- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Alternative to vanilla AMEX Blue Cash Preferre...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Great Alternative to vanilla AMEX Blue Cash Preferred

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Great Alternative to vanilla AMEX Blue Cash Preferred

If you have ... or are considering ... the American Express Blue Cash Preferred card, you may be interested in an excellent alternative. Many of us know that besides the standard AMEX Platinum card, there are affiliate cards available for clients of Charles Schwab, Goldman Sachs, or Morgan Stanley. And for clients of Charles Schwab, the "investor card" offers a Schwab-equivalent version of the Cash Magnet 1.5% cash back card.

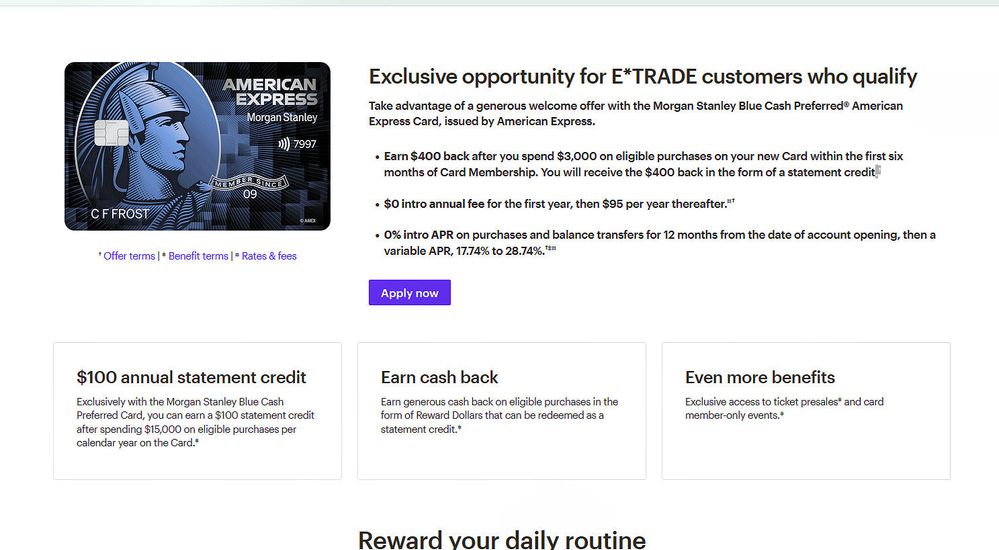

But if you are an e-Trade (Morgan Stanley) customer, there is also a Blue Cash Preferred variant that may be much more beneficial than the vanilla AMEX version.

The regular BCP has a rewards structure of: 6% on groceries up to $6K annually, 6% uncapped on streaming services, 3% uncapped on gas and transit, and 1% on everything else. The annual fee is $95. The current AMEX SUB is $0 AF for the first year; 0% APR on both purchases and Balance Transfers for the first 12 months and then 18.24% to 29.24%; and a cash bonus of $250 after spending $3,000 in the first six months.

The >Morgan Stanley Blue Cash Preferred version< has the same rewards structure as above. It has the same $95 AF. It has the same waived first year AF. It has a 0% APR for 12 months also; the permanent APR is slightly lower at 17.74% to 28.74%.

But ... the cash SUB is $150 higher at $400 for spending the same $3,000 in the first six months! ![]()

But it gets even better. If you spend $15K annually on the card, there is a $100 annual credit, meaning the AF is effectively credited back permanently with sufficient spend. If you spend the full $6K cap on groceries at 6%, you'd need to spend just another $9K annually or $750 per month on the other categories to reach $15K annual spend.

For anyone who doesn't have an e*Trade account, there is also currently a >bonus for opening a new account that ranges from $50 to $3,500< for funding levels between $5K+ and $1.5M+. (Offer ends 04/18/2023.) However, there is no minimum funding requirement on brokerage accounts.

For many of our members, I think this could be an excellent opportunity to consider. If you want this card, product changes from the regular AMEX BCP are not available; a new application is required.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

I believe @Adkins introduced the Morgan Stanley BCP topic back in Nov 2021 associated with this particular CC (thread locked due to age).

Though, different SUB offers have been featured since the introduction of this particular card, not many members may jump into the idea of parking significant deposits with Morgan Stanley or maintain the required AMB to avoid steep monthly fees -- just for BCP. For E*TRADE, brokerage account eligibility plays a role it seems.

For one of their products:

To avoid a $15 monthly fee, the account holder must 1) set up a direct deposit of $200 or more per month to the account, or 2) maintain an average monthly balance of at least $5,000 in the account on or after the end of the second statement cycle, or 3) maintain an average monthly balance of at least $50,000

Also, the Morgan Stanley BCP has no downgrade path given the flux of members who traditionally enjoy upgrade/downgrade flexibility, especially when an enticing SUB offer is involved.

ETA - based on the BCP disclaimer -- E*TRADE clients with an eligible brokerage account can apply for the Morgan Stanley Blue Cash Preferred® Card... so the question would be, which brokerage account is eligible since E*TRADE offers several types.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Great Alternative to vanilla AMEX Blue Cash Preferred

Compares kind of disfavorably to a Citi Custom Cash imo. Same spending cap, no AF or hoops. No need for brokerage account, $5k balance, or direct deposit. 9k non category spend to cancel out the AF probably costs as much in lost rewards unless you have 9k in yearly streaming and gas expenses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Great Alternative to vanilla AMEX Blue Cash Preferred

Same here. Good to always see different options but I'd rather get 5% on grocery, 5% on gas, and 2% minimum on not-cat spending, with no annual fee. Even if it means using more than one card.

Let's just say someone spends $6k/yr on groc, $4.5k on gas, and $4.5k non-cat.

Amex: $360 + $135 + $45 + $5 ($100 - $95) = $545

Other cards: $300 + $225 + $90 = $615

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

Good points and thanks for those details and additional clarification, @FinStar.

I suppose I missed @Adkins Original thread on the subject (11/10/21) but I see it now that I search for it. Kudo's to @Adkins for the discovery and mention to the community. Like her, I was just trying to do a favor for those who might find the card useful in lieu of the vanilla BCP. The SUB right now, combined with the potential waived AF, might make a substantial difference to some of our members. Once I search, I also see a mention of the card by @PullingMeSoftly. I also see a reported approval post by @maximo781 on 10/22/22.

The deposit requirements might inhibit some applicants so that is a valid consideration, just like it is with many other cards we discuss on the forums whose qualification hoops might dissuade someone's interest. Many of our community wouldn't be deterred by a $200 a month investment or $5K lump-sum to defer the fee if they were otherwise interested in the card, so I see this card as much more attainable by the average consumer than some other special card programs. For example, Bank of America's Preferred Rewards requires much larger deposits of $20K, $50K or $100K.

And true, the no-downgrade path for affiliate AMEX cards is a consideration for someone not committed to holding the new card.

For "ELIGIBLE" brokerage account definition, I believe the answer is found in the disclosure on the application and it appears to be any brokerage or trust account as long as it is in the name of the card applicant.

I suppose it's also worth noting that if you terminate your relationship with Morgan Stanley, AMEX may close your card. I imagine this is similar to other affiliate AMEX cards as well as cards like my CITI Costco card that can be closed if I terminate my Costco membership.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Great Alternative to vanilla AMEX Blue Cash Preferred

@Bockrocker wrote:Compares kind of disfavorably to a Citi Custom Cash imo. Same spending cap, no AF or hoops. No need for brokerage account, $5k balance, or direct deposit. 9k non category spend to cancel out the AF probably costs as much in lost rewards unless you have 9k in yearly streaming and gas expenses.

= = = = = = = = = = = = = = = = = = = = = = = = = = =

@ptatohed wrote:

Same here. Good to always see different options but I'd rather get 5% on grocery, 5% on gas, and 2% minimum on not-cat spending, with no annual fee. Even if it means using more than one card.

Let's just say someone spends $6k/yr on groc, $4.5k on gas, and $4.5k non-cat.

Amex: $360 + $135 + $45 + $5 ($100 - $95) = $545

Other cards: $300 + $225 + $90 = $615

I'm not saying that I disagree with those points but they go beyond the purpose of mentioning the option of either vanilla or Morgan Stanley BCP if someone has decided to add that card. I posted to let others know, even though I also don't plan to apply myself. I've considered BCP before, but IMO, the MS version is potentially much more competitive between the two options and might change someone's calculations.

The $6K cap on BCP's 6% earnings is only $115 a week; I know we have some members who spend far more than that weekly, so they would consider multiple options to cover grocery rewards. Likewise, the Citi Custom Cash would only pay higher rewards on an average of $125 grocery spend per week. And, we have many members who stop short of fully-optimizing their rewards lineup in favor or simplicity and fewer cards. But knowing your options is always good! ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

@Aim_High wrote:Good points and thanks for those details and additonal clarification, @FinStar.

The deposit requirements might inhibit some applicants so that is a valid consideration, just like it is with many other cards we discuss on the forums whose qualification hoops might dissuade someone's interest. Many of our community wouldn't be deterred by a $200 a month investment or $5K lump-sum to defer the fee if they were otherwise interested in the card, so I see this card as much more attainable by the average consumer than some other special card programs. For example, Bank of America's Preferred Rewards requires deposits of $20K, $50K or $100K.

And true, the no-downgrade path for affliate AMEX cards is a consideration for someone not committed to holding the new card.

For "ELIGIBLE" brokerage account definition, I believe the answer is found in the disclosure on the application and it appears to be any brokerage or trust account as long as it is in the name of the card applicant.

I suppose it's also worth noting that if you terminate your relationship with Morgan Stanley, AMEX may close your card. I imagine this is similar to other affiliate AMEX cards as well as cards like my CITI Costco card that can be closed if I terminate my Costco membership.

Right.

This is the other piece of consideration, since the same would happen with any Charles Schwab or Goldman Sachs [AmEx] products as well. The only bilateral relationship that was flexible without such requirements was Ameriprise, but those AmEx products were discontinued, and for anyone that retained their Ameriprise AmEx CCs, such products were folded into the AENB respective products suite (Gold, Platinum).

Then again, it depends on whether someone wants to open an E*TRADE brokerage account and keep that particular BCP version knowing there's no downgrade path (or multiple if they already have BCE and/or BCP with AENB proper).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

This means that after reaching the 6k cap, if someone spends an additional 9k, he would get $100. This is only 1.1% cashback. Do I miss something? After reaching the cap, somebody can easily switch to another card to earn ~3-5% cashback to maximize the return.

BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclay View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

@xenon3030 wrote:This means that after reaching the 6k cap, if someone spends an additional 9k, he would get $100. This is only 1.1% cashback. Do I miss something? After reaching the cap, somebody can easily switch to another card to earn ~3-5% cashback to maximize the return.

Well, one would get the 6% back on grocery up to the $6k spend cap, but, in order to get the $100 to wash out the 'gulp' (hives) $95 AF, another $9k in spending would be needed. But it doesn't necessarily need to be at 1%. Some/all of it may be at the 3% gas/transit.

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alternative to vanilla AMEX Blue Cash Preferred

@xenon3030 wrote:This means that after reaching the 6k cap, if someone spends an additional 9k, he would get $100. This is only 1.1% cashback. Do I miss something? After reaching the cap, somebody can easily switch to another card to earn ~3-5% cashback to maximize the return.

<sigh> ![]()

Again, the point of this thread wasn't to critique the earning structure of the Blue Cash Preferred versus other alternative cards. Or to compare ways to optimize rewards earnings with multiple cards. But yes, you're missing something. Part of that $9K can earn 6% uncapped on streaming and we have members who pay a lot for streaming. Part of that $9K can also earn 3% uncapped on gas and transit. While there certainly are cards that earn more, again some of our community doesn't fully optimize so 3% rewards in those categories are acceptable to them. Finally, yes, anything else earns 1%. Again, not optimizing but many people don't want to carry multiple cards like some on My Fico. You may be surprised at our members who quietly carry two or three cards and accept some 1% or 1.5% rewards without optimizing.

The bigger point is how does BCP with a $95 AF compare to BCP with a $5 net reward and a SUB that is larger? The posting was to offer an alternative to those who have/want BCP, not to encourage anyone to apply who wasn't already interested in the card rewards structure.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.