- myFICO® Forums

- Types of Credit

- Credit Cards

- How do you keep track of the best card to use for ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do you keep track of the best card to use for spending?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you keep track of the best card to use for spending?

What's your method to keep track of the best cards to use for maximum rewards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

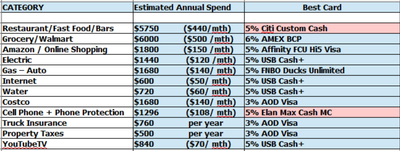

I've posted this before....this is how I do mine with the cards I own (red ones are cards I still need from my siggy below)

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

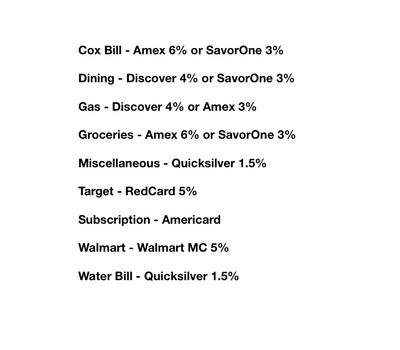

I put each category of spend and which card I use for what. Saved picture to my favorites on my phone.

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

Depends on how much you want to spread your spend around. Diluting it too much can be a hassle especially if the bank/card have minimum redemption thresholds you need to reach just to withdraw your rewards. There are some where you just need to reach a minimum like AMEX with their cash rewards and others like US Bank where they only let you withdraw in $25 increments

With that said spreadsheets seems to be the best way to go if you have a handful of cards to work with

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

I try not to worry too much about using the "wrong card" but I'm not a hard-core optimizer like some of our members. To me, rewards are great but not the end-all, even though I often try to use the best card for the circumstances. In my case (and in the case of many on My Fico), I have overlap of rewards programs so I may be getting the highest rate (or close to it) on more than one card at one time. But keeping up with the absolute best card can get complicated and is why I generally have disliked having "rotating category" 5% cards which change quarterly, even though I finally broke down and converted my Discover to the IT and got a Chase Freedom. Same for cards with spending caps that are well below what I might spend in a selected category. Getting that few extra percentage points may come with a price of more cards to monitor, categories to remember, and spending caps to track. Only you can decide if you're getting enough value for your time investment.

This question most often comes up for how to remind family members where they need to place their charges. I've heard of some of our members using a small notecard in their wallet with their current rewards strategy. Another technique is the small post-it notes on the back of each card. With smart phones, similar reminders could be kept in the "Notes" or "To-Do List" applications. Or keeping a photo of a spreadsheet that was made on a computer.

Some of our members literally rotate cards in and out of wallet from the sock drawer to remember which cards have useful categories that quarter. Again, with smart phones it is easy to set reminders to activate quarterly categories or to rotate cards. Some members have reported selecting a limited number of perhaps only three (out of many total cards) to use for one month or one quarter.

An easier way is just to simplify spending so that a certain category almost always goes on a certain card/cards. For example, I get my best dining out returns with my Chase Sapphire Reserve, AMEX Gold, and Bank of America Premium Rewards and I rotate between those. It's a big category for me, including with travel. That's pretty easy to just remember. It becomes a habit. Before I had those cards, I got my best dining out with my Citi Costco. However, this quarter I'm getting 5% back on my Discover IT card so I'm using that card at the moment. (The rewards are +/- the same as with my other cards but this is a good opportunity to put some spend on my Discover card to keep it active since it's my oldest currently-active card.) For another example, most of the time my best returns on gasoline are with my Citi Costco card that earns 4% back (on up to $7K annually). The cap is high enough that I don't normally hit it, but I can also rotate in my Discover and Freedom cards sometimes. For groceries, I have a choice of AMEX Gold (4x MRs up to $25K spend, so a high cap), or 3.5% cash back on my Bank of America Customized Cash Rewards with Platinum Honors (up to $2500 per quarter between groceries, warehouse clubs, and my higher paying selected category.) Recurring bills can be easy to set-and-forget. My cellphone and cable tv/internet bills are always paid from the sock drawer with my Chase INK Cash, which earns me 5% cash back or 7.5% URs in travel.

If I really want to keep things simple, I can just go for a flat rate card. My AOD FCU Visa Signature gets an uncapped and uncategorized 3% cash back. Easy-peasy. But you could do the same with quite a few other cards paying 2% to 3% cash back and just call it a day. Having one or two cards that offer a solid uncapped and uncategorized return makes things a little more simple when you have doubt about getting better rewards on a different card.

If you're having trouble keeping up with which card to use and it has become a chore, you've probably reached or exceeded your own comfort level with how many cards is a good fit for your circumstances.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

I use the CardPointers app

Barclay(jetblue, arrival)

Bofa(US pride, premium, travel, cash, Suzy komen)

Citi(Premier, Double cash, Costco)

Fnbo(Mlife)

Amex(everyday, cash, Hilton)

Blockfi

Caesars rewards

Sofi

Gemini

Cap One Savor One

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

While not out/released here in the US, I am slightly intrigued by the potential this has. Managing which card for what purchase "sounds" like it's made easy and I'm certain the data they obtain is used for something. It'll be interesting to read more about this once/if it launches

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

For me, the bigger issue comes with the more dynamic decisions: e.g. cards with a cap, such as Freedom/Discover/BCP/Cash+/MaxCash etc. As you get near the cap (if you are aware that you are near!) the high% -> 1% rewards earned on the card may be beaten by another one with a flat rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

This is embarrassing, but I guess I went the analog route. I write the rewards % in sharpie on the back of my cards. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you keep track of the best card to use for spending?

Lmao @ Analog route.....! ![]()

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently