- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO vs. FAKO – Share your FAKO stories

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO vs. FAKO – Share your FAKO stories

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

No one has seen a denial letter referencing VS.

Also you're a new account so I am not very trustful that new users defending VS aren't accounts run by VS.

No banks use Vantage for creditworthiness purposes. Zero.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:

You didn't name a lender. If a denial letter doesn't mention Vantage Score, it wasn't used.

You're a new account so I am not very trustful that new users defending VS aren't accounts run by VS.

No banks use Vantage for creditworthiness purposes. Zero.

@Anonymous

I might be a new registered member here but I started using myfico credit score services over a decade ago and would read the forum without contributing for many years. I prefer to research and read before I enter the discussions. I've gone from ~400 FICO scores in 2007 to north of 800 on all scoring models. Not that it matters and it's irrelevant to the discussion here, but you did accuse me of being a shill simply for pointing out the facts. That's offensive.

I'll just leave this here, directly from Experian:

Who uses VantageScore today?

- 7 of the top 10 Financial Institutions

- 6 of the Top 10 Credit Card Issuers

- 4 of the Top 10 Auto Lenders

- 4 of the top 5 Mortgage Lenders

- Experian has over 1,300 clients utilizing VantageScore

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:

You didn't name a lender. If a denial letter doesn't mention Vantage Score, it wasn't used.

No one has seen a denial letter referencing VS.

Also you're a new account so I am not very trustful that new users defending VS aren't accounts run by VS.

No banks use Vantage for creditworthiness purposes. Zero.

Enough of this. Completely uncalled for and out of line. While there may be no credit card companies currently using VS 3.0, the score is used in by some creditors in apartment leases and there have been reports that at least one auto lender is using the score. Regardless, do not accuse other posters of having a fake account. Thank you for your understanding and cooperation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:@Anonymous wrote:

You didn't name a lender. If a denial letter doesn't mention Vantage Score, it wasn't used.

You're a new account so I am not very trustful that new users defending VS aren't accounts run by VS.

No banks use Vantage for creditworthiness purposes. Zero.@Anonymous

I might be a new registered member here but I started using myfico credit score services over a decade ago and would read the forum without contributing for many years. I prefer to research and read before I enter the discussions. I've gone from ~400 FICO scores in 2007 to north of 800 on all scoring models. Not that it matters and it's irrelevant to the discussion here, but you did accuse me of being a shill simply for pointing out the facts. That's offensive.

I'll just leave this here, directly from Experian:

Who uses VantageScore today?

- 7 of the top 10 Financial Institutions

- 6 of the Top 10 Credit Card Issuers

- 4 of the Top 10 Auto Lenders

- 4 of the top 5 Mortgage Lenders

- Experian has over 1,300 clients utilizing VantageScore

While there may be some creditors actually using VS 3.0, I wouldn't put too much stock in those statistics from EX. Remember, the score was created by EX, TU and EQ to compete with FICO so they have self interest in promoting the score. Additionally the word 'use' has a lot of different meanings. As of right now, I am not aware of any credit card company basing their credit decision on Vantage Score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Those banks "use" the Vantage scores for cardholder education, not for making loan decsions. For the latter, they use FICO.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

It's not enough to know that FICO is more used than any other scoring company (the answer is obvious). Your own FICO can vary by more than 100 pts depending on which credit bureau you're looking at as well as which scoring model. The variance is just as high as when comparing FAKO to any of your FICO scores, and hence cannot be relied upon. The best you can do is know which specific scoring model is mostly used and then use that as a guideline. If you're concerned about getting a mortgage, this scoring model is much different than for credit cards, or an auto, etc. The point is, everything is in context and a specific FAKO score has roughly equal informational value as any random FICO specific model score, as each one can be just as innacurate when it comes to what you're applying for. If you really want to know your overall credit health, its not enough to pay attention to only one scoring model/methodology.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I completely agree. FICO is as FAKO as the rest. Sure, Fair Isaac assures us that 90% of lenders use FICO... but which FICO?

For example, I applied for insurance with GEICO two months ago, and they gave me a quote, which I did not accept as it was high. Later they sent me a nice fact sheet explaining the factors that resulted in my insurance rate being higher. I can only assume that some FICO-generated insurance score was used.

Today I checked my FICO score with Discover. I scored 812. This score is not too shabby, but not good enough to get a good insurance rate, I suppose!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

So here's my story.

About a year ago I started to get serious about my credit. My scores were in the high 400's to low 500's according to Credit karma.

Throughout this past year I've been getting everything cleaned up on my report and currently have only 1 late pay from nearly 5 years ago. I've also opened up a number of credit cards and started using them. Initially I thought carrying a balance of 50-60% or more per card was the way to build credit fast. (I know better now) Even with these high balances my scores all started to creep up over the 600's..according to CK that is. Currently I am under 15% utilization and all of my scores are over 650 according to FICO 8. However, once I paid down all those balances my CK scores have actuallt dropped by as much as 90 points. lol..

In short, going from >60% utilization to less than 15% dropped all my scores back to the low 500's according to CK. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

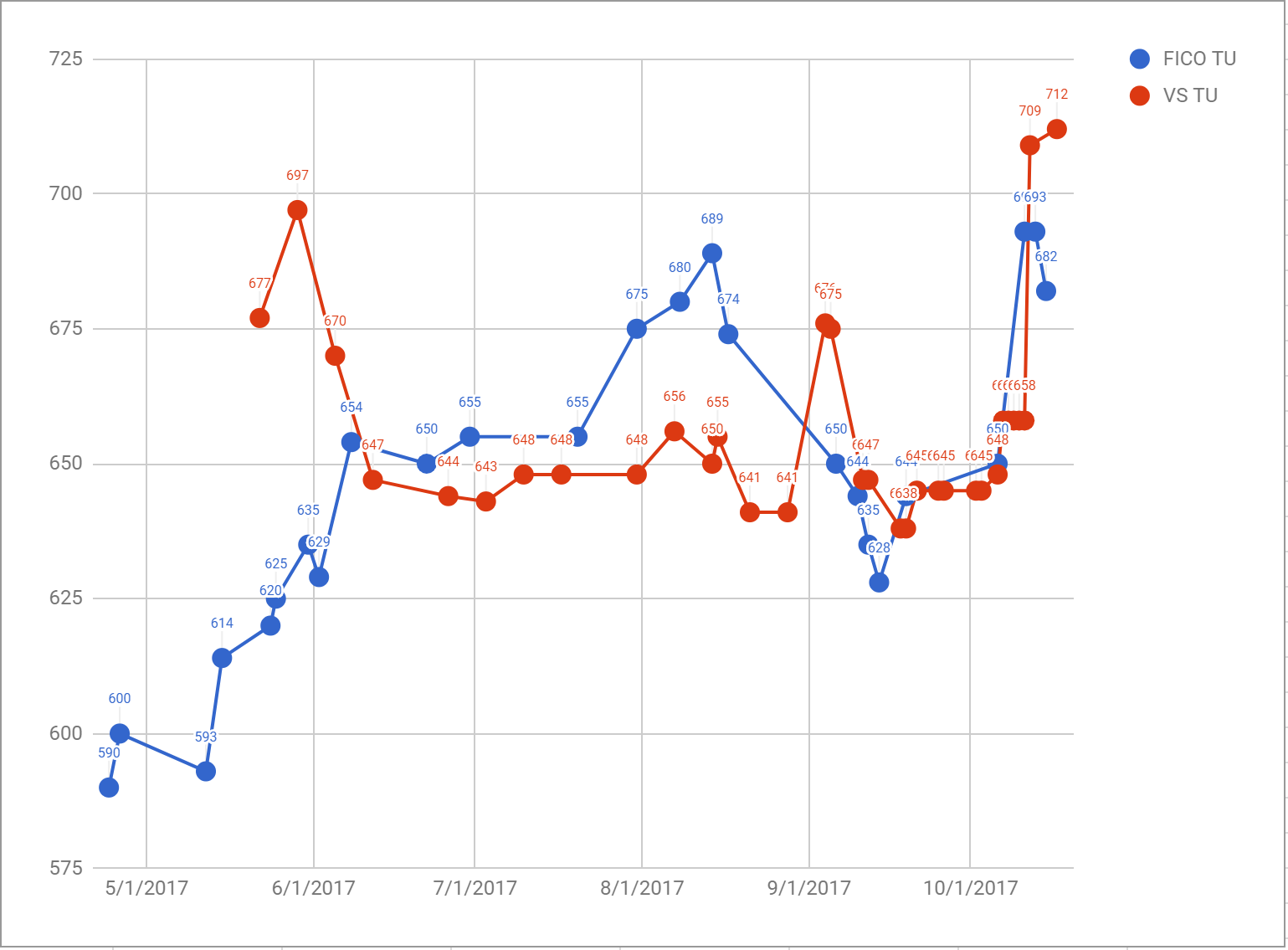

Decided to go back and chart the variance between FAKO Vantage Scores and FICO8 scores using TU as an example.

Some data points in the beginning and at the end are missing, especially recent ones that I need to update. I can't get access to my VS scores before a certain early date but am looking for them to show the 100 point difference early on.

As you can see, there are numerous places where VS would show me approved for a given credit product but I would get declined as FICO8 was way lower. Also, vice versa, there are times VS shows me too low for approval but FICO8 was much higher.