- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Lenders balance chasing/CLDing my cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Lenders balance chasing/CLDing my cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lenders balance chasing/CLDing my cards

I haven't posted here in a very long time, I hope everyone is staying healthy and safe!

Over the years, I opened so many credit accounts and with my pre-Covid business travel, I rarely had the opprtunity to sit down and review my usage of these accounts. Unfortunately, that meant that I carried balances on almost all of my accounts, sometime so high that I was only making minimum payments on a bunch of accounts because the minimum payment itself was a very hight amount.

The pandemic has given me the opportunity to review my finances closely and I devised a plan to pay off all my debt (~$65,000) by the end of this year. The problem I started running into is whenever I pay off a card, the lender immediately reduces the credit line on that card to a very low amount! Yeah, they must be thinking that I would max it out again.

What is the best strategy to avoid running into this situation? My strategy has been to make large payment on one account then move to the next. Is it better to divide payments between accounts to avoid giving the lender the opprtunity to slash the credit line?

I apprecaite what this forum gives in terms of advice.

#BacktoDebtFree

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

Once the balancing chasing has started, there isn't much you can do to stop it. As they say, you can't put the toothpaste back in the tube...

The lenders simply see you as a risk for default and they are minimizing their risk. Only time and low balances may change their minds.

Pay off the debt and let the cards fall where they may.

Purely out of curiosity, which lenders are chasing you?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

Well it started with Barcly's. I have the Arrival+ and the Apple card (both disontinued). I pay off the Arrival+ and within 5 days its credit line gets slashed by the same payment amount.

Now Chase is doing the same. I have 5 cards with them (paid of 3 this year) and today the decreased my credit lines on 2 of the ones I paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

Unfortunately many of us have been there. It really depends on how aggressively you can pay the balances down. If you can get all of them under certain thresholds (under 89% for sure including any new interest, but preferably under 29%) quickly that should minimize the domino effect.

Otherwise it's really just a matter of letting the chips fall where they may as you pay each card down. Are you a member of a credit union that may offer a personal loan in order to consolidate some of the balances?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

The lenders are doing risk management. The chasing will most likely continue through pay down. Pay as quickly as you can, be prepared for that result with each payment.

While lenders may not raise limits for a long while, the utilization aspect is temporary.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

To counter this I suggest you move away from these kinds of banks and open accounts with regional and national CUs who have more lienient policies on all of this. Also increasing overall available credit will be a helper as well as far as overall utilization. As already stated you want to not max anything out (89% or more). Since this has already started you can just plod on and see where it all lands as far as these creditors are concerned.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

Should I contiue to aggressivley pay down balances on cards with lenders who already reduced my credit lines on other cards I paid off?

Or move to pay off balances with lenders I have one card with them?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

@CreditPacMan wrote:Should I contiue to aggressivley pay down balances on cards with lenders who already reduced my credit lines on other cards I paid off?

Or move to pay off balances with lenders I have one card with them?

It would be helpful to the members if you posted who the issuing banks are and which ones you are talking about

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

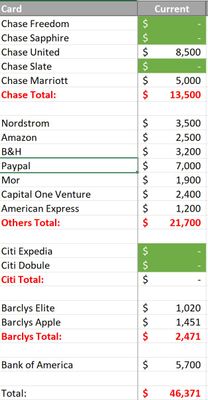

These are all my cards with their current balances. Green is the ones I recently paid off and being balance chased for.

One note, these are all maxed out (utilization above 90%).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Lenders balance chasing/CLDing my cards

If they are all above 90%, I would probably try to pay them down according to percentages of utilization to see if you can get that under control if the difference in interest rates is negligible. (If you have some cards at like 27% and the others are at 15%, it may make more financial sense to go after the bigger interest ones first.) Lenders may still balance chase you along the way which might keep those cards above 90%, but at least you won't be aggravating the risk further by having that many major scoring penalties. Eventually, lenders will get to a point where they no longer chase the balances, and if they were going to close then they would have done so already. It's a difficult domino process to watch, but you can definitely recover from it if the balances are paid down substantially.

Also keep in mind that if you continue to use any of those cards, you are paying interest from the time you make the charges as you have no grace period. If you can put daily expenses on a card that is paid in full each month or (not something I would normally say) a debit card, that will help as well.