- myFICO® Forums

- Types of Credit

- Credit Cards

- Garden Club of August!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Garden Club of August!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

These garden club meetings are as bad as attending AA meetings where everyone relapses all the time! ![]() No one ever recovers!

No one ever recovers!

TU Fico 8 - 850

EX Fico 8 - 850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

@visorboy1974 wrote:Gardening is soooooo boring!!! That said, I need to do it!

On the conttrary I find it very exciting to watch my scores improve just from no new credit and natural aging.

From a BK years ago to:

EX - 3/11 pulled by lender- 835, EQ - 2/11-816, TU - 2/11-782

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

@android01 wrote:These garden club meetings are as bad as attending AA meetings where everyone relapses all the time!

No one ever recovers!

Well, I think that there's an important distinction to be made. The goal of an AA meeting is to encourage members to abstain from drinking permanently, as it is an inherently harmful activity for the individual in question. The goal of a Garden Club meeting is to allow members to share how they are doing with abstaining from apping for an appropriate amount of time, but not forever. In other words, to abstain from mindless, undproductive apping. Members are to look at their credit portfolio in terms of where they eventually want to be, and what do they need to do in order to get there.

For instance, my goal is to be able to be eligible to be approved for prime cards. I would love to be able to apply for a particular BoA card, but the timing is not right -- I need to let my accounts age a bit more and allow some old baddies to age off. So, I wait, I garden. In the meantime, I have cards in my portfolio that I want to keep long term; I'm watching those cards begin to grow and develop into cards that I'm quite pleased to have. As my current crop of cards improve, via positive reporting and increased CLs, I become more attractive to future lenders, such as BoA.

So, the goal is not to abstain from apping forever. Rather, the goal is to wait until the time is right to app for desireable cards, all while continuing to develop one's current TLs. Or, in the case of someone who is already happy with what they have, to sit back and watch them grow. Yes, sometimes an opportunity comes along that one did not expect and was not part of one's original plan; WalMart offering free TU FICO scores is such an example. But, if this is beneficial to a particular individual, then it makes sense to amend the gardening plan and continue on from there. I can't fault anyone who chose to "leave the garden" temporarily to add this card. Rather, I consider it "planting a seed" for future benefit. Once again, it comes down to apping mindfully, adding credit with a purpose in mind.

Does that make sense? ![]()

Current Scores: EQ 775 (03/04/2014), EX 756 (03/01/2014), TU 760 (03/01/2014)

Ruby Spade Garden Club Member - Last App: 03/04/2013 - No apps until 2014

Cards: Cap1 Venture 6.4k, Cap1 Quicksilver MC 1.75k, BankAmericard 1-2-3 Visa Signature - UCF Alumni Association 5k, Discover 7k, Citi Diamond Preferred MC 10.35k, Wells Fargo Rewards Visa 7k, Chase Freedom 5k, Chase Ink 7.5k, Amex Green NPSL, Dillard's Amex 7.5k, JC Penney 7.5k, Kay Jeweler's 5.1k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

@MarineVietVet wrote:

@visorboy1974 wrote:Gardening is soooooo boring!!! That said, I need to do it!

On the conttrary I find it very exciting to watch my scores improve just from no new credit and natural aging.

From a BK years ago to:

EX - 3/11 pulled by lender- 835, EQ - 2/11-816, TU - 2/11-782

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

+1 -- that's where I'm at right now. ![]()

Current Scores: EQ 775 (03/04/2014), EX 756 (03/01/2014), TU 760 (03/01/2014)

Ruby Spade Garden Club Member - Last App: 03/04/2013 - No apps until 2014

Cards: Cap1 Venture 6.4k, Cap1 Quicksilver MC 1.75k, BankAmericard 1-2-3 Visa Signature - UCF Alumni Association 5k, Discover 7k, Citi Diamond Preferred MC 10.35k, Wells Fargo Rewards Visa 7k, Chase Freedom 5k, Chase Ink 7.5k, Amex Green NPSL, Dillard's Amex 7.5k, JC Penney 7.5k, Kay Jeweler's 5.1k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

OK, I'm definetely here to stay for at LEAST a year I promise!!!! My app spree netted me 5 new accts:

JCP Store Card (150)

Cap 1 No Hassle Cash Rewards Card (500)

Household Bank Platinum Card (300)

Old Navy Store Card (300)

Best Buy Store Card (750)

Plenty of UTIL and more than enough accts to manage with my other 4. Now it's time to watch the score's rise.

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

Ok, it's the 1st of the month, so I just pulled my FICO scores...

My TU hasn't moved from last month. But, I received a 12 point boost on my EQ -- to 668!

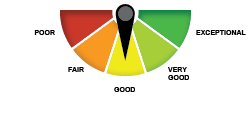

This is a major milestone for me. According to the FICO scale of bad/not good/good/very good/great, this is the very first time that I've crossed the 660 threshhold, placing me in the "Good" category! This is a far cry from the 567 score that I started with when I began tracking. While I still have a ways to go before getting into the 700 club, it's a real psychological boost to see that one of my FICO scores has crossed over into the "Good" category. ![]()

Woo, hoo!!!!!

So, gardening pays off. The very best thing that I can do for my scores at this point in my journey is to sit back and tend to my current accounts. Let them continue to age, keep util low (I'm at 1%), wait for baddies to age off, and ALWAYS pay EVERYTHING on time. I've come a long way in a year, and I'm feeling very encouraged for the future.

On August 1, 2011

Score Watch® does not check your FICO® score every day, so there may be a delay between a change in your FICO® score and the time you receive an alert from Score Watch.

Current Scores: EQ 775 (03/04/2014), EX 756 (03/01/2014), TU 760 (03/01/2014)

Ruby Spade Garden Club Member - Last App: 03/04/2013 - No apps until 2014

Cards: Cap1 Venture 6.4k, Cap1 Quicksilver MC 1.75k, BankAmericard 1-2-3 Visa Signature - UCF Alumni Association 5k, Discover 7k, Citi Diamond Preferred MC 10.35k, Wells Fargo Rewards Visa 7k, Chase Freedom 5k, Chase Ink 7.5k, Amex Green NPSL, Dillard's Amex 7.5k, JC Penney 7.5k, Kay Jeweler's 5.1k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

Hello!

So, I'm new... relatively anyway. Just left my gardening stage for a while, but am VERY happy to return. I got tired of looking at the low CL's on my accounts, and knew that I could do a little bit better. Also, knowing that we were about to run our Home Depot bill close to limits as we're rehabbing our kitchen, I wanted to do so before my util went up too high. So here it goes...

Orchard - $300 CL $0 balance (Great rebuilder, but will not give me a CLI, so really considering closing out)

Citibank- Platinum Div- $4000 CL $1,232 balance (authorized user on this account, they REFUSE to give me a card of my own ![]() )

)

Total Access Visa (Midwest Bank)- $250 CL $0 balance (my oldest card, low limit, helped me with rebuild, but no CLI, after others age, I will probably close out)

Cap 1- $750 CL $0 Balance- (just like everyone else, no CLI on the credit steps card, definitely going to close after some more aging)

Express retail- $860 CL $221 balance

VS Angel Card- $800 CL $0 Balance

BR/ Gap- $800 CL $0 Balance (joint with hubby)

Home Depot- $22,000 $0 Balance (joint with hubby)

Macys- $2,500 CL $0 Balance (joint with hubby)

JCP- $800 CL $0 Balance

!NEW! Nordstrom- $3,00 CL -$600 Balance (thanks to the Anniversary Sale)

!NEW! Chase Freedom- $7,500 CL $0 Balance

What are peoples thoughts on closing the smaller accounts? Namely the Total Access, Cap 1, and Orchard? Those have just been in full bloom for quite some time, and really just sort of annoy me for even being there.

Thanks for all of your advice in the forums too. I've been reading and not commenting for a while now. Low credit scores had been so embarassing to even talk about for so long, now I feel a little bit better, and hope I can pass on whatever I've learned to others. HAPPY AUGUST!

Current Score: 08/01/2011 EQ 684 EX (Lender Pull) 702 TU 712

Goal Score: 780+

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

@Switch2007 wrote:Hello!

So, I'm new... relatively anyway. Just left my gardening stage for a while, but am VERY happy to return. I got tired of looking at the low CL's on my accounts, and knew that I could do a little bit better. Also, knowing that we were about to run our Home Depot bill close to limits as we're rehabbing our kitchen, I wanted to do so before my util went up too high. So here it goes...

Orchard - $300 CL $0 balance (Great rebuilder, but will not give me a CLI, so really considering closing out)

Citibank- Platinum Div- $4000 CL $1,232 balance (authorized user on this account, they REFUSE to give me a card of my own

)

Total Access Visa (Midwest Bank)- $250 CL $0 balance (my oldest card, low limit, helped me with rebuild, but no CLI, after others age, I will probably close out)

Cap 1- $750 CL $0 Balance- (just like everyone else, no CLI on the credit steps card, definitely going to close after some more aging)

Express retail- $860 CL $221 balance

VS Angel Card- $800 CL $0 Balance

BR/ Gap- $800 CL $0 Balance (joint with hubby)

Home Depot- $22,000 $0 Balance (joint with hubby)

Macys- $2,500 CL $0 Balance (joint with hubby)

JCP- $800 CL $0 Balance

!NEW! Nordstrom- $3,00 CL -$600 Balance (thanks to the Anniversary Sale)

!NEW! Chase Freedom- $7,500 CL $0 Balance

What are peoples thoughts on closing the smaller accounts? Namely the Total Access, Cap 1, and Orchard? Those have just been in full bloom for quite some time, and really just sort of annoy me for even being there.

Thanks for all of your advice in the forums too. I've been reading and not commenting for a while now. Low credit scores had been so embarassing to even talk about for so long, now I feel a little bit better, and hope I can pass on whatever I've learned to others. HAPPY AUGUST!

Hi, Switch2007 -- welcome to the forum! You'll find a lot of good advice here. And not to worry about the low scores; many forum members have or are currently recovering from low scores, so you're in good company. Glad to hear that things are improving for you -- feels good, doesn't it?

Congrats on the recent approvals, very nice! As for the smaller cards, how long have you had them? Which is your oldest active TL? If it's been a long time, you may want to consider keeping it open to anchor the age of your overall account history. Also, it seems that Cap1 might be starting to soften up on CLIs. How long have you had the card? When is your next AF coming due? Also, Orchard is up for sale. Leading candidates to buy them include Cap1, Wells Fargo and (someone correct me if I'm wrong) Chase. I have an Orchard card, too, and I'm hanging onto it for another year to see who winds up buying it and if there is any potential for it to turn into a decent account.

I'm sure others can give you their perspectives. Good luck on the kitchen rehab! ![]()

Current Scores: EQ 775 (03/04/2014), EX 756 (03/01/2014), TU 760 (03/01/2014)

Ruby Spade Garden Club Member - Last App: 03/04/2013 - No apps until 2014

Cards: Cap1 Venture 6.4k, Cap1 Quicksilver MC 1.75k, BankAmericard 1-2-3 Visa Signature - UCF Alumni Association 5k, Discover 7k, Citi Diamond Preferred MC 10.35k, Wells Fargo Rewards Visa 7k, Chase Freedom 5k, Chase Ink 7.5k, Amex Green NPSL, Dillard's Amex 7.5k, JC Penney 7.5k, Kay Jeweler's 5.1k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

@tinuviel wrote:

Hi, Switch2007 -- welcome to the forum! You'll find a lot of good advice here. And not to worry about the low scores; many forum members have or are currently recovering from low scores, so you're in good company. Glad to hear that things are improving for you -- feels good, doesn't it?

Congrats on the recent approvals, very nice! As for the smaller cards, how long have you had them? Which is your oldest active TL? If it's been a long time, you may want to consider keeping it open to anchor the age of your overall account history. Also, it seems that Cap1 might be starting to soften up on CLIs. How long have you had the card? When is your next AF coming due? Also, Orchard is up for sale. Leading candidates to buy them include Cap1, Wells Fargo and (someone correct me if I'm wrong) Chase. I have an Orchard card, too, and I'm hanging onto it for another year to see who winds up buying it and if there is any potential for it to turn into a decent account.

I'm sure others can give you their perspectives. Good luck on the kitchen rehab!

Closing an account(s) doesn't affect your AAoA (it stays on your report for 7 - 10 years) and while it shows up as closed, it doesn't really affect your FICO score. I would still leave Capital One, I feel like they will start giving CLI in the future once things are more stable. I would close Orchard Bank if I were you, it did its purpose and now you have the Chase Freedom card.

If you're worried about the credit limit given by your Home Depot card, try asking for an increase without a hard pull. If not possible, maybe wait until Chase offers 5% cashback in that category and than use it between the cards (Though you are probably trying to get interest free financing, but atleast its something).

The high debt to avail. credit may hinder your scores for a bit, but once you pay it down, you'll be alright in about a year.

Another interesting thing, try cost saving ways of using just 20,000$ to remodel your kitchen, you'll be suprised at how much you can save without skipping out on anything important if you just do enough research. I helped my parents remodal their bathrooms at about 15k and they love it (though, we did most of the work by hand).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Garden Club of August!

Co-signing for Student Loans for my oldest daughter has put me in the "club" and I plan to stay for at least one year - until the next round of SL's comes up!

We were lucky and got some prime interest on this years loans but the end result was 5 INQ's on my reports. ![]()

So I plan to work with what I have for credit cards and let them age / grow without any hard pulls...

Ray

** Every Card has a Job, and Every Card does its Job **