- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: MR/UR/TY after recent changes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MR/UR/TY after recent changes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@longtimelurker wrote:

@Aim_High wrote:

Propel is an attractive card also, but not the only other no-fee option.I was referring to the combo of Propel + the Visa Sig card. That makes the 3% categories of Propel worth 4.5%, same as CSR (and AR for that matter!) with no AF.

So the Propel points can be combined with Visa Sigature that pays 50% bonus for airfare?

And is that also true of the Cash-Wise Visa that pays 1.5% on everything?

Propel pays 3x points on not only dining and travel (flights, hotels, car rentals) plus also gas and some streaming services. So you'd get 4.5% back on all of these by rolling over the points?

Except that 50% bump and the SUB for higher payout in first six months, that Visa Signature appears to be a pretty basic 1.5% travel card which isn't very special.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@wasCB14 wrote:

@Aim_High wrote:

@wasCB14 wrote:

@Aim_High wrote:

...UR points are worth a minimum of a penny a piece, whether I cash them out or use for travel. MR points are worth less for cash...Part of what I like about MRs is that Schwab Platinum gives me a reasonable cash floor at 1.25 cpp (2.5% on spend within BBP's cap) if I find I have more MRs than I can use as miles.

So does the Schwab Platinum version give a higher cash floor than the regular AMEX Platinum non-cobranded card? Not that I would have it since I'm not with Schwab, but good to know. I thought the benefits and T&C of all the AMEX Platinum cards were identical except for the cobrand or perhaps the offset of AF's based on investments.

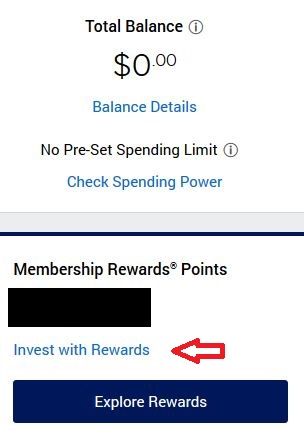

Yes. On the Home dashboard the card has an extra button for Schwab deposits at 1.25 cpp:

And there is a "loyalty credit" of $100 per year at $250k or $200 at $1M.

So to get the 1.25 ccp, it has to be deposited to an investment account, not directly cashed out? At least that is an option, though, to keep point value from diminishing too far. I don't think there is a comparable option with the other Platinum cards, from what I've read. That seems similar to Fidelity (Elan Financial) Visa that pays 2% only if redeemed into an investment but 1% if cashed.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

None of the above -- IME, I prefer the cashback cards I have like like my Cap1, US Bank Cash+, DC (I don't use TY with my DC), and a few others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@Aim_High wrote:So to get the 1.25 ccp, it has to be deposited to an investment account, not directly cashed out? At least that is an option, though, to keep point value from diminishing too far. I don't think there is a comparable option with the other Platinum cards, from what I've read. That seems similar to Fidelity (Elan Financial) Visa that pays 2% only if redeemed into an investment but 1% if cashed.

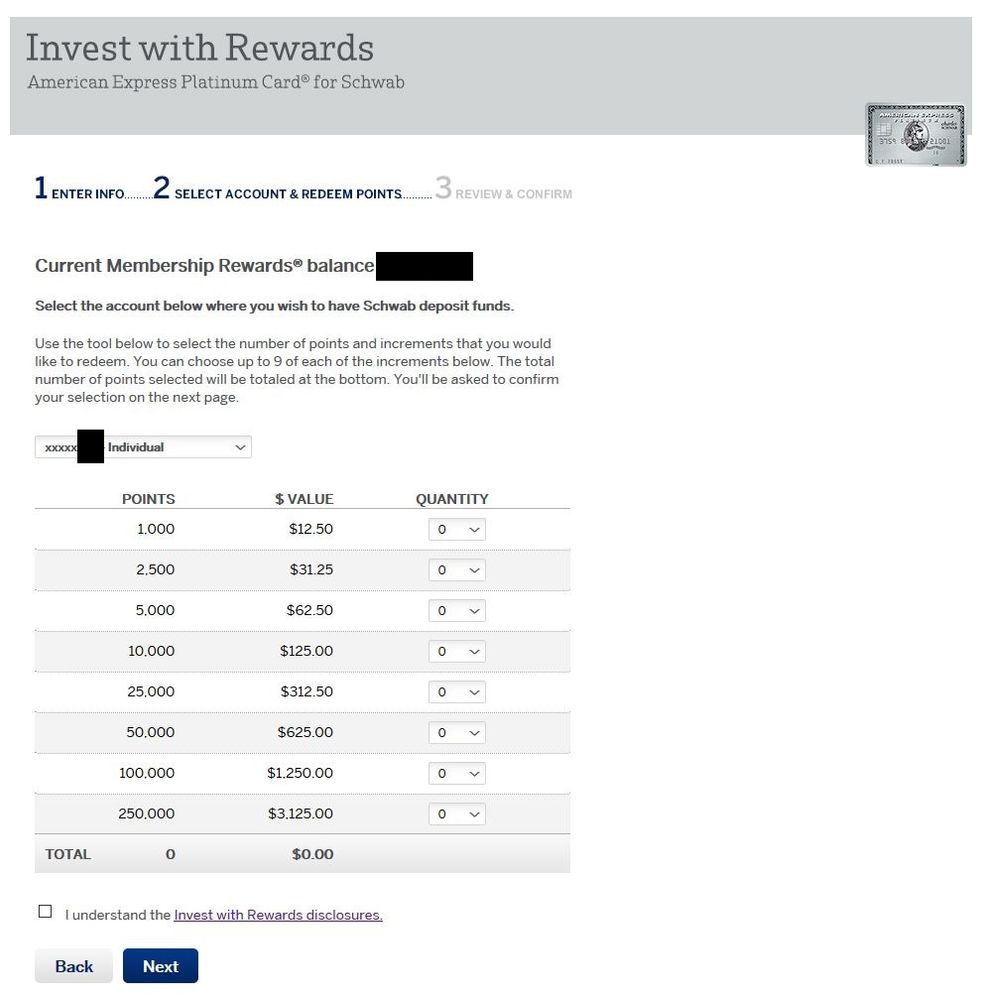

Yes. You select the linked Schwab account you want the deposit to go into from a drop-down menu. You then build a "basket" of cash deposits:

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@Aim_High wrote:

@longtimelurker wrote:

@Aim_High wrote:

Propel is an attractive card also, but not the only other no-fee option.I was referring to the combo of Propel + the Visa Sig card. That makes the 3% categories of Propel worth 4.5%, same as CSR (and AR for that matter!) with no AF.

So the Propel points can be combined with Visa Sigature that pays 50% bonus for airfare?

And is that also true of the Cash-Wise Visa that pays 1.5% on everything?

Propel pays 3x points on not only dining and travel (flights, hotels, car rentals) plus also gas and some streaming services. So you'd get 4.5% back on all of these by rolling over the points?

Except that 50% bump and the SUB for higher payout in first six months, that Visa Signature appears to be a pretty basic 1.5% travel card which isn't very special.

Yes, you can combine propel and visa signature for 4.5% on travel, gas, dining, etc. This 4.5% is only for flight booking through portal.

You can also pool points with anyone (you can't app for 2nd WF card within 6 months) if s/he has a visa signature and you have a propel, you two doesn't even need to be related in anyway. lol, Just ensure the pool account is initiated by the one holding the signature card.

I don't believe cash wise earn GF points, so it probably won't work with the 150% multiplier.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

There are also less prominent programs and/or smaller issuers.

I am talking about cards like Capital One Venture, Wells Fargo Go Far cards, Barcalays Arrival +, US bank Altitude Reserve and Cash+, CNB Crystal, HSBC cash back, ABOC MasterCard, Navy cards if you are eligible, etc.

You can find a gem or two there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@Anonymous wrote:There are also less prominent programs and/or smaller issuers.

I am talking about cards like Capital One Venture, Wells Fargo Go Far cards, Barcalays Arrival +, US bank Altitude Reserve and Cash+, CNB Crystal, HSBC cash back, ABOC MasterCard, Navy cards if you are eligible, etc.

You can find a gem or two there.

Welcome to My Fico Forums! ![]()

Thanks for that mention and that's true. Here is my quick review of those cards.

IMO, out of that list the only one even close to meriting inclusion with the "Big Three" in the thread title (MR/UR/TY - AMEX-Chase-Citi) is that US Bank Altitude Reserve which was mentioned upthread a few times. While the $400 AF AR doesn't have any transfer partners like the Big Three, it definitely has it's strengths in some aspects with those bigger brothers.

Barclay's Arrival+ is no longer available to new cardholders.

CNB Crystal Visa Infinite ($400 AF) has been discussed on several other threads. While it's a good travel card, it's not in the same league with USB AR much less MR/UR/TY. (It has good offsets available to the AF and premium Visa Infinite benefits; however, it's highest payout is 3% for travel-dining and does not offer 50% more value for travel redemptions like CSR or USB AR, so it's a step behind them.)

From this point, we enter a completely different segment of the travel market than the more premium travel cards listed above. These cards tend to be free or have annual fees under $100, but consequently with substantially less benefits and features. They may allow you to book travel through a portal but they don't allow any transfer to outside partners. They certainly have their place in the market but they are more for the occasional or value-conscious leisure traveler.

The highest-payout of these is probably the Wells Fargo Propel/Visa Signature combo which was just discussed. Propel is a good medium-tier 3% cash-back card that can pay 4.5% if points are combined with VS, but it lacks the premium features of the cards above. However, it's an option as you move down the "food-chain" and has a good payout rate.

Another travel option in this less-expensive middle-tier that you didn't mention is the $95 AF Chase Sapphire Preferred. Not as many benefits or as high a payout as the CSR, but a decent option for the less-frequent traveler, especially when paired with other Chase cards in the UR portal for 25% bonus. The travel protections on this card are excellent for a Visa Signature-level card and the ability to transfer points to travel partners like the CSR is unusual for a card at this price-point. (Citi Premier is another card in this price-point that accumulates TY points eligible for transfer and offers a 25% bonus for travel redemption but doesn't offer all the features of CSP.)

While the rewards payout on the premium cards can go well over 4%, everything remaining is basically a 3% or less redemption. The other cards you mentioned, including Capital One Venture, Navy Flagship, or other travel cards like Discover IT Miles or Bank of America Travel Rewards or Barclays/Uber are all basically cash-back cards, possibly with options to redeem that cash for travel. If you have a Costco membership, Citi Costco Visa pays 3% on all travel and dining for no additional AF above the Costco membership, but there is no 50% bump for travel redemption like WF P/VS. You might see some Visa Signature level of benefits on some of these cards but nothing comparable to the offerings on the more expensive cards.

There's nothing wrong with any of these choices! Different cards are geared towards different lifestyles, spend, and travel patterns. It's great that we all have options to evaluate and see what works best for us.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

nah, once you agreed to their terms, they have already fed you their cookies and are tracking you. the browser add on is just "more convenient" for them to show you ads.

@Aim_High wrote:

@digitek wrote:You can install the Rakuten browser Addon and it makes using it almost effortless. They will track everything that you do online, but in the end that doesn't really even matter to you, doesn't cost you anything.

Whoa.

That caught my eye. Online privacy and tracking is a huge deal to me, so that does matter to me ... a lot!

If I were to use a site like Rakuten, it would be isolated to web sign-in only, not with a browser add-on watching my every move online.

@Aim_High wrote:

@digitek wrote:You can install the Rakuten browser Addon and it makes using it almost effortless. They will track everything that you do online, but in the end that doesn't really even matter to you, doesn't cost you anything.

Whoa.

That caught my eye. Online privacy and tracking is a huge deal to me, so that does matter to me ... a lot!

If I were to use a site like Rakuten, it would be isolated to web sign-in only, not with a browser add-on watching my every move online.

@Aim_High wrote:

@digitek wrote:You can install the Rakuten browser Addon and it makes using it almost effortless. They will track everything that you do online, but in the end that doesn't really even matter to you, doesn't cost you anything.

Whoa.

That caught my eye. Online privacy and tracking is a huge deal to me, so that does matter to me ... a lot!

If I were to use a site like Rakuten, it would be isolated to web sign-in only, not with a browser add-on watching my every move online.

In my wallet:

In my desk:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

I'm guessing that you don't use the typical web browsers then?

Because the big three, especially Chrome already tracks you. Heck Google tracks you in other ways that you wouldn't even think of as it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MR/UR/TY after recent changes

@Anonymous wrote:I'm guessing that you don't use the typical web browsers then?

Because the big three, especially Chrome already tracks you. Heck Google tracks you in other ways that you wouldn't even think of as it is.

I use firefox, all third party cookie blocked by default, browsing through firefox private network, with ad block, https everywhere, ghostly equipped. Everytime I vist rakuten or AA shopping, they kept asking me for permissions, and I usually say no. lol

Chrome is an entirely different beast, the thing is a walking spy machine, doubt I will ever touch it.