- myFICO® Forums

- Types of Credit

- Credit Cards

- How do you guys manage so many cards?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do you guys manage so many cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

@addicted_to_credit wrote:I use spreadsheets but I also rotate out my cards to ensure active usage across the board.

I put a small monthly subscription (e.g. streaming, newspaper, charitable contribution) on all cards that would otherwise be sockdrawered. I've also used Amazon gift card reloads to put activity on lesser used cards.

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

I am not the norm but I like this kind of stuff. I have several methods to make sure my bills get paid. After two 1 day lates in the last two years I have become even more fastidious.

1) My go-to is my spreadsheet. My wife thinks my system is overly convuleted but the goal is tracking each card balance which I update at least weekly if not more frequenty, when I update it I also may any payments needed.

2) I use Mint but not all my accounts link there, I mostly use Mint for tracking savings goals and not necessarily for tracking credit card information but it is there for an extra reminder.

3) I have auto-pay set up on most of my cards as a backup

4) Most of the card isurers send me emails and also phone alerts

I also don't use every card every month, and I generally have a good idea of what cards I have a balance on and around the amount of the balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

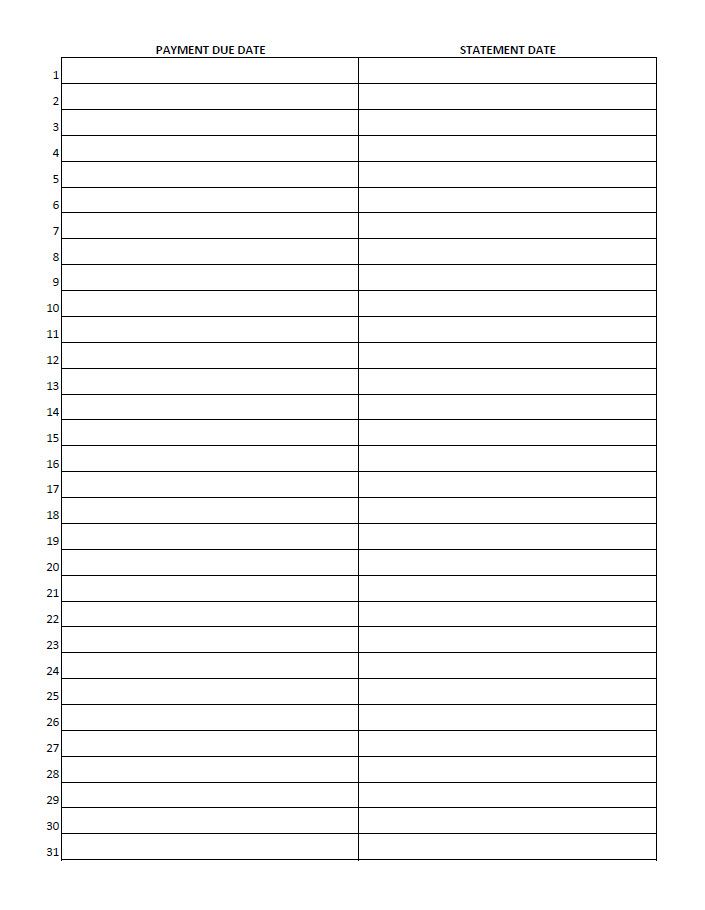

I use a printed sheet of paper (see attached image). Each card gets two entries, one in each column. The entry in the "Payment Due Date" column is written in red ink.

It's my habit to manually schedule all of my payments, to be paid on the upcoming due date. I do not autopay because I always double-check to make sure my checking account can cover the payment first.

04/01/2020 - EX 849 (Credit Scorecard EX FICO® Score 8, range 300-850)

02/20/2020 - TU 850 (Discover TU FICO® Score 8, range 300-850)

03/24/2020 - EQ 884 (Citi EQ FICO® Bankcard Score 8, range 250-900)

GOAL - 800! - App free since 11/22/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

a Jean notebook, pen and my Sony noise canceling headphones![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

@SouthJamaica wrote:Personally, in this day and age I feel it's not safe to have credit cards unless you're willing to monitor them daily. Some people enjoy monitoring a lot of cards, to some it would be abhorrent. So my advice is to have no more cards than you're willing to stay on top of.

And then I would keep a record of everything important, including statement balances, current balances, and upcoming statement dates.

And to me, that is massive overkill. You only owe the bill once a month, and I think checking around the often, ideally before it is paid,you should be fine. If it's fraud, you can get it back fairly easily (usually!).

Now even with my narco-terrorist billions, if EVERY credit card was maxed out by fraud and hit my bank account at the same time, it would be bad, but the chance of that happening seems fairly small.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

@longtimelurker wrote:

@SouthJamaica wrote:Personally, in this day and age I feel it's not safe to have credit cards unless you're willing to monitor them daily. Some people enjoy monitoring a lot of cards, to some it would be abhorrent. So my advice is to have no more cards than you're willing to stay on top of.

And then I would keep a record of everything important, including statement balances, current balances, and upcoming statement dates.

And to me, that is massive overkill. You only owe the bill once a month, and I think checking around the often, ideally before it is paid,you should be fine. If it's fraud, you can get it back fairly easily (usually!).

Now even with my narco-terrorist billions, if EVERY credit card was maxed out by fraud and hit my bank account at the same time, it would be bad, but the chance of that happening seems fairly small.

Transaction alerts help a lot.

Wallet app notifications, large transaction alerts, card-not-present alerts, etc.

You can also keep rarely-used cards locked.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

@NoHardLimits wrote:

I've also used Amazon gift card reloads to put activity on lesser used cards.

Bingo. I like your style.

$2 every 6 months on Amazon for gift card reload.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

I have 8 credit cards. I have an excel spreadsheet that I use for budgeting. I make sure there's a payment in the column corresponding with my biweekly bookkeeping schedule and I check the spreadsheet meticulously before and while paying bills to make sure I haven't missed anything.

I also set all of my cards up on autopay for their minimum payments. This ensures that I'll never miss a payment, even if my spreadsheet method somehow fails me.

I receive email notifications when my statements are ready and I look at every credit card statement when they're available, just to make sure I'm not missing anything like unexpected yearly fees on cards that I rarely use.

I only spend about an hour or so every two weeks reviewing my accounts and ensuring a payment is scheduled, but I feel like I have a really great handle on all of my accounts.

♛ Total Credit Lines: $52,750

⚖ Chapter 7 Discharge: October 2018

☼ Credit Scores: Mid to High 600s

☮ Gardening As of May 13, 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

@csl1 wrote:I also set all of my cards up on autopay for their minimum payments. This ensures that I'll never miss a payment, even if my spreadsheet method somehow fails me.

Wouldn't it be better to have autopay set up to pay the full statement balance in your case? It sounds like autopay is only a backup anyway, which means that it is not normally used. The only downside I can think of for making the full payment vs minimum payment is that it raises the chance of not having enough funds in the payment account to cover the bill.

Business Cards

Debit Cards

FICO 8 Scores (as of Dec 14, 2022)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you guys manage so many cards?

spreadsheet!