- myFICO® Forums

- Types of Credit

- Credit Cards

- Is this a good offer for Citi Thankyou points?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this a good offer for Citi Thankyou points?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this a good offer for Citi Thankyou points?

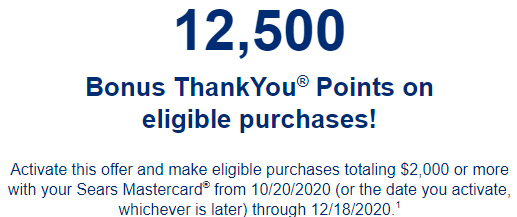

I haven't used CITI TY points much, but it appears the points are worth about a penny, so $125 for $2k spend.

Based on my math, this works out to be 6.25 cents per dollar spent, which seems like a good return. Any gotchas I'm not thinking of or other thoughts?

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

No gotchas other than a fairly short period to complete the spending. Nice that it's not category-specific as TYP offers usually are. FWIW the points can be much more valuable if you have Citi Premier or Prestige and they go to a combined TYP account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

If you don't have the Sears mastercard already 12,500 points is not that much to chase.

I wouldn't app for it either as they are closing their stores. For that matter, I wouldn't app for anything unless it also comes with strategic value (helping you pay down debt or enhancing point earning rates).

Chase Ultimate Rewards 661,525 | IHG One Rewards 144,443 | Hilton Honors 143,801 | AMEX Membership Rewards 102,729 | World of Hyatt 90,413 | Marriott Bonvoy 65,343 | Citi Thank You 62,712 | Wells Fargo Rewards 33,652 | Southwest Rapid Rewards 28,105 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,661 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 792 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 6,992 ($69.92) | Amazon Rewards 475 ($4.75) | Discover CB 499 ($4.99)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

@Citylights18 wrote:If you don't have the Sears mastercard already 12,500 points is not that much to chase.

I wouldn't app for it either as they are closing their stores. For that matter, I wouldn't app for anything unless it also comes with strategic value (helping you pay down debt or enhancing point earning rates).

That is a targeted offer that is not available to all cardholders, and definitely not to new applicants. New applicants are eligible for a $40 statement credit when spending $50 or more, an astonishing 80% cash back... on the first $50.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

@Citylights18 wrote:If you don't have the Sears mastercard already 12,500 points is not that much to chase.

I wouldn't app for it either as they are closing their stores. For that matter, I wouldn't app for anything unless it also comes with strategic value (helping you pay down debt or enhancing point earning rates).

Moot point. Citi stopped allowing PCs to the TYP-earning Sears Mastercard just about a year ago.

Even if OP has no intent on trying to go for the bonus he should still sign up for it as that tends to lead to followon offers as well, some of them are quite lucrative (I'll collect another 360 TYP + 9,000 bonus TYP on $360 spend for utilities again this month)

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

Ooh good point, I forgot the current version of the card no longer earns TYPs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

@coldfusion wrote:

@Citylights18 wrote:If you don't have the Sears mastercard already 12,500 points is not that much to chase.

I wouldn't app for it either as they are closing their stores. For that matter, I wouldn't app for anything unless it also comes with strategic value (helping you pay down debt or enhancing point earning rates).

Moot point. Citi stopped allowing PCs to the TYP-earning Sears Mastercard just about a year ago.

Even if OP has no intent on trying to go for the bonus he should still sign up for it as that tends to lead to followon offers as well, some of them are quite lucrative (I'll collect another 360 TYP + 9,000 bonus TYP on $360 spend for utilities again this month)

I don't chase a spending bonus unless I already have the intent to buy something online. Then I look to see what bonuses I have available.

It can be tempting though. I've been tempted to take up a couple of nights of Hyatt to help push up my status. But I'm better off not spending the money in the first place.

Chase Ultimate Rewards 661,525 | IHG One Rewards 144,443 | Hilton Honors 143,801 | AMEX Membership Rewards 102,729 | World of Hyatt 90,413 | Marriott Bonvoy 65,343 | Citi Thank You 62,712 | Wells Fargo Rewards 33,652 | Southwest Rapid Rewards 28,105 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,661 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 792 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 6,992 ($69.92) | Amazon Rewards 475 ($4.75) | Discover CB 499 ($4.99)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

For many people it's not hard to spend $2K organically over a 60 day window especially since the timeframe covers most of the Christmas shopping season.

Given that the yield is up to 7.25% (2,000 earned + 12,500 bonus TYP for $2K spend) it may worthwhile for the OP to meet the spend requirement. My classic redemption example is 2500 TYP yields a $25 Home Depot gift card, not every exchange yields a 1 TYP = $0.01 rate but a number of them do.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

@K-in-Boston wrote:No gotchas other than a fairly short period to complete the spending. Nice that it's not category-specific as TYP offers usually are. FWIW the points can be much more valuable if you have Citi Premier or Prestige and they go to a combined TYP account.

No, I don't have either of those, but it still seems like there are a lot of 1cpp redemption options.

@Citylights18 wrote:If you don't have the Sears mastercard already 12,500 points is not that much to chase.

I wouldn't app for it either as they are closing their stores. For that matter, I wouldn't app for anything unless it also comes with strategic value (helping you pay down debt or enhancing point earning rates).

This is my wife's card, she's had it for 35 years already, so no new app.

@coldfusion wrote:

For many people it's not hard to spend $2K organically over a 60 day window especially since the timeframe covers most of the Christmas shopping season.

Given that the yield is up to 7.25% (2,000 earned + 12,500 bonus TYP for $2K spend) it may worthwhile for the OP to meet the spend requirement. My classic redemption example is 2500 TYP yields a $25 Home Depot gift card, not every exchange yields a 1 TYP = $0.01 rate but a number of them do.

Even though I still need to spend $1k to finish the SUB spend for another card I just got, I don't think $2k should be hard, even if I limit it to things that aren't bonuses for other cards. I'll certainly keep Amazon and Lowes spend on their respective cards since they are 5%. Between Christmas and daughter buying and moving into a new house ("housewarming gifts"), $2k should be easy even without groceries or other categories that are bonus on other cards.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this a good offer for Citi Thankyou points?

@coldfusion wrote:Even if OP has no intent on trying to go for the bonus he should still sign up for it as that tends to lead to followon offers as well, some of them are quite lucrative (I'll collect another 360 TYP + 9,000 bonus TYP on $360 spend for utilities again this month)

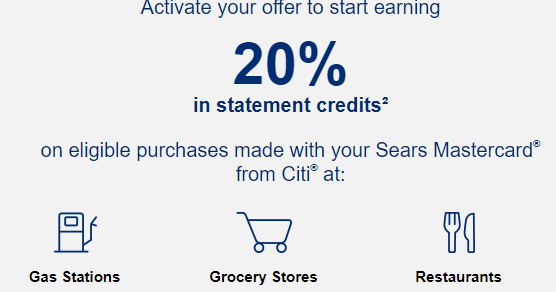

I haven't been paying as much attention to these emails because they are on my wife's card, but I do get cc'ed on them. I just checked and see that they had one (expired now) in August for 7,500 points on $750 spend, another that I missed on utilities (probably the one you are doing), and this one here that is good until 12/31:

I'll be watching these emails more closely going forward.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)