- myFICO® Forums

- Types of Credit

- Credit Cards

- Flagship vs PPMC

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Flagship vs PPMC

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@Aim_High wrote:I agree with @Slabenstein that unless you seek pure simplicity there's no reason to close PPMC even if you add FSR. Within reason, having backup cards for either uncategorized spend (or) special categories, lender diversity, utilization padding are all good reasons to keep it alive. I have a LOT of redundancy in my lineup, and while I am questioning how much I need, it's always good to have at least one backup. In my case, I have many layers of uncapped and uncategorized.

I'm in the same boat you - I have several cards with redundant categories. For DW, she prefers simplicity, so I lot of her spend is on a specified card that earns the highest amount of CB. For me, I'll rotate cards if I have 2 or 3 that earn the same thing. I do it keep spend running through all of them in hopes of getting better a shot at higher CLI's.

I don't mind the "inconvenience" of it.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

As your history gets longer, I think some redudancy is almost inevitable, cards in general may get better, and the cards that you can get improve as well. Then it becomes the old question of whether you should close cards you don't use, and opinions vary.

I've always been in the "close if it does no good" group vs the "keep open if it does no harm" heretics, but, since hypocrisy is one of my middle names, I still have a Cap One Quicksilver, despite having some 2 and 3% cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@JNA1 and @longtimelurker, this is a conversation I've been having with myself recently while I'm gardening and plotting my next moves. My card strategy has evolved many times in 35-ish years. In the past two and a half years, I've made a major shift into travel/points cards as well as more cash back options exceeding 1.5%. Three years ago, my best flat rate uncapped uncategorized returns were 1.5% on Capital One Quicksilver and Chase Freedom. Now, thanks to My Fico community, I have multiple options over 2%. I've also grown my total limits over $500K and hesitate to start tearing that down since I do value the utilization padding. However, I still plan to have even more cards in the $50K-$100K range by the end of the year and at that point it may be tempting to thin the herd to fewer high-quality and high-limit cards in exchange for some portion of potential rewards. And where exactly to draw the line in that process is complicated. I've always said I don't want to be an ultra-rewards-optimizer in my strategy. I prefer to have a more limited strategy that generally works year-round without thinking about it.

Definite Keepers: AMEX Gold (since DW and I dine out often, 4x MR on dining and groceries for 4-8% return), Chase Sapphire Reserve (dining out or travel at either 3%, 4.5%, or 6% depending on redemption method, travel perks, high limit), AOD FCU Visa (3% uncapped and uncategorized plus low APR), Bank of America Premium Rewards (2.625% uncapped and uncategorized, 3.5% uncapped dining and travel, my current highest limit card.)

Next most valuable: Discover IT (oldest open card, high limit, 5% categories), PenFed Power Cash Rewards (backup flat rate 2% uncapped and uncategorized, high limit, low 9.9% APR), Citi Costco (4% gas, 3% dining and travel).

Also, my Bank of America Cash Rewards and Freedom Unlimited, Chase Freedom, and INK Cash are hard to eliminate because of high earnings rates of 2.25% in UR travel (CFU) and 5.25% (CR) to 7.5% (CF/INK) in cash or URs. The big question is making sure the incremental values are worthwhile based on my actual spending as opposed to the potential value. For example, I spent less than $2K of my $6K Chase Freedom annual cap last year. For this reason, I'm wondering if I've exceeded optimum stratification of card options for my spending.

And then there are the cards like my Capital One Quicksilver, which has a very decent $25K limit now (after starting out at only $1K a long time ago) but only earns 1.5%. So it ... "does no harm" with no fees and decent 11.90% APR. As much as I like lender diversity, this one would be fairly easy to close.

A lot to think about!

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

Thanks - I doubt I'd close the PPMC - just wondering if there is any reason not to put it in the sock drawer. I've had a good experience with the card, with CLIs taking it from $3,000 to $10,000 in a year (not phenomenal but not bad), and easy cash back redemption. No complaints.

I don't like the idea of a $50 minimum redemption, although as someone noted, since it would be an everyday driver that would get quite a bit of spend per month, that's not much of an obstacle. I've also had a good experience with my Cash Rewards card through NFCU.

Right now, I'm thinking I'll wait a while to apply. I get a gold spade, first time ever since I started (re)build early last year, on Feb. 7, and will be 0/6 by then. I have thought a little about opening it now simply so I would have opened it in 2020 and could more easily keep track of when the account is a year or two years old!

For my cards in general, I am a bit overindexed for travel in the covid era, but don't want to go overboard changing direction, as I'm hoping the vaccine will start returning things to normal. I did close my Hilton Aspire recently. Otherwise, I'm pretty happy with them (wish Coastal did SP CLIs - wish I hadn't opened the Apple Card, but no point closing it now).

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

Besides my Summit card and my Discover, I've built my lineup with the advice and research I've found here. All of my cards (except Summit, the BB&T card, and now the PPMC) are part of my regular rotation, by design. Every card I've gotten since I've been was acquired with specific purpose, again besides the BB&T which I accidentally applied for. The PPMC was our uncategorized spend card until we got the AOD card.

The remaining goal cards in my sig are ones that will serve a purpose to optimize rewards on our spent.

When I acquire those cards, I'll have to make the decision of whether I want to open more redundant cards. I like the thought of another a potentially high limit card, like the BOA Cash Reeards, or NFCU card, a PenFed card, and maybe an Alliant card because I have money parked in all of those FIs - but truthfully - None of their cards benefit me in the way of rewards. I'll have to decide if i want to get those cards to diversify my profile and add to my total CL, but knowing they won't be part of my regular rotation. I have been faced with prospect yet.

My eventual plan is to utilize that card lineup in this way:

BCP - 6% groceries

Discover - 5% rotating

Freedom Flex - 5% rotating

Cash + - 5% utilities, cell phone

Max Cash - 5% internet, dept stores

Synovus - 5% travel, 3% ? category

PNC - 4% gas, 3% dining

BBVA - 3% - restaurants, bonus 4 - 6X monthly categories

NFCU MR - 3% alternate restaurant card

AOD - 3% - uncategorized spend

NFCU Platinum - Low ARP card if I need it for extended time.

Based on our spend for the last 2 years, this lineup would average around 4.2% cash back, and would yield around $1850 - $1900 cash back, not counting any SUB's

In 2019, my average was 3.3% and this year the average was 3.73%.

Both DW and I have a ClearPoints and Disco cards that we can alternate if we like.

The ClearPoints cards, the More Rewards card, the Synovus card, and the PNC card habe very useful 3% categories if the AOD was to ever go away. The BOA Cash Rewards card would become much more attractive if that ever happened as well.

At the end of the day, I will have to adjust my strategy when I acquire the remaining goal cards.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@KJinNC wrote:Thanks - I doubt I'd close the PPMC - just wondering if there is any reason not to put it in the sock drawer. I've had a good experience with the card, with CLIs taking it from $3,000 to $10,000 in a year (not phenomenal but not bad), and easy cash back redemption. No complaints.

I don't like the idea of a $50 minimum redemption, although as someone noted, since it would be an everyday driver that would get quite a bit of spend per month, that's not much of an obstacle. I've also had a good experience with my Cash Rewards card through NFCU.

Right now, I'm thinking I'll wait a while to apply. I get a gold spade, first time ever since I started (re)build early last year, on Feb. 7, and will be 0/6 by then. I have thought a little about opening it now simply so I would have opened it in 2020 and could more easily keep track of when the account is a year or two years old!

For my cards in general, I am a bit overindexed for travel in the covid era, but don't want to go overboard changing direction, as I'm hoping the vaccine will start returning things to normal. I did close my Hilton Aspire recently. Otherwise, I'm pretty happy with them (wish Coastal did SP CLIs - wish I hadn't opened the Apple Card, but no point closing it now).

I had a couple of other thoughts on the subject, @KJinNC.

Why have I kept the Capital One Quicksilver so long? Well, to be honest, I just have enjoyed the card. They were the first to give me 1.5% unlimited cash back, customer service has generally been a good experience except for their arduous and fully automated CLI requirements, fraud protection has been good, and their no-minimum redemption is probably why some other banks have followed suit. And if you like the no-minimum redemption and have had no issues with the card, it may be a good reason to hang onto it.

Another reason I have hung onto this (and other) cards besides the lender diversity, CL utilization padding, and backup category rewards is that I've found that card features may be enhanced or there might be a chance to product-change a card without a hard pull. All four of my oldest cards (over 20 years old each) have been product-changed at least once into more rewarding programs. I might kick myself if I closed my Capital One just before they enhanced it to a better rewards program. And right now, I could product change to the Venture card. While I don't want to do that, what if that program's rewards became more attractive to me? Right now, Capital One doesn't allow credit limit consolidation, but they may again in the future. I might be able to move those limits over to another card.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@JNA1 wrote:Besides my Summit card and my Discover, I've built my lineup with the advice and research I've found here. All of my cards (except Summit, the BB&T card, and now the PPMC) are part of my regular rotation, by design. Every card I've gotten since I've been was acquired with specific purpose, again besides the BB&T which I accidentally applied for. The PPMC was our uncategorized spend card until we got the AOD card.

The remaining goal cards in my sig are ones that will serve a purpose to optimize rewards on our spent.

When I acquire those cards, I'll have to make the decision of whether I want to open more redundant cards. I like the thought of another a potentially high limit card, like the BOA Cash Reeards, or NFCU card, a PenFed card, and maybe an Alliant card because I have money parked in all of those FIs - but truthfully - None of their cards benefit me in the way of rewards. I'll have to decide if i want to get those cards to diversify my profile and add to my total CL, but knowing they won't be part of my regular rotation. I have been faced with prospect yet.

My eventual plan is to utilize that card lineup in this way:

BCP - 6% groceries

Discover - 5% rotating

Freedom Flex - 5% rotating

Cash + - 5% utilities, cell phone

Max Cash - 5% internet, dept stores

Synovus - 5% travel, 3% ? category

PNC - 4% gas, 3% dining

BBVA - 3% - restaurants, bonus 4 - 6X monthly categories

NFCU MR - 3% alternate restaurant card

AOD - 3% - uncategorized spend

NFCU Platinum - Low ARP card if I need it for extended time.

Based on our spend for the last 2 years, this lineup would average around 4.2% cash back, and would yield around $1850 - $1900 cash back, not counting any SUB's

In 2019, my average was 3.3% and this year the average was 3.73%.

Both DW and I have a ClearPoints and Disco cards that we can alternate if we like.

The ClearPoints cards, the More Rewards card, the Synovus card, and the PNC card habe very useful 3% categories if the AOD was to ever go away. The BOA Cash Rewards card would become much more attractive if that ever happened as well.At the end of the day, I will have to adjust my strategy when I acquire the remaining goal cards.

Now there's a man with a spread sheet and a sharp pencil! I admire your awareness and thoughtful strategy versus the mindless app'ing we sometime see here.

I have no idea what my "real" total rewards return was for 2019 or 2020. Part of the problem is having added many new cards, the SUB rewards have been quite lucrative and the SUB spending has tainted a realistic picture of what my spending or rewards by each card would look like in a "normal" year without adding new accounts. COVID shifts in travel spending haven't helped either. All of that may be another sign that gardening is a good idea.

Whatever my return, I know it's much better than it was since I've added many valuable cards, and like you @JNA1 it was with grateful thanks to the My Fico community.

For me, the other problem with calculating a return rate once I started to diversify into point systems is that it gets very complicated. I know I'm earning higher on some of my spending than I could with any no-AF cash back card, but with points-based cards you often must allow for (1) effect of fees (2) ability to diminish fees by organic use of credit offsets and (3) how the value of your points will vary based on redemption methods. So I can't say I will definitely always get x.xx% on my Chase Ultimate Rewards points (unless I maybe always redeem them for the lower cash value.) However, in hindsight, if I redeem 30,000 of them for travel or hotels, I can give you a pretty good idea of what my return was for those points AFTER I've decided to spend them.

I mentioned reevaluating my lineup and your posting ties into some thoughts on the subject. In my case, I realized that the more I spread my spending, the less valuable each card in my lineup becomes. Each one is more work to manage, less likely to grow without methodical periodic focused spend, and possibly even more likely to shrink or close due to low spend. Rewards on each card may accumulate very slowly, especially if there are minimum redemption thresholds of if you can't pool them between cards like I can with my Chase cards, for example. The question becomes balancing rewards with complexity; at what rewards price point am I willing to give up some complexity so that I can use my cards in a more healthy and balanced manner? If I have a card I just use for $1 Amazon charges once every six months, or it only gets my $40/month gym membership on a $10K limit because it gives me an extra 2% back on Fitness, is this a card that's still worth my time? (That would work out to $9.60 annual savings, for example.)

I'm not saying there's anything wrong with optimizing as deeply as anyone wants to take it! I'm just vocalizing a little of my thoughts about my own lineup right now, and I encourage anyone optimizing rewards to recognize the complexity trap and make a conscious decision about how far they want to take the process. And not to be afraid to reevaluate and simplify if necessary. Your tracking of actual return is helpful versus looking at just how much a card could potentially save you as a percentage or dollar figure.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@Aim_High wrote:

If I have a card I just use for $1 Amazon charges once every six months, or it only gets my $40/month gym membership on a $10K limit because it gives me an extra 2% back on Fitness, is this a card that's still worth my time? (That would work out to $9.60 annual savings, for example.)

Yes, keep/close discussions can get complex! Now if you came on announcing you are going to get a new card that saves you $9.60 a year, most of us (I hope!) might be friendly and respectful, but would not be all that supportive of the plan! However, once you have it, yes, it's a tiny amount of money, but now does the effort of keeping it exceed that return (or could the time you put into keeping the card be put to a more profitable use). I think many of us find that hard to evaluate.

In the old MS world, where you would visit 10 stores a day to buy the product, and a different 4 stores to liquidate, and 6 banks to deposit the proceeds of liquidation, people would often ask what really is that $ per hour return? For people with bad geographies, it turned out it could very small (and for those in centers with lots of the right stores, it could be very big). But these things were fairly easy to measure, basically how much time do you take to complete the process, gas cost etc.

Anyone any guesses/insight into the cost of keeping a credit card (assume it's the only one with that issuer)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

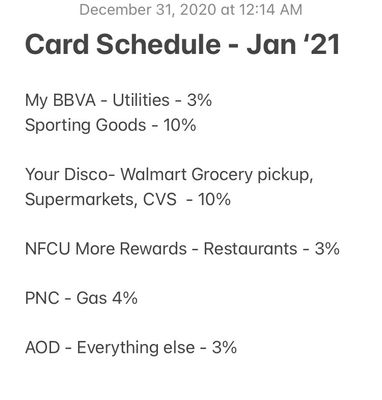

Dealing with straight cash back makes it much easier for us, but we don't travel enough (and we never fly) so high AF travel cards make no sense for us. The Synovus card I want offers 5% up to $5K which will handle our travel expenses perfectly most years. Another factor that helps me manage things is looking a month ahead and segregating the cards we're going to use for the month in our wallets. For instance, starting Saturday, I'll move the new Disco to the front slots and move the BCP to a separate set of slots out of the way until after March since we'll be getting 10% groceries. The cards that I use to pay utilities typically stay at home in our safe. For DW, early on she asked that I make her a cheat sheet and that's what I've continued to do. As complicated as it all sounds, we keep it pretty simple. Here is her cheat sheet for Jan:

Next month, I'll remove the 10% targeted sporting goods from the BBVA card, change restaurants to her BBVA card, and may juggle something else around if either of us get a targeted offer from BBVA, or one of the 10% offers we get from BBVA or PNC.

Since I started doing this only 2 years ago, I started out keeping up with cash back as I redeemed it and tracked all of our SUBs, and I've kept doing it for the fun of it. I've got to figure up December's cash back, including the SUB we collected on DW's NFCU cashRewards card and update it soon.

DW's happy because she says I finally have a hobby that makes money! ![]()

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Flagship vs PPMC

@longtimelurker wrote:Yes, keep/close discussions can get complex! ... it's a tiny amount of money, but now does the effort of keeping it exceed that return (or could the time you put into keeping the card be put to a more profitable use). I think many of us find that hard to evaluate.

Exactly. And where to draw that line for any individual card can be difficult and a personal decision. Maybe $9.60 matters to someone's circumstances enough to keep a card open. Others might decide $50 or less isn't worth the trouble. Still others might say it would take $100 or more a year. And as I pointed out, it's even harder on cards where the spending may vary over time. It's pretty easy if you know how much you average spending per month on a certain category and that a card always pays a high rate on that category. It becomes more problematic when you either have variable spending or the categories change over time like they do with the revolving cards (Including the low spend I noted on my Chase Freedom, for example.)

At that point, you might decide a card isn't worthwhile but it's also a chance to purposefully put more effort into using card categories, as long as it is organic spending anyway.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.