- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: I am running out of banks for credit cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I am running out of banks for credit cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

@sarge12 wrote:

@wasCB14 wrote:Re: DC extended warranty nerf

I think Rewards+ will be keeping the Extended Warranty. I know the Costco Visa is keeping it. You might look into that to confirm and possibly PC. Or just use your Amex.

With the elimination of price protection from Citi, I'll be putting all big ticket items on Amex except for Costco purchases (which will go on the Costco Visa). I've already started, buying specialized building fixtures on sale (lower prices are not likely) and getting financing promos from BCP.

Once you have a 2%+ card in place, the value of a new 3% or 4% category is pretty limited for most people. The value is in bonuses, but big cash (not miles or travel credits) bonuses are relatively few.

I know that is true, and some have added fine print that limits a SUB for the issuer to one SUB for a given time frame. Just judging the offers I see these days, I think they are catching on that some people are gaming the system to actually make credit cards profitable for the cardholder. More people every year are becoming transactors, and never carry a balance. I might be a little upset that these transactors refusal to ever pay any interest on their cards is leading to these lower SUB offers, if I was not one of those who do that. They offer these SUBs to gain market share in the competitive credit card business, but they are finding that a fairly large and growing number of card holders are getting their cards solely for the SUB. It is becoming more difficult to find higher SUB cards, and it is quite possible that the SUB will eventually go away.

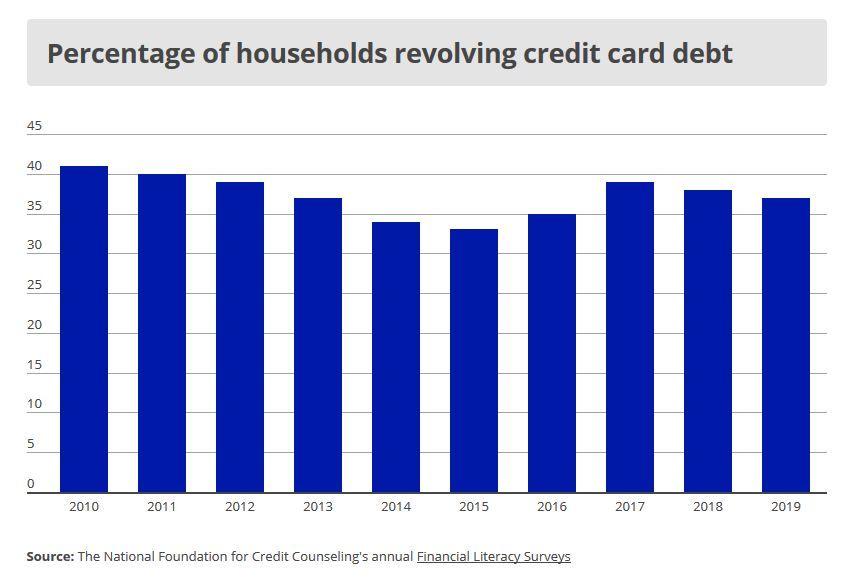

Transactors vs. revolvers is somewhat cyclical. See: https://www.creditcards.com/credit-card-news/credit-card-debt-statistics-1276.php

With interest rates low, banks seem fairly willing to offer 0% promotions. Not all revolvers pay interest or BT fees. That said, I'm not sure what share of revolvers only carry during 0% (or other very low) periods.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

@privacyadvocate69 wrote:

Why do you need so many credit cards?

I don't....I don't actually need any credit cards at all, to be honest. It is just a matter of the free money they offer just for getting their cards and charging 500 to1000 dollars on the card for spending I was going to do anyway. In return they give me 150-250 dollars, often for a card that will just be thrown in the sock drawer. I don't need the credit, I don't need the money, and I don't need a very high credit score either. It is not about need at all, I just have problems with saying no to these offers that give me free money for doing nothing except paying bills or buying things I would buy regardless.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

You can goto doctorofcredit.com and sign up for their weekly email, they put out one of the best lists of CC bonuses and checking account signup bonuses. I too now am only going after nice signup bonuses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

I do think with widespread blog coverage, the number of transactors is probably increasing, but at the same time, many people spend beyond their means chasing rewards and bonuses. I do think that overall, SUB offers are shifting. I think we will see more and more of "x% extra rewards for a year" instead of a huge initial bonus. It encourages you to use the card for an entire year as opposed to meeting the spend and dumping the card or SDing it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

Yeah, I got a targeted offer in the mail yesterday from BoA for their cash rewards card... it said $250 bonus offer on the front, which caught my eye and caused me to open it. Upon further reading it was a $150 bonus after an initial spend (maybe $500, I forget) and then an additional $100 bonus if you spend I think $7500 in your first year. Clearly their goal is to stimulate at least a year of use rather than meeting just an initial spend requirement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

@sarge12 wrote:

@Aim_High wrote:

@sarge12 I'm confused. Why do you want more cards? Are you just collecting them or do they serve a purpose? You don't mention which cards you have with which banks or where your monthly spending goes as far as cash-back rewards cards, so we can't help you there. Many of my cards were for high SUB...just to make a profit and the SD the card. Free money.

If you're just collecting cards, there are plenty of more options!

You're just getting started.

As mentioned, double-dip some of the large banks. I have double dipped a few, but limit my exposure to two cards each.

Most will give you at least two or three cards.

You have nothing from Synchrony or Commenity. PayPal Mastercard 2% CB? Lowe's? Etc ... I never ever get store cards, or any Comenity or Synchrony...too many bad posts on here. All my cards are Visa, MC, Discover, or Amex.

I have the PayPal 2% which is MasterCard and I love it. I wouldn't count Synchrony out so fast.

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

@sarge12... what a situation to be in ![]()

You could pursue City National Bank's Crystal Visa Infinite and bump with the big time rollers in the event, you would find that of interest ![]()

Got'ta keep your interest so you stay in the loop!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I am running out of banks for credit cards

@Queen_Etherea wrote:I have the PayPal 2% which is MasterCard and I love it. I wouldn't count Synchrony out so fast.

I don't think it offers a worthwhile SUB though, does it? Also Sarge said above that he's already got a 2% card (even 3% for the next year) so no doubt he'd find no value in another 2% card.