't much data on Renasant Bank, Capital City Bank, or Credit Union of Georgia

It's not the hosting bank that makes the decisions, does the UW or backs the cards. It's Elan itself from what I've seen with my own Elan card. The only difference is the image on the card itself and possibly being able to make in-branch payments and such.

When you click to apply, either bank will take you to the same Elan application site, with the only difference being the pic of the bank on the page.

Does this mean that you wouldn't have to bank with one of these banks to apply? Is there an Elan website or app that you manage the card with, or is it done through the bank's app?

My Elan card started out as "Florida Community Bank". I had never heard of them, but for some reason I got a mailer from them... In California. All the Elan Credit card apps end up at the same webpage

https://online1.elancard.com/oad/apply.personal.controller?method=start

Managing an Elan credit card is done at likely the most generic credit card website you will ever visit:

https://www.myaccountaccess.com/onlineCard/login.do

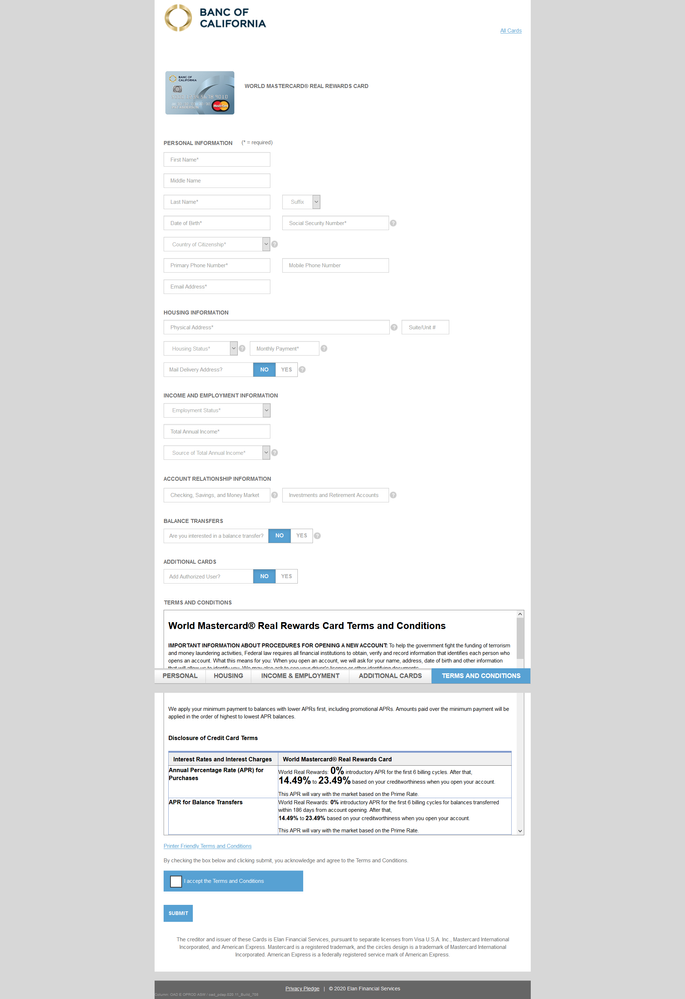

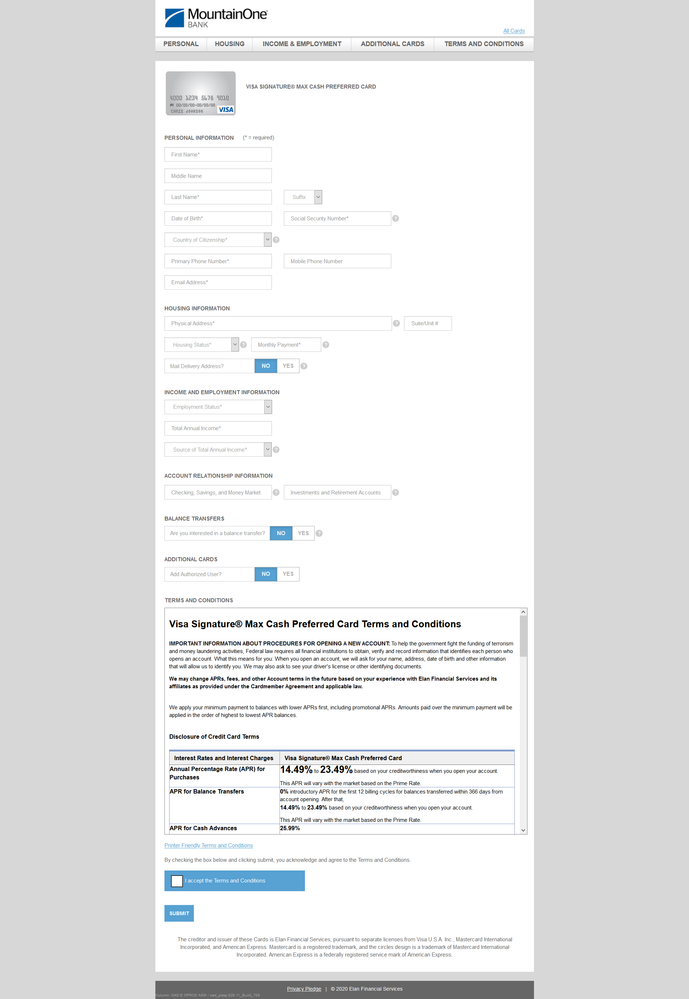

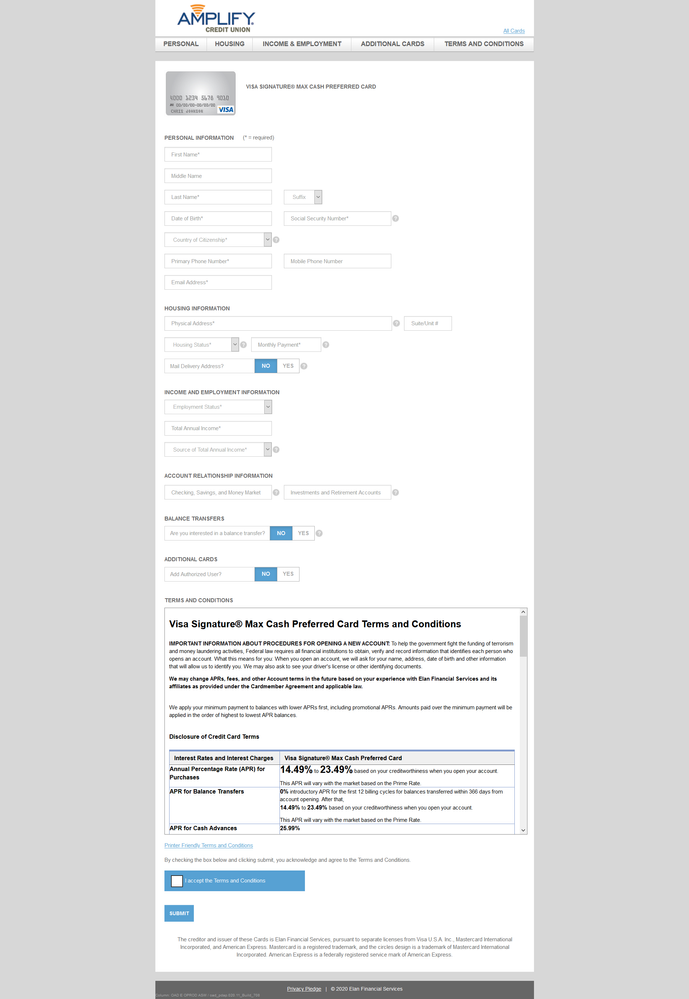

Some random Elan credit card apps from different hosting banks and CU's

Banc of California Elan app...

Mountain One Bank Elan app

Amplify CU Elan app

See a trend going on here?

At the bottom of each one is:

The creditor and issuer of these Cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc., Mastercard International Incorporated, and American Express. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. American Express is a federally registered service mark of American Express.

The hosting bank contracts with Elan to handle offering credit cards with their name and/or logo on it, which they cover everything from the application, approval, risk and financial backing. Should a bank pull out of the contract, your card becomes a simple "Elan" branded card as mine has. Nothing changed except the card now just says "Elan Real Rewards" instead of "FCB Florida Community Bank".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@1GaDawg85 wrote:I am really hoping it isn't about not having a relationship with the particular bank. I am curious about their denial reasons now.

I had ZERO relationship with the bank I applied through, not to mention it was on the other coast. I don't see named bank relationship coming into play.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@1GaDawg85 wrote:I am really hoping it isn't about not having a relationship with the particular bank. I am curious about their denial reasons now.

My own experience with the Fidelity card from a few years ago was that even Wealth Management level of assets does not ensure a positive outcome. I've yet to see any real evidence elsewhere indicating that has changed in any meaningful way.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@1GaDawg85 wrote:I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

Just out of curiosity, why is that? I ask because I only have 1 EQ pull, so that actually makes me consider trying it.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@JNA1 wrote:

@1GaDawg85 wrote:I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

Just out of curiosity, why is that? I ask because I only have 1 EQ pull, so that actually makes me consider trying it.

Between EQ and EX, those are popular pullers recently compared to TU

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@1GaDawg85 wrote:

@JNA1 wrote:

@1GaDawg85 wrote:I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

Just out of curiosity, why is that? I ask because I only have 1 EQ pull, so that actually makes me consider trying it.

Between EQ and EX, those are popular pullers recently compared to TU

I'd much rather have an EQ pull than EX. It seems to me that everyone-and-their-brother pulls EX for credit applications and it gets hit unreasonably hard relative to others. ![]() My 24-month inquiries are EX: 8, EQ:4, TU: 3. I live in Texas, so maybe it's a regional thing.

My 24-month inquiries are EX: 8, EQ:4, TU: 3. I live in Texas, so maybe it's a regional thing.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@Aim_High wrote:

@1GaDawg85 wrote:

@JNA1 wrote:

@1GaDawg85 wrote:I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

Just out of curiosity, why is that? I ask because I only have 1 EQ pull, so that actually makes me consider trying it.

Between EQ and EX, those are popular pullers recently compared to TU

I'd much rather have an EQ pull than EX. It seems to me that everyone-and-their-brother pulls EX for credit applications and it gets hit unreasonably hard relative to others.

My 24-month inquiries are EX: 8, EQ:4, TU: 3. I live in Texas, so maybe it's a regional thing.

@1GaDawg85 - OK I see.

Im kinda where @Aim_High is on that too. I am at 8 on EX, 3 on TU, and 1 on EQ. My AOD card is the only EQ pull I've ever had, except a CU car loan I have (that HP has fallen off now).

That said, I understand Alliant, PenFed, and lots of other CU's especially pull EQ.

I do have 4 HP's falling off in the next few months on EX, so my report won't look so lopsided after that.

Does US Bank typically pull EQ as well?

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Elan "Max Cash" -vs- US Bank Cash+

@Aim_High wrote:

@1GaDawg85 wrote:

@JNA1 wrote:

@1GaDawg85 wrote:I got an alert they pulled EQ down here in GA. So there's that.

I hate EQ pulls also.

Just out of curiosity, why is that? I ask because I only have 1 EQ pull, so that actually makes me consider trying it.

Between EQ and EX, those are popular pullers recently compared to TU

I'd much rather have an EQ pull than EX. It seems to me that everyone-and-their-brother pulls EX for credit applications and it gets hit unreasonably hard relative to others.

My 24-month inquiries are EX: 8, EQ:4, TU: 3. I live in Texas, so maybe it's a regional thing.

No doubt. Everyone and their brother pulls EX. I might try again after my utilization is updated but it could also be that they don't like BK's showing either so I will be curious to see the reasons why they denied.

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023