- myFICO® Forums

- Types of Credit

- Credit Cards

- How good are Citi DC starting lines?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How good are Citi DC starting lines?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How good are Citi DC starting lines?

I've read that Chase basically matches your other credit limits which is why I don't want to app for it quite yet as my limits are very low (500, 600, and 1,250) so I want to make sure that whatever I get next has a good chance of offering a higher SL now that my credit is in the low 700s.

The Amex BCE is what I've had in mind for this because of the 60 day 3X CLI. I figure use the Amex to get my available credit higher and get myself in a better position. But is Citi decent for this too or are they conservative when it comes to starting limits?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

@Anonymous wrote:

I just got a pre-qual in the mail for the Citi DC, which is a card that I'd like to have to effectively replace my Quicksilver. But I currently have three cards (got all of them in the past 9 months) and I want to also try for a Chase Freedom later this year. Due to the 5/24 rule this of course leaves me room for one more card.

I've read that Chase basically matches your other credit limits which is why I don't want to app for it quite yet as my limits are very low (500, 600, and 1,250) so I want to make sure that whatever I get next has a good chance of offering a higher SL now that my credit is in the low 700s.

The Amex BCE is what I've had in mind for this because of the 60 day 3X CLI. I figure use the Amex to get my available credit higher and get myself in a better position. But is Citi decent for this too or are they conservative when it comes to starting limits?

It's going to vary but anecdotally, Citi seems to give lower starting limits from what I've seen around the forums. However, people have been successful in taking another HP for an increase (I did this myself). I think going the BCE route is a good plan, too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

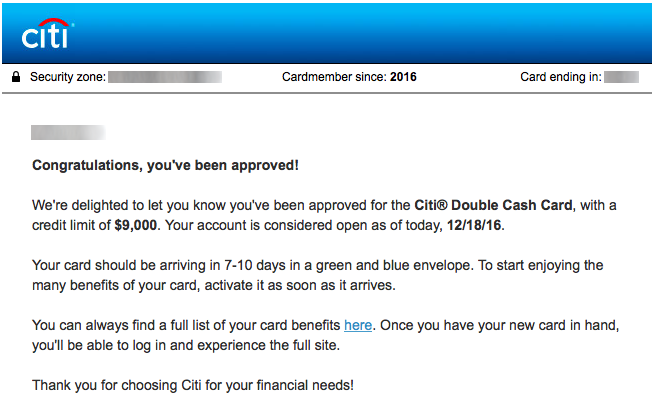

I had a pre-selected offer via mailer and applied. Received a starting limit of $9K which is actually one of the higher starting limits for the DC card.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

0Re: How good are Citi DC starting lines?

I got approved last week for a DC with an $800 limit. Which matches my highest non Cap1 limit.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

@Ysettle4 wrote:I had a pre-selected offer via mailer and applied. Received a starting limit of $9K which is actually one of the higher starting limits for the DC card.

Love your MV Agusta avatar!

Well thanks for the feedback guys, looks like I'll definitely go with Amex first instead of Citi as they seem to have looser pocket strings when it comes to SLs. Appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

@Ysettle4 wrote:I had a pre-selected offer via mailer and applied. Received a starting limit of $9K which is actually one of the higher starting limits for the DC card.

That's a great SL. What is your APR going to be (assuming you'll have a $0 APR intro)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

@Anonymous wrote:

@Ysettle4 wrote:I had a pre-selected offer via mailer and applied. Received a starting limit of $9K which is actually one of the higher starting limits for the DC card.

That's a great SL. What is your APR going to be (assuming you'll have a $0 APR intro)?

0% for 18 months then it's 14.24% afterwards.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How good are Citi DC starting lines?

@Anonymous wrote:

I just got a pre-qual in the mail for the Citi DC, which is a card that I'd like to have to effectively replace my Quicksilver. But I currently have three cards (got all of them in the past 9 months) and I want to also try for a Chase Freedom later this year. Due to the 5/24 rule this of course leaves me room for one more card.

I've read that Chase basically matches your other credit limits which is why I don't want to app for it quite yet as my limits are very low (500, 600, and 1,250) so I want to make sure that whatever I get next has a good chance of offering a higher SL now that my credit is in the low 700s.

The Amex BCE is what I've had in mind for this because of the 60 day 3X CLI. I figure use the Amex to get my available credit higher and get myself in a better position. But is Citi decent for this too or are they conservative when it comes to starting limits?

Citi DC is known to be conservative, and has been in my case.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687