- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Maintain grace period?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Maintain grace period?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Anonymous wrote:

I know we need to make at least the minimum payment regardless of the negative balance. Do we need to pay the entire statement balance of $831.10 to maintain the grace period?

I don't believe that you need to make any payments. In the case everybody is refering due, the OP had a negative balance somewhere in the middle of the statement period. But then the OP made extra charges and an ended up with a positive balance on the statement. As long as you don't have a positive balance on the next statement, you should be ok.

In fact, in April my CF statement closed with a $430 balance and $35 minimim payment due. In May I received a $410 refund and had an auto payment of $20 (and had no new charges). So my payment was below the minimum payment due. This did not cause any problems at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Yankee2 wrote:this is from my last Chase statement. It's my opinion that Chase uses statement credit toward your minumums...

Your AutoPay amount will be reduced by any payments or merchant credits that post to your account before we process your AutoPay

payment. If the total of these payments and merchant credits is more than your set AutoPay amount, your AutoPay payment for that

month will be zero.

Exactly. I'm using AutoPay for all my three Chase cards. I had refunds lots of time. Refunds to indeed reduce the autopay and I never lost the grace period (even when I ended up with a positive balance)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

I had this exact situation on a Chase card recently. Despite the large credit balance, I went ahead and paid the minimum payment due. Then I used the card for a bunch of purchases to wipe out the large credit balance. My rationale: the statement, not the online display, is the legal document.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

Thanks to all. We're not brave enough to be the guinea pigs. We're just going to pay the statement balance and transfer the entire resulting credit to another card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Anonymous wrote:Thanks to all. We're not brave enough to be the guinea pigs. We're just going to pay the statement balance and transfer the entire resulting credit to another card.

I never knew how brave I am. I have had chase cards for 15 years, and according to my records paid 21 times less than the statement balance (and never lossed the grace period).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

While I'm late to the party on this one, i would probably pay the statement balance as well just to be safe. However, if there is a credit made to the account by the due date that is large enough to cover both the minimum and statement balance. It should technically be satisfied as there is indeed nothing left to pay.

Not knowing exactly how they treat credits versus a payment in terms of accruing interest, that's why I would opt to pay and you most likely will use a credit balance on a CC for something. I mean it's not exactly like it's lost Money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

Chase's online system will not allow us to make a payment. I sent Chase a secure message explaining the situation and asking whether we need to make a payment. I'll have the response in writting. We could push a payment from our bank, but if Chase tells us in writting that we don't need to do so, that's good enough for us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Anonymous wrote:Chase's online system will not allow us to make a payment. I sent Chase a secure message explaining the situation and asking whether we need to make a payment. I'll have the response in writting. We could push a payment from our bank, but if Chase tells us in writting that we don't need to do so, that's good enough for us.

Why go through the hassle of potentially having to fight to get a late payment removed and battling with misinformed CSRs who can't or won't help you down the line and potentially trigger accounts being closed (even if only temporarily). Just push the payment and be done with it. Don't let you credit health depend on anybody but yourself. Why leave your credit score up to Chase when you can be the one to control this situation.

Push the payment, and request a check for the credit balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Credit12Fico wrote:

@Anonymous wrote:Chase's online system will not allow us to make a payment. I sent Chase a secure message explaining the situation and asking whether we need to make a payment. I'll have the response in writting. We could push a payment from our bank, but if Chase tells us in writting that we don't need to do so, that's good enough for us.

Why go through the hassle of potentially having to fight to get a late payment removed and battling with misinformed CSRs who can't or won't help you down the line and potentially trigger accounts being closed (even if only temporarily). Just push the payment and be done with it. Don't let you credit health depend on anybody but yourself. Why leave your credit score up to Chase when you can be the one to control this situation.

Push the payment, and request a check for the credit balance.

You're right, that's a better plan. Done.

I am curious about Chase's response to the original inquiry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maintain grace period?

@Anonymous wrote:

@Credit12Fico wrote:

@Anonymous wrote:Chase's online system will not allow us to make a payment. I sent Chase a secure message explaining the situation and asking whether we need to make a payment. I'll have the response in writting. We could push a payment from our bank, but if Chase tells us in writting that we don't need to do so, that's good enough for us.

Why go through the hassle of potentially having to fight to get a late payment removed and battling with misinformed CSRs who can't or won't help you down the line and potentially trigger accounts being closed (even if only temporarily). Just push the payment and be done with it. Don't let you credit health depend on anybody but yourself. Why leave your credit score up to Chase when you can be the one to control this situation.

Push the payment, and request a check for the credit balance.

You're right, that's a better plan. Done.

I am curious about Chase's response to the original inquiry.

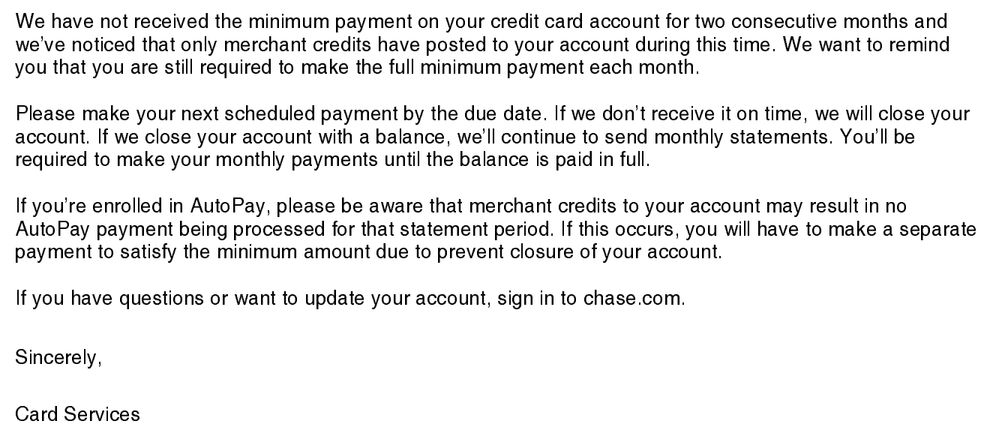

Cheers! I had some alarm bells going off because I have seen in another forum this month your same exact issue of a credit balance posting during the billing cycle that was larger than the statement balance of the previous billing cycle. In the end, this account holder's card was closed due to non-payment even though there was a credit balance like your situation. See the notice that Chase sent them: