- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Major Chase Freedom Revamp - Effective 9/15/20

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Major Chase Freedom Revamp - Effective 9/15/20

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@longtimelurker wrote:

@randomguy1 wrote:Chase's trend has been nothing but increasing value with their cards, I do not anticipate them nerfing their cards or getting rid of the UR system for the CF/CFX.

Not sure that's true for all! In the pandemic they have started adding value (back), but recall that just prior they increased the AF on CSR to $550, with additional benefits that many found not all that valuable. So I wouldn't say it's been monotonically increasing value.

Some found the new benefits not valuable. Some of us cleaned up. You'd imagine something is coming to the CSR/CSR unless they were losing their a*sses on the new benefits and travel credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@randomguy1 wrote:Chase's trend has been nothing but increasing value with their cards, I do not anticipate them nerfing their cards or getting rid of the UR system for the CF/CFX.

There was that pesky nerfing of price protection, the two guest limit added to Priority Pass, no longer earning rewards on charges that qualify for the travel credit, and the $100 AF increase on the CSR. None of those exactly increased its value.

The rumor with axing UR transfers did start with a survey about Chase cards, so unfortunately it's not like they haven't at least considered it.

I'm kind of in a backwards situation from many others; the transfer capability makes it worth me having Freedom and Freedom Unlimited rather than it making CSP/CSR worth it. If that gets nixed, there wouldn't be much use for me to keep CFU, and CF (or a PC to CFF) would be a card seeing a lot of sock drawering; 7.5% net back is incentive for me to use it over other cards, but since the categories often overlap with ones where I am already getting 5% or more elsewhere, not much of a point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@K-in-Boston wrote:

@randomguy1 wrote:Chase's trend has been nothing but increasing value with their cards, I do not anticipate them nerfing their cards or getting rid of the UR system for the CF/CFX.

There was that pesky nerfing of price protection, the two guest limit added to Priority Pass, no longer earning rewards on charges that qualify for the travel credit, and the $100 AF increase on the CSR. None of those exactly increased its value.

The rumor with axing UR transfers did start with a survey about Chase cards, so unfortunately it's not like they haven't at least considered it.

I'm kind of in a backwards situation from many others; the transfer capability makes it worth me having Freedom and Freedom Unlimited rather than it making CSP/CSR worth it. If that gets nixed, there wouldn't be much use for me to keep CFU, and CF (or a PC to CFF) would be a card seeing a lot of sock drawering; 7.5% net back is incentive for me to use it over other cards, but since the categories often overlap with ones where I am already getting 5% or more elsewhere, not much of a point.

I live alone, I have an income that puts me in lower middle class/upper lower class. This is to say, I don't have much additional frivelous spend as I would like. I have been banking UR's on both Freedoms for a couple of years now (had to withdraw CB when I got into a bind) but for me, it's a significant amount of UR's I have atm. I planned to transfer them with an app to CSP/CSR at a time when it made financial sense to do so. I have no travel cards in my profile because I travel ~1.5 times per year.

If they nuke the ability to transfer UR to CSP/CSR to use at an increased value, they will never get a penny from me for an AF. It would be sad to see happen but I have hope. At least I know I would be able to just withdraw as a statement credit at that point...or maybe use it in their portal for 5% back now? I'm not sure which would be a more financially savvy situation. I have often found hotels much cheaper off the UR portal than on it.

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

forgive me for my ignorance. I dont have chase freedom, chase freedom unlimited, or the saphire reserve....

but wouldnt being able to earn the 5x travel on the freedom cards would require that people pay some "out of pocket" expenses for travel? or can the saphire reserve travel credit be transferred to other cards like the points can?

I am thinking the "catch" is just having these higher earnings on the freedom cards simply encouraging people to spend on travel outside of their reserve's travel credit maybe??? assuming you can only use the travel credit on reserve.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@ChargedUp wrote:

As a Trifecta holder, I'm cautiously optimistic that Chase is not going to do much nerfing (if at all), and is simply looking to lure savvy credit card users from other lenders. I'm certain there's PLENTY of people out there ticked off at Cap One right now with them doing a massive CL reduction across its card holders. Keep in mind that the holiday spending season is just around the corner as well. Those that have qualified for the AF Venture and Savor likely have a credit profile that would at the minimum get them in the door at Chase (sans 5/24) This is interesting timing for sure.

. Even if you just occasionally pull through the In N Out drive-thru, CFU now kills most every 1.5% card out there. If you're someone who has regular prescriptions, the 3% pharmacy will catch some attention as this isn't a heavily saturated category.

As I said earlier, I see this as Chase looking to increase the amount of people holding and using their core cards. Chase is certainly in a better place financially than a lot of issuers and can afford to sweeten the pot to grab marketshare. Remember also that once these new cardholders are signing into their Chase page for card info and payments, Chase can now tempt them into other banking products from car loans to checking accounts. I think there's more strategy to this than most are giving credit for.

I think you see what I see. I think Chase is going after CO cardholders with this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

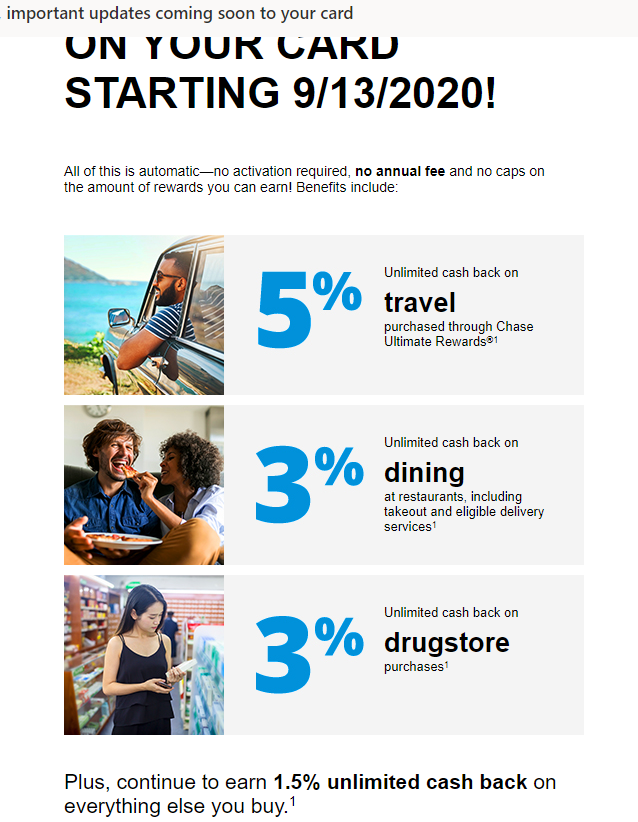

@Anonymous I was just about to post a Forum about this LOL looks like my Unlimited is included but mine starts the 13th! Wooot wooooot!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@Anonymous wrote:forgive me for my ignorance. I dont have chase freedom, chase freedom unlimited, or the saphire reserve....

but wouldnt being able to earn the 5x travel on the freedom cards would require that people pay some "out of pocket" expenses for travel? or can the saphire reserve travel credit be transferred to other cards like the points can?

I am thinking the "catch" is just having these higher earnings on the freedom cards simply encouraging people to spend on travel outside of their reserve's travel credit maybe??? assuming you can only use the travel credit on reserve.

Perhaps more encouraging people to spend travel through the portal, where the profit margins might be enough to support 5% back. People with the CSR were likely putting at least some travel expenses outside the portal, with Chase just getting the swipe fee, whihc is less than the 3% that card gives.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@Girlzilla88 wrote:@Anonymous I was just about to post a Forum about this LOL looks like my Unlimited is included but mine starts the 13th! Wooot wooooot!!!

I just got the same email 10 seconds ago. Changes are coming!! lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@Anonymous Brace yourself!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Major Chase Freedom Revamp - Effective 9/15/20

@SecretAzure wrote:I live alone, I have an income that puts me in lower middle class/upper lower class. This is to say, I don't have much additional frivelous spend as I would like. I have been banking UR's on both Freedoms for a couple of years now (had to withdraw CB when I got into a bind) but for me, it's a significant amount of UR's I have atm. I planned to transfer them with an app to CSP/CSR at a time when it made financial sense to do so. I have no travel cards in my profile because I travel ~1.5 times per year.

If they nuke the ability to transfer UR to CSP/CSR to use at an increased value, they will never get a penny from me for an AF. It would be sad to see happen but I have hope. At least I know I would be able to just withdraw as a statement credit at that point...or maybe use it in their portal for 5% back now? I'm not sure which would be a more financially savvy situation. I have often found hotels much cheaper off the UR portal than on it.

The 5% would be earnings on Chase UR travel portal spend, rather than redemption value. So you'd be better off to charge the purchase to your card, then just take the statement credit at 1 cpp, if CSP/CSR bonuses were not involved. It's often mentioned that OTA (online travel agency) pricing (Expedia, Travelocity, Amex Travel, Chase UR portal, etc.) is more than booking elsewhere, but with the exception of rare sales I have never really found that to be the case. Usually the differences there are when the OTA shows a price inclusive of tax and other places do not. So if marriott.com for instance is showing $300/night for 7 nights at the St. Regis but Expedia is showing $384/night, the most likely scenario is that Expedia is showing the tax-inclusive rate whereas Marriott by default would not be including the 27% in state and local hospitality taxes (they recently added an option to show prices with all taxes and fees, which is a massive timesaver as I used to have to go all the way to the reservation screen to make apples to apples comparisons between properties). At the end of the day, it might look like booking direct will save you $588 over the course of a week, but in reality the price is the same. That often comes into play when people discuss the value of Marriott points; award stays include all taxes and fees, so valuing of the points should be based on the full price including taxes and fees rather than the base room rate. There are some exceptions where an OTA will actually be less, however. Amex Insider Fares will result in airfare (usually Delta) being less than anywhere else, including directly with the airline. Unfortunately, I never seem to get those on the flight schedules I actually want and saving 5-10% isn't worth me changing my plans.