- myFICO® Forums

- Types of Credit

- Credit Cards

- Equifax goal reached - What card should I apply fo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Equifax goal reached - What card should I apply for?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Equifax goal reached - What card should I apply for?

I've reached my goal with Equifax. Please recommend three credit cards for me.

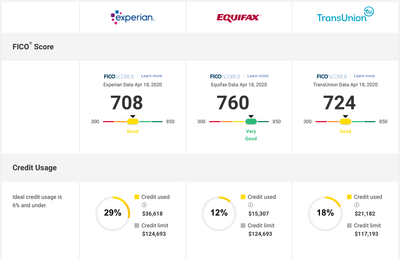

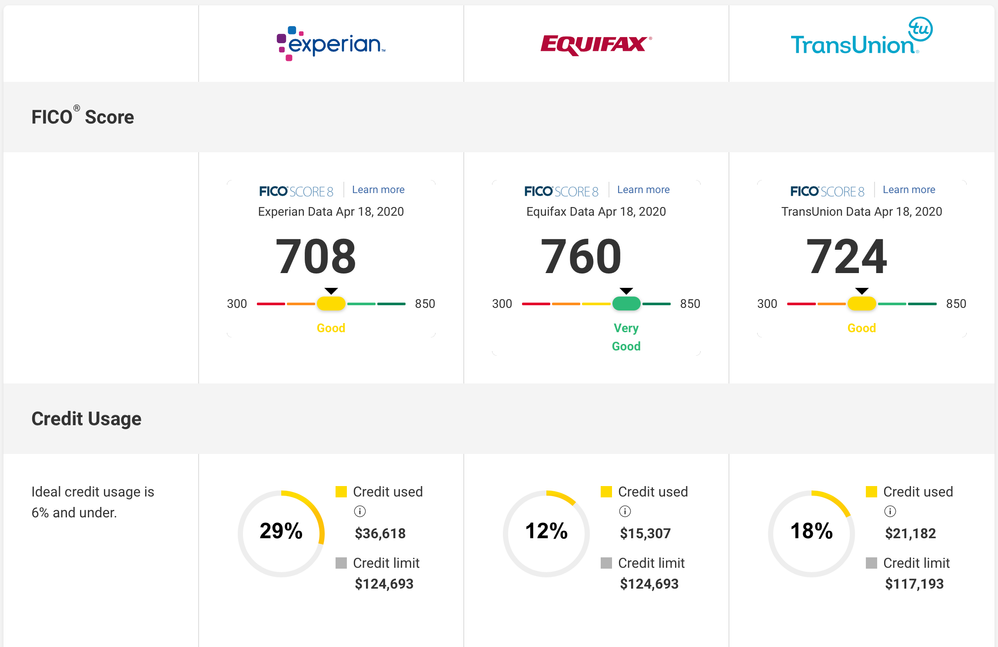

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

We can't make recommendations without your FICO scores. You can get all three of your FICO 8 scores from creditchecktotal.com for a $1 (just make sure to cancel the trial so you don't get billed).

Your Credit Karma scores are VantageScore which can be wildly different in either direction from your FICO scores that lenders will use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

@Anonymous wrote:We can't make recommendations without your FICO scores. You can get all three of your FICO 8 scores from creditchecktotal.com for a $1 (just make sure to cancel the trial so you don't get billed).

Your Credit Karma scores are VantageScore which can be wildly different in either direction from your FICO scores that lenders will use.

Experian and Transunion reporting are behind.

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

760 with an EQ puller will usually get the farm. The problem is finding EQ pullers. Usually exclusive EQ pullers are going to be credit unions. Your other two scores are by no means bad though.

What are you looking for - low APR, rewards, travel? And does it have to be an EQ puller?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

@Anonymous wrote:760 with an EQ puller will usually get the farm. The problem is finding EQ pullers. Usually exclusive EQ pullers are going to be credit unions. Your other two scores are by no means bad though.

What are you looking for - low APR, rewards, travel? And does it have to be an EQ puller?

It doesn't have to be an EQ puller. Low APR would be good. 0% BT would be good, but not a deal-breaker.

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

@bustinloose82 here are a few cards

EQ Puller: PenFed Gold Visa, 8.99%APR, 0% BT for 12 months, 3% BT fee

EQ and/or EX: Citi Double Cash, 13.99% APR, 0% BT for 18 months, 3% BT fee

TU Puller: NFCU Platinum, 7.49% APR, 0% BT for 12 months, 0% BT fee

A 2nd Discover IT, 11.99% APR, 0% BT for 14 months, 3% BT fee

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

@Anonymous wrote:@bustinloose82 here are a few cards

EQ Puller: PenFed Gold Visa, 8.99%APR, 0% BT for 12 months, 3% BT fee

EQ and/or EX: Citi Double Cash, 13.99% APR, 0% BT for 18 months, 3% BT fee

TU Puller: NFCU Platinum, 7.49% APR, 0% BT for 12 months, 0% BT fee

A 2nd Discover IT, 11.99% APR, 0% BT for 14 months, 3% BT fee

See a bit of flaw in your logic as nothing is guaranteed on on going APR.. PenFed in my main CU and have score right around 800 and can tell you I have never gotten their best apr, this also applies for citi as well.. It can happen, but certainly not just score driver and not guaranteed. Same goes for NFCU and discover... Granted all these cards do have a 0% for first for BT's for first 12 moths usually with a fee associated other then what you listed NFCU here. Most likely OP wouldnt get the best ongoing rates on any of the cards above with their scores IMHO.

Example my PenFed card I believe is around 14.xx with 800 score, my Citi Card is probably around 13% now with FED rate cuts and having card for awhile and calling and nagging them about how high my APR was and got it down over many months/years. NFCU is easier to get the best APR, but not guaranteed and discover you can find out by running their Pre-qual tool on APR... With Discover and Citi your initial CL will most likely be pretty disappointing as well

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

@CreditCuriosity wrote:

@Anonymous wrote:@bustinloose82 here are a few cards

EQ Puller: PenFed Gold Visa, 8.99%APR, 0% BT for 12 months, 3% BT fee

EQ and/or EX: Citi Double Cash, 13.99% APR, 0% BT for 18 months, 3% BT fee

TU Puller: NFCU Platinum, 7.49% APR, 0% BT for 12 months, 0% BT fee

A 2nd Discover IT, 11.99% APR, 0% BT for 14 months, 3% BT fee

See a bit of flaw in your logic as nothing is guaranteed on on going APR.. PenFed in my main CU and have score right around 800 and can tell you I have never gotten their best apr, this also applies for citi as well.. It can happen, but certainly not just score driver and not guaranteed. Same goes for NFCU and discover... Granted all these cards do have a 0% for first for BT's for first 12 moths usually with a fee associated other then what you listed NFCU here. Most likely OP wouldnt get the best ongoing rates on any of the cards above with their scores IMHO.

Example my PenFed card I believe is around 14.xx with 800 score, my Citi Card is probably around 13% now with FED rate cuts and having card for awhile and calling and nagging them about how high my APR was and got it down over many months/years. NFCU is easier to get the best APR, but not guaranteed and discover you can find out by running their Pre-qual tool on APR... With Discover and Citi your initial CL will most likely be pretty disappointing as well

What would you recommend for a strong initial CL? I'm not set on a BT card as I'll be able to pay my current balances off in a few months.

I'm also open to good travel cards, specifically for cruise rewards.

Update 4/18/20: Current EQ: 760 | EXP: 708 | TU: 724

Goal EQ: 750 | EXP: 750 | TU: 750 (12/17)

Credit Card Debt Free Goal: March 2018

*NEW* Chase Sapphire Preferred $0 ($17,600) 4/18/20 | Chase Freedom Unlimited $0 ($5,500) | Chase Slate $0 ($2,100) | PNC Visa $11,100 ($12,500) | Citi Costco $0 ($5,500) | Citi Simplicity $0 ($2,700) | Discover It $0 ($8,000) | Barclay Card NFL Extra Points $0 ($12,000) | Marvel Mastercard $0 ($6,000) | Nordstrom Visa $0 ($17,000) | American Express Every Day $0 ($3,000) | Bayport Credit Union $6,876 ($7,500) | American Express Delta $700 ($12,000) | Macy's $601 ($5,000) | JC Penney $0 ($3,500) | Synchrony Amazon $2,728.40 ($6,500)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax goal reached - What card should I apply for?

Lots of options with your scores, IMO. I didn't notice a dining rewards card, other than some that cover various categories including that, like Costco. I might consider Propel, which is 3x on dining and 3x on cruise lines. Savor is another option, but features the dreaded triple-pull. If you are ok with annual fees, you might want to consider Amex Gold.

The only two I know of that only ever (I think?) pull Equifax are PenFed and Coastal. Coastal is only available in a geographic area if criteria are met and their cards are nothing special, so I wouldn't worry about them unless you're already a member. Others, including Chase and Discover, may pull only Equifax depending on your location and whatever other factors that aren't publicly known. But I don't think you need to limit yourself to EQ-only.

JMO, good luck!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content