- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Help Maximizing Points :: Amex Aspire :: Chase...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help Maximizing Points :: Amex Aspire :: Chase Preferred

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help Maximizing Points :: Amex Aspire :: Chase Preferred

Hello,

First, thank you to everyone who has taken the time to share information on this forum. It is not easy to build a place like this that is filled with such great and resourceful information. I hope to be able to return the favor overtime. Now that I have created an account, I can begin to share my experience and I hope that it can help someone else reading these forums/posts looking for answers.

I have acquired 2... okay well 3 cards so far.

I got the Chase Sapphire Preferred and also the Amex Hilton Honors Aspire

I would like to use these cards to the best of their abilities, I am under the impression that the CSP would best be used for airfare and the AA for hotel stays

But what card should be my everyday card?

From the online "research" that I have done, Amex HH Aspire points come out to approximately .5 - .9 cents per point and Chase is 1.0 - 1.5 cents per point.

Chase Offers:

2 points per $1 for travel and dining

1 point per $1 for everything else

Amex HH Aspire:

14 points per $1 for hotels / resorts

7 points per $1 for travel

3 points per $1 for everything else

These are my first cards that take thought on how I should properly use them, so any advice would be helpful.

If you are wondering what my 3rd card is, it is the Amex Cash Magnet. To wrap up this post, I plan on using these 3 cards until I get one or two CLI's on the Amex HH and the CSP, then I am going to apply for the Chase Freedom and also the Chase Ink Business Cash.

I would probably be approved for all of the cards if I applied right now, but I am also sure that all of the SL's would be really low. So I am hoping that buy establishing trust and gaining higher limits on my current cards, I can get decent SL's on the new cards... is this how it works?

Thank you in advance for your time reading my post and any information that is shared.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@Anonymous wrote:Hello,

First, thank you to everyone who has taken the time to share information on this forum. It is not easy to build a place like this that is filled with such great and resourceful information. I hope to be able to return the favor overtime. Now that I have created an account, I can begin to share my experience and I hope that it can help someone else reading these forums/posts looking for answers.

I have acquired 2... okay well 3 cards so far.

I got the Chase Sapphire Preferred and also the Amex Hilton Honors Aspire

I would like to use these cards to the best of their abilities, I am under the impression that the CSP would best be used for airfare and the AA for hotel stays

But what card should be my everyday card?

From the online "research" that I have done, Amex HH Aspire points come out to approximately .5 - .9 cents per point and Chase is 1.0 - 1.5 cents per point.

Chase Offers:

2 points per $1 for travel and dining1 point per $1 for everything else

Amex HH Aspire:

14 points per $1 for hotels / resorts7 points per $1 for travel

3 points per $1 for everything else

These are my first cards that take thought on how I should properly use them, so any advice would be helpful.

If you are wondering what my 3rd card is, it is the Amex Cash Magnet. To wrap up this post, I plan on using these 3 cards until I get one or two CLI's on the Amex HH and the CSP, then I am going to apply for the Chase Freedom and also the Chase Ink Business Cash.

I would probably be approved for all of the cards if I applied right now, but I am also sure that all of the SL's would be really low. So I am hoping that buy establishing trust and gaining higher limits on my current cards, I can get decent SL's on the new cards... is this how it works?

Thank you in advance for your time reading my post and any information that is shared.

Neither of those cards is a really good everyday card, but if I had to choose, I'd still go with the CSP. The flexibility of UR usually makes it much more useful, unless you really like staying at Hiltons.

Edit: If you don't have too much travel coming up in the near future, you could consider downgrading to the CFU. Either way, if you're going to take this part of the game seriously, it's probably best for most people to max out with Chase UR-earning cards before going to Amex and nabbing the MR cards.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

This was actually great advice!

I do plan on upping my travel in the next coming months.

But I also understand what you are saying about neither of them being everyday drivers.

With that being said...

Since the Chase Freedom caps out at $1500 quarterly, do you feel that I should apply for it now and get started on using it in the selected categories of choice?

Even if they give me a $1000 starting limit, in order to put it to its full use, I can only spend $1500 a quarter on it.

I was planning on getting the Freedom Unlimited, but in all honesty, after the first year, it is the same as my Cash Magnet.

I am trying to stay slim and focused on which cards and how many I get.

Finally, the main reason that I wanted to wait to apply for new cards with both of these companies is so that when I got new cards through them I could move the balance to my main cards and have bigger credit lines on those cards.

For example, if I got the Chase Freedom with a $5k balance, since I can only use $1500 quarterly, I could move $3500 to my CSP.

I feel by keeping all of my cards at amex and chase it will be easier for me to keep track of which ones need to be paid.

Thank you for taking the time to respond to my post and help clarify that I may need to add a couple more cards to my wallet in order to maximize my spending efforts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@Anonymous wrote:This was actually great advice!

I do plan on upping my travel in the next coming months.

But I also understand what you are saying about neither of them being everyday drivers.

With that being said...

Since the Chase Freedom caps out at $1500 quarterly, do you feel that I should apply for it now and get started on using it in the selected categories of choice?

Even if they give me a $1000 starting limit, in order to put it to its full use, I can only spend $1500 a quarter on it.

I was planning on getting the Freedom Unlimited, but in all honesty, after the first year, it is the same as my Cash Magnet.

I am trying to stay slim and focused on which cards and how many I get.

Finally, the main reason that I wanted to wait to apply for new cards with both of these companies is so that when I got new cards through them I could move the balance to my main cards and have bigger credit lines on those cards.

For example, if I got the Chase Freedom with a $5k balance, since I can only use $1500 quarterly, I could move $3500 to my CSP.

I feel by keeping all of my cards at amex and chase it will be easier for me to keep track of which ones need to be paid.

Thank you for taking the time to respond to my post and help clarify that I may need to add a couple more cards to my wallet in order to maximize my spending efforts.

When looking for credit card rewards, it's almost always best to choose whether you want travel rewards or cash back. Most people don't spend quite enough to max out the efficiency on points and still have enough left over for cash back. If you're like the rest of us, I would recommend you deciding whether you want points or cash back and go from there. Right now, you have the CSP and Hilton which earns points, but then you have the CM earning cash back, which is ultimately taking away from your travel rewards. So if you're decided on maximizing your travel rewards earning, then I'd recommend SD'ing the CM and focus solely on Chase, using your Aspire solely for Hilton stays. Then, grab a couple Chase Ink cards (CIU/CIC are both solid for every day spend). Even the CIP could help quite a bit, though it's kinda redundant with your CSP (cell phone insurance is always nice though). Grabbing the Ink cards first is probably best, since this doesn't add to your 5/24 count. That being said, space these apps out to be safe. With the Ink cards, the CSP, and then maybe a Freedom, you'll have a very solid UR-earning lineup. If you want to continue on, there are always the Amex MR cards.

I'd also like to add that your travel plans will affect how solid this plan is for you. Sometimes MR-earning cards are better, depending on where you want to go, etc. That being said, Amex doesn't have a 5/24 rule, so, in general, the above is probably the better choice, if you want to go all-out on travel.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

How I ended up with the CM is that I was going to go all out on Chase, CSP, FR, FU

But I like Amex credit limit increases, so I decided to get the CM which provides the same 1.5 as the unlimited.

I was going to wait until my 3X CLI increase on amex, then ask chase to increase my limits so that in event that I leave a small balance on my card it does not kill my utilization.

Regardless of what I tell them, I will always pay in full.

My goal is to have these few cards but have really high limits on them.

Is this the best / fastest way to get the increases that I am looking for?

Do ink busines cards come with higher limits?

Can I transfer an ink limit to my csp?

Thank you for your time and information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@Anonymous wrote:

Thank you for providing me with all of this great information that is specifically geared toward my needs.

How I ended up with the CM is that I was going to go all out on Chase, CSP, FR, FU

But I like Amex credit limit increases, so I decided to get the CM which provides the same 1.5 as the unlimited.

I was going to wait until my 3X CLI increase on amex, then ask chase to increase my limits so that in event that I leave a small balance on my card it does not kill my utilization.

Regardless of what I tell them, I will always pay in full.

My goal is to have these few cards but have really high limits on them.

Is this the best / fastest way to get the increases that I am looking for?

Do ink busines cards come with higher limits?

Can I transfer an ink limit to my csp?

Thank you for your time and information

The difference is that the CFU earns UR, while the CM is limited to cash back. 1.5 UR is worth 2.25 cents at a minimum with the CSR, and potentially even more when transferred to travel partners. The 1.5% you get with the CM, however, is just that, 1.5 cents. I recommend the Ink cards over the Freedom cards mainly cause of the SUB's. And the CIC has a $25K limit for 5x, while the Freedom only has a $6K.

I understand the bigger credit limits are nice, but there isn't too much of a way to push it. And honestly, the size of your limit isn't too important unless you truly have that much spend each month. If you do, Chase has been known to auto CLI you when you push up on your limit all the time. That being said, they are also known to generally give out a total CL of about 50% your reported income. You cannot move CL's from your Ink cards to personal cards. Amex is quite generous with limits, but their best MR cards are the BBP and Gold. Over time, you'll be able to get 3x CLI's up till you reach their internal limit for you.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

Also, thank you for explaining and clarifying how a freedom, or even ink would be and is still a better option to use instead of the CM.

This was perfect!

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

Depends on where you live, the Hilton redemptions have been raised across the board. it's closer to 3.5c now...

In my wallet:

In my desk:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@L3KickButt wrote:

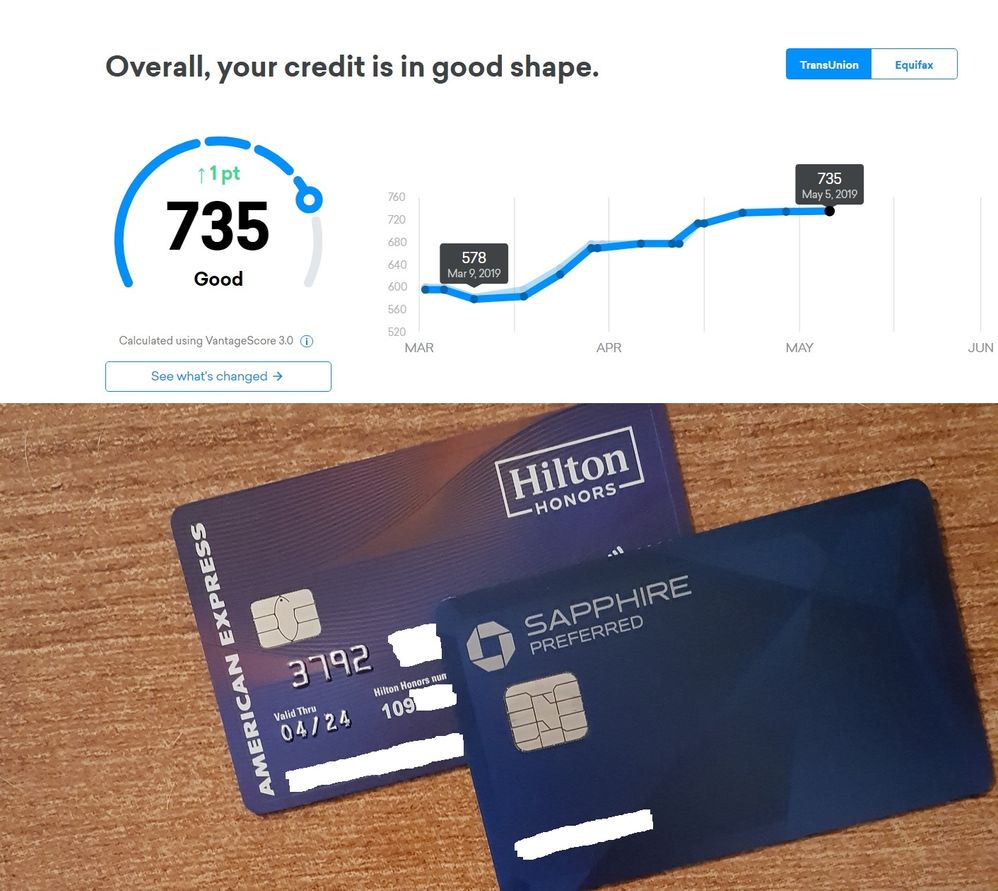

Just curious how you went from mid 5’s to mid 7’s in a month? Want to share your magic?

Great question!

First, let me explain... 3/2019 - 5/2019, even though it looks like one month, it is really (3.1.2019 to 5.31.2019) 92 days

A lot can happen in 92 days if you remain proactive.

"Credit utilization (cociane) is a hell of a drug"

- Credit (Rick) James

Two things were weighing my score down:

Collections and Utilization

Once I fixed both, my score sky rocketed.

I owe a lot to this forum, if not all of the information I know, 99.8% of the information in regards to establishing credit came from here.

Thank you to all of the contributors and people that manage this forum!