- myFICO® Forums

- Types of Credit

- Credit Cards

- Is Sync moving away from giving FICO scores?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is Sync moving away from giving FICO scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Synchrony changed credit score offer to Vantage 4.0

Yesterday (8-19-2019) I logged into my Synchrony Amazon account to make a payment. As I always do when logged into my account, I checked my credit score, my score was 703 TU Fico score 8 model.

Today (8-20-2019) I logged into my Synchrony Amazon account to check if my payment was posted. Again, while checking my credit score, A notice appeared that the credit score has changed to Vantgage 4.0. So I enrolled and my score for TU vantage 4.0 is 734.

Curious I checked my other Sychrony accounts (Lowes, PayPal MC and JCPenney) and indeed the credit score reflects TU vantage 4.0.

Is this the score Synchrony will use for new account approval or when requesting a CLI?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

Obviously I don't know if Synchrony will change its credit score used for new accounts and account maintenance, but I will be you dollars to donuts that they will continue to use some version of the FICO score. In all the years I've been on here, I have never heard of a single lender that uses Vantage scores. I'm pretty sure that the reason that the reason Vantage scores are given away for free is that they are either free or much cheaper than the royalties that are paid to FICO for their proprietary scoring models.

Anybody who disagrees with me, please by all means let me know, but I'm guessing this is a cost issue only. In fact when Vantage scores are shown they typically say "for educational purposes only," so not for lending purposes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

Not likely to be the only score they use for approvals (though, it might use it as part of their approval, in conjunction with FICO).

Probably they just got a better deal on buying VS4.0 scores for their credit score monitoring services than FICO was giving them, so they switched.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

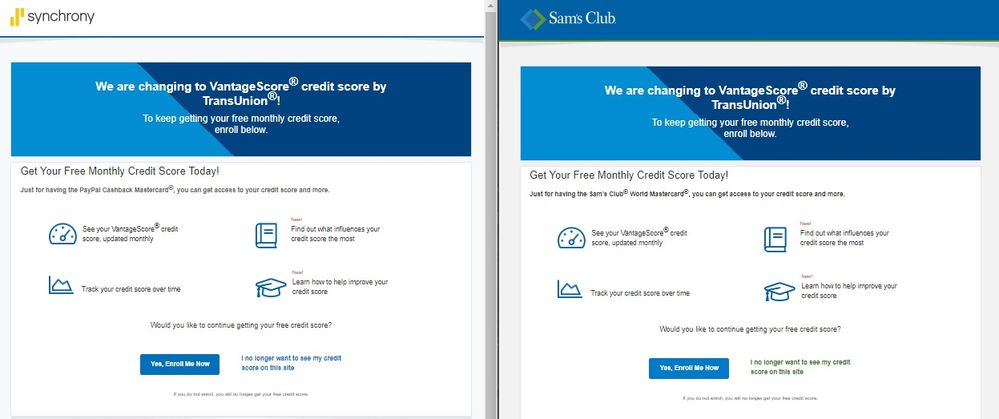

Can confirm. Here are my PayPal and Sam's Club accounts. It is a complete switch, unlike Amex who offers both.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

Care credit is still showing FICO, but speculate that will goto Vantage as well. FYI Lowes has switched for me to Vantage just when i logged on awhile ago. Think it is fair to say all Sync cards will be using vantage for at least the scores, not necessarily the approval as we have no way of knowing that info, but i speculate it will still be off of FICO scores as sync is VERY score driven on their limit tiers tied to FICO scores

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

Thanks for all the replies. Yes it makes sense that some banks offer free Vantage credit score vs FICO due to the cost to them. I am curious if other banks will now drop the free FICO score and offer the new vantage 4.0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

@Anonymous wrote:Thanks for all the replies. Yes it makes sense that some banks offer free Vantage credit score vs FICO due to the cost to them. I am curious if other banks will now drop the free FICO score and offer the new vantage 4.0.

Chase recently did the same with the Slate card, but I'm not sure if it is Vantage 4 or 3.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sams Club Advantage Scoring

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sams Club Advantage Scoring

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony changed credit score offer to Vantage 4.0

I have the Chase Freedom and Chase Freedom Unlimited for over two years and always only offered TU vantage 3.0 with there "Credit Journey" montoring system.