- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Help Maximizing Points :: Amex Aspire :: Chase...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help Maximizing Points :: Amex Aspire :: Chase Preferred

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

Anyway just received my first new CC in 7yrs commenity was nice enough to let me get started, and I’ve had a Discover I’ve kept at under 40% utilization, but am about to pay down but I too started mid 5’s, so just wondering but your right and congrats on the success.

I’ve always known credit is simply a tool, way too many people look at it as money and it simply isnt. Wouldn’t even care except doing some mortgage deals I’m involved with giving me an issue simply because of this number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@Anonymous wrote:

@L3KickButt wrote:

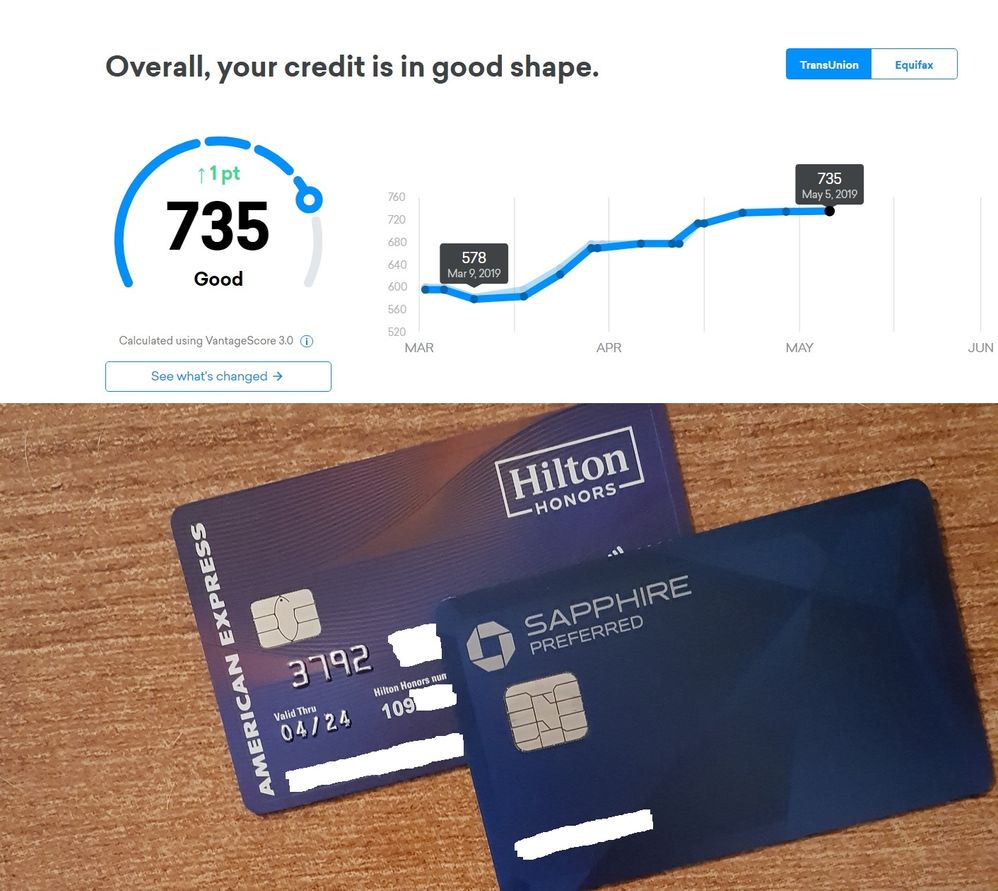

Just curious how you went from mid 5’s to mid 7’s in a month? Want to share your magic?Great question!

First, let me explain... 3/2019 - 5/2019, even though it looks like one month, it is really (3.1.2019 to 5.31.2019) 92 days

A lot can happen in 92 days if you remain proactive.

"Credit utilization (cociane) is a hell of a drug"

- Credit (Rick) James

Two things were weighing my score down:

Collections and Utilization

Once I fixed both, my score sky rocketed.

I owe a lot to this forum, if not all of the information I know, 99.8% of the information in regards to establishing credit came from here.

Thank you to all of the contributors and people that manage this forum!

Which scores in your signature are VantageScore 3.0 scores and which one(s) are FICO 8 scores? Based on the screenshot it appears that your TransUnion and Equifax scores are VantageScore 3.0 scores, and your Experian score a FICO score (given the variance from the other two scores). Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

Off topic a bit but can you please share how you were able to get your scores so high in a matter of months?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@L3KickButt wrote:

How do you add scores in your signature by the way?

You have to at least rank as a Member to be able to add signatures. There are detailed threads in the Smorgasbord section that explain how its done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@L3KickButt wrote:

By the way, you using monitoring from here? I was thinking of using Experian tool. Any thoughts on that?

I use Credit Karma and Wallet Hub to track my scores and monitor my credit.

I have a basic profile, nothing too hard to keep track of to where I need MyFico services just yet.

I only have

4 credit cards now that I cancelled my two credit one cards

1 large student loan

1 paid off vehicle (paid off 7+ years ago, still showing up... maybe for 3 more years)

Now do I want MyFico services, yes. But in one of my previous posts I asked the question of which service was best to use and I received a lot of great advice.

Right now I am not looking to get a car/home loan. So I am fine with just making sure nothing weird shows up on my credit report

Just like you, I did not care about my credit score for years before 3.2019

But as you can see, then I tried to make some changes, and thanks to this forum I was able to.

So far, for my credit profile, I have noticed that 3% credit utilization will give me the best credit score...

I am still tinkering around with this, but 0% credit utilization is about 7-12 points better than 90% MAXED OUT LOL

it is actually quite funny to think about how bad 0% utilization is.

I will soon test 5%, 7% and 9% to see if I can get over 735.

In regards to adding a signature, use the code below to add it into your personal settings profile tab.

After a certain period of time/posts you can add a signature.

<img src="https://creditcards.chase.com/K-Marketplace/images/cardart/sapphire_preferred_card.png" width="125px" title="CSP :: $5K">

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help Maximizing Points :: Amex Aspire :: Chase Preferred

@Anonymous wrote:

Which scores in your signature are VantageScore 3.0 scores and which one(s) are FICO 8 scores? Based on the screenshot it appears that your TransUnion and Equifax scores are VantageScore 3.0 scores, and your Experian score a FICO score (given the variance from the other two scores). Is that correct?

The image of my score is a screen shot from credit karma.

So yes, you are correct. The TU and EQ are vantage 3

The EX was from their site at the time, so probably a version of Fico 8.

Now that all of my collections have been removed all of my scores are within 2-3 points from each other.