- myFICO® Forums

- Types of Credit

- Credit Cards

- Grocery store credit card set up?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Grocery store credit card set up?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Grocery store credit card set up?

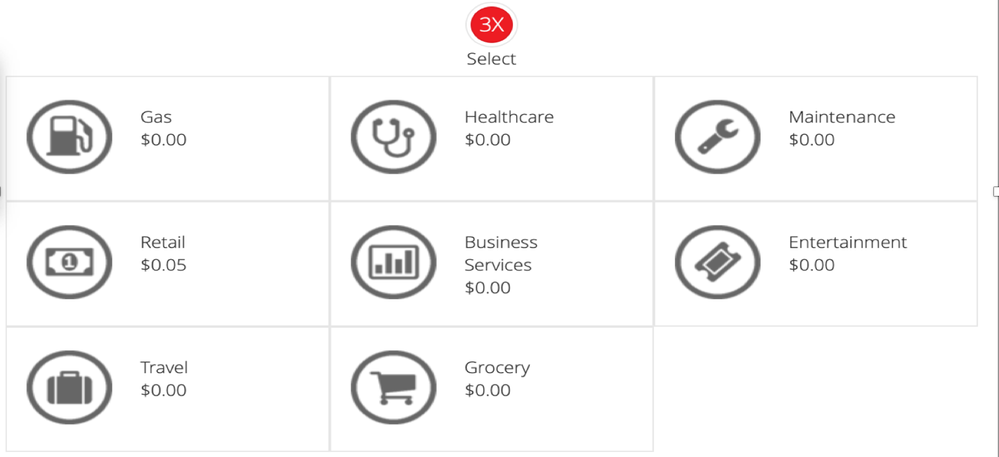

Welp my original plan was to use the US Altitude Reserve for our grocery purchases using mobile wallet. However, we do the majority of our shopping at Kroger who don't accept mobile wallet payments. Our Kroger spend is $600-$800 a month. We also spend about $100 a month at wholesale (mostly Costco). Our restaurant and gas spend is low maybe $100 a month each. So now I find myself facing a decision of getting a card specifically for groceries since it's such a big spend for us. Other cards we have: Citi DC (DH)(very low CL), Costco VISA, Chase Freedom, Discover, CSP, Amazon, some hotel cards.

The option I ruled out:

AmEx Gold Card: I know it's a favorite but I wouldn't use the credits and I can't see paying a $250 annual fee for 4x spend when I have some good 3x options.

Options I'm considering:

Navy Federal More Rewards: 3x on groceries, gas, dining. Pros: good multiplers, no annual fee con: can't use at Costco (We do have the Costco credit card but hate the once a year redemption certificate system). Points would be isolated.. (not combinable with other cards we have).

US Bank Altitude Go: 4x on dining. 2x on groceries, gas, and streaming. $15 streaming credit. Pros: no annual fee, streaming credit Cons: 2x isn't any better then a 2% cashback card of which we have several options already, points would be isolated...

AmEx Blue Cash Everyday: 3x on groceries, 2x on gas and department stores. Pros: 3x on groceries- high multiplier. Cons: capped at $6k for groceries, we would have to use another card. Can't use at Costco. Dont' like redemption only as statement credit.

AmEx Blue Cash Preferred: 6x on groceris, 6x streaming, 3x gas stations. Pros: 6x on groceries- high multiplier, annual fee waived first year. Cons: capped at $6k we would have to use another card. Can't use at Costco, wouldn't be interested in paying annual fee 2nd year. Dont' like redemption only as statment credit.

CitiPremier: 3x on groceries, restaurants, gas stations. Pros: good multipliers on groceries and dining. Could pool points with DH Citi DC. Strong sign up bonus. Cons: $95 annual fee, no travel protections (wouldn't redeem for travel), wouldn't want to pay AF in 2nd year.

Any thoughts on which could work best for us? Other cards we should consider that I haven't thought of?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

The More Rewards is the best card on that list for your needs because its uncapped.

If you can get approved for it, the UMB Simply Rewards is another good option because its uncapped and includes Walmart and Target (discount stores is actually one of the categories), but UMB is known to be pretty selective and they have a geofence but lots of affinity cards that expand beyond their fence. VISA card.

Not explicitly a grocery card but the uncapped 3% on all purchases AOD card is also a VISA for those Costco purchases.

Bank of the West has their cash back card which is set up with 3% groceries, 3% gas, 3% dining. Geofenced and is unfortunately a MC.

Consumers CU (anyone is eligible to join with a $5 donation) has their VISA Signature cash rebate card for 3% on groceries but its got a $6K cap like the AMEX cards.

I personally would go for the BCP for the $6K and the More Rewards or UMB if you can get it. Your spend more than makes up for the AF on the BCP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

Another good grocery card is the Verizon Visa, if that's an options for you. The cashback can only be redeemed for Verizon bills and purchases, so you'd have to have service w/ them and plan to keep it long-term, but it gives 4% on groceries and gas and 3% on dining.

I did a lot of research on grocery cards last year before opening one, and I ended up going w/ the Amex BCP just b/c the math on rewards worked out in its favor. Our grocery spend is around where yours is, and when I mathed it out $8,400/year for groceries on the BCP ($6k @ 6%, $2.4k @ 1%) came out $37 ahead of a flat 3% card like the More (taking the BCP's AF into account, of course). Compared in the same way, BCP + a 2% card comes out $61 ahead. So even with the cap and the AF, the BCP might still be a good option for you, depending on what all you're looking for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

What is your aversion to receiving statement credits if not using toward travel? If you were going to get cash back, couldn't you just use those dollars in your checking account elsewhere rather than applying them to your payment each month? Blue Cash Preferred even with its cap would net you $157 more than a 2% card after the annual fee each year ($252 more than a 2% card plus a Welcome Offer around $300 the first year) based on $6k of grocery and $1200 in gas. Plus there are Amex Offers that can add up easily as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

Not sure what state you're in but Synovus Cash Rewards sounds like an option

- 3% cash back for dining PLUS

- 3% cash back in a category of your choice (groceries is one of them)

- Quarterly cap is $3,000 and based on your $700 average monthly grocery spend, you'd be under for the year

- $0 annual fee, and can be used at Costco

- Generous lines, not averse to new accounts/inquiries

I hear BBVA has a good option for groceries as well. I'm not in their service area so not sure of the full details

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

Doh! How did I forget the BBVA ClearPoints!?

Yeah that's another uncapped 3% grocery card if you set that category, it's a VISA, and they do targeted offers a lot. They do have a geofence so you would have to check that.

It's my favorite card and gives me much higher returns on groceries with all their offers for 5, 6, 7% so I can't believe I forgot it! 😅

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

Our grocery spend is similar to yours, and our setup is the AMEX BCP, BBVA, and Discover It. Discover it has 5% a grocery quarter for $1500 worth of spend, the BCP has 6% up to $6K (but even with the AF, it nets 4.4%) and BBVA catches the rest with the 5,6, and 7% targeted offers.

This is the 2nd year we haven't got below 4.4% on grocery spend.

For 2020 we spent $9127 on groceries and earned $427 in cash, which is right at 4.7% for the year.

I think you mentioned in another you were looking at an everyday card as well. You should try for the AOD card, if your profile supports. That gets you uncapped 3% on everything and you can backfill for higher categories as time goes by. I would try for it before getting any card that only earns 3% on groceries, but that's me. If I had gotten the AOD card earlier in my journey, I wouldn't have several that I currently have. JMO...

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

If your Kroger is Fred Meyer, that does not take Mobile Wallet, but also does not code as Grocery on AMEX.

There's a reason for that: prices at Kroger such as Fred Meyer are probably better than other grocery stores.

So you could use the AR or an AMEX at true grocery stores, pay more and get the points, or save some coin at Kroger and call it good on a 2% card.

I prefer a certain specialty grocery store because I like the quality of the food, and realize it costs more to produce that food. I also shop Fred Meyer regularly and realize it's better prices. If Chase Freedom ( or temporarily CSR ) gets more grocery points, I use those at Fred Meyer and enjoy the temporary bonus. But generally VISA and MasterCard don't have rich grocery categories, and that's just reality.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

@NRB525 wrote:If your Kroger is Fred Meyer, that does not take Mobile Wallet, but also does not code as Grocery on AMEX.

There's a reason for that: prices at Kroger such as Fred Meyer are probably better than other grocery stores.

So you could use the AR or an AMEX at true grocery stores, pay more and get the points, or save some coin at Kroger and call it good on a 2% card.

I prefer a certain specialty grocery store because I like the quality of the food, and realize it costs more to produce that food. I also shop Fred Meyer regularly and realize it's better prices. If Chase Freedom ( or temporarily CSR ) gets more grocery points, I use those at Fred Meyer and enjoy the temporary bonus. But generally VISA and MasterCard don't have rich grocery categories, and that's just reality.

My Kroger is an actual Kroger. And it's like 1 minute from our house so we buy everything there. Walmart, Target, etc much further and it's just easier to buy everything at Kroger. LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grocery store credit card set up?

@JNA1 wrote:Our grocery spend is similar to yours, and our setup is the AMEX BCP, BBVA, and Discover It. Discover it has 5% a grocery quarter for $1500 worth of spend, the BCP has 6% up to $6K (but even with the AF, it nets 4.4%) and BBVA catches the rest with the 5,6, and 7% targeted offers.

This is the 2nd year we haven't got below 4.4% on grocery spend.For 2020 we spent $9127 on groceries and earned $427 in cash, which is right at 4.7% for the year.

I think you mentioned in another you were looking at an everyday card as well. You should try for the AOD card, if your profile supports. That gets you uncapped 3% on everything and you can backfill for higher categories as time goes by. I would try for it before getting any card that only earns 3% on groceries, but that's me. If I had gotten the AOD card earlier in my journey, I wouldn't have several that I currently have. JMO...

This is about as good as you can do for grocery category. It is probably the second largest family expense behind mortgage/rent. The Amex BCP is kind of an outlier. There aren't many other cards that offer groceries as a category over 3% other than rotating category cards. There was a large thread on this within the last year and the BCP was still the clear winner with a whole bunch of 3% options out there, too.

Amex Gold if you can use the credits and like MR, Altitude Reserve if you can use mobile wallet. Other than that, aside from Amex BCP, your options are kind of limited for anything over 3%.