- myFICO® Forums

- Types of Credit

- Credit Cards

- NFCU wants every single penny

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU wants every single penny

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

@Aim_High wrote:

@Anonymous wrote:Most of my cards would have waived such a small amount. I paid it obviously but I got a chuckle out of a 12 cent bill and thought I would share the smallest credit card bill I have ever had. 😂

@chiefone4u wrote:

Capital One charged me $2.00 interest on a $0.10 balance (I miscalculated remaining balance after cashing in rewards). If I knew then what I know now I would have called and complained-- instead I just paid it ($2.10 bill)

@Remedios wrote:I just want to make sure I read this right...you'd call Capital One and complain about two dollars in interest because you didn't pay bill in full due to miscalculation?

How does that even work?

@gdale6 wrote:

So does BoA, a few year ago they sent me a bill for 6 cents....

Lol ... amateurs. I've got you all beat!

How about 0.03 cents!?!

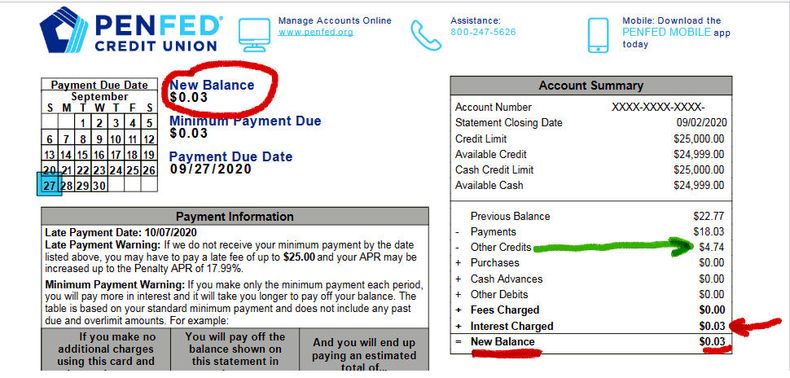

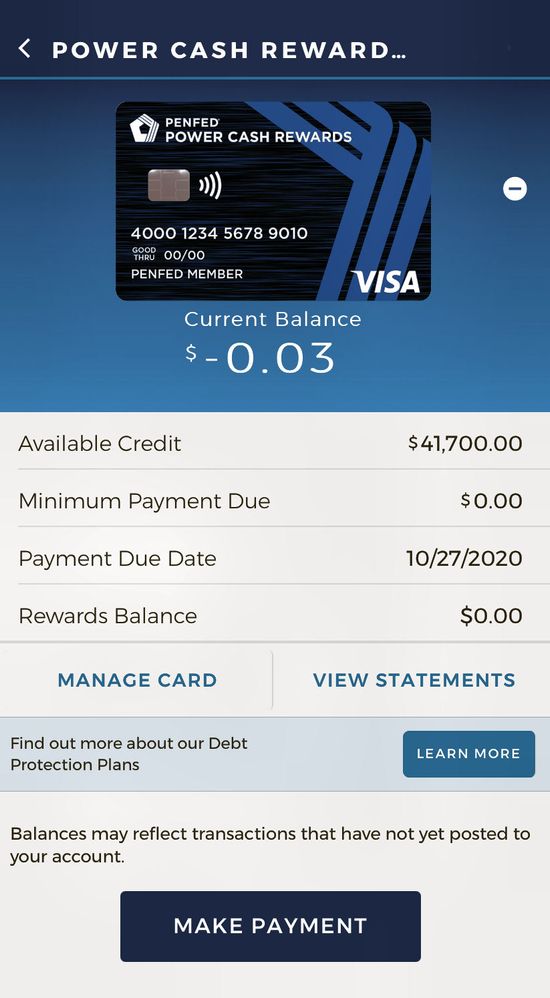

I had $4.74 in rewards on my PenFed Power Cash Rewards card to redeem. My other cash back cards have usually allowed me to reduce my balance due when I went to make a payment by redeeming the cash back. So a few days before payment was due, I redeemed the $4.74 and paid the remainder. I checked a few times and was a little puzzled how my balance didn't reduce below the $4.74 but I gave it more than 48 hours to post. After the statement cut, they credited the $4.74 but also charged me $0.03 cents interest! I actually thought it was a mistake and yes, even over just three cents, emailed to ask what had happened. It turns out, they credit the cash back differently from other lenders I've had. Any redeemed cash back always goes on AFTER the statement cut, so the full balance is always due. As a courtesy, they refunded the $0.03 cents and then I ended up with a $0.03 cent credit balance.

Hey, three cents is three cents. But it was more the principle of the thing and wanting to understand how to prevent it in the future, so now I know how they do things.

*And yes, the Credit Limit did increase from $25K to $41.7K in between the statement and screenshot. They had offered me $16.7K in additional credit line or on a new card back in June but were then slow to implement it since they are officially capping each card at $25K. I had to appeal to Customer Service Manager to complete the offer.

Good DP on PCR, thank you for sharing CB posts after statement cuts... could save myself and possibly other's the headache you experienced.

Starting Score: EQ:608, EX:617, TU:625

Current Score 3/11/2020: EQ:695, EX:703, TU:720

Goal Score: 740+

Take the myFICO Fitness Challenge

Member of the Synchrony Bank giveth then Taketh away April 2020 Club! $86,900 in available credit gone without warning.

Newest Account July 8, 2020 -- Last HP October 24, 2020 -- Gardening Goal: August 2022 and reach 0/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

@Loquat wrote:

@Brian_Earl_Spilner wrote:

@Anonymous wrote:Perhaps because the amount was interest and not an actual charge? Twelve cents does seem like a very small amount to worry about, and the perfect amount to waive. I'm sure they had their reasons for not waiving the amount and it might be an interesting story.

@KJinNC wrote:I can't imagine that it would be a good use of time for anybody to call to argue about $2. The only reason I might call would be if I got dinged for a late payment on 12 cents or whatever.

While i would agree, the many years I spent at retail dealing with people that argued over two cent difference would beg to differ.

I remember I once mailed a penny taped to an index card because a customer was making a big stink and said we were trying to rip people off. Said we were probably doing it to everyone and all those pennies added up to big dollars.

Pennies do add up. Think of Verizon Wireless. If they kept just 2 cent from all of their 93M customers they'd pocket 1.8M each month...which is a significant amount of money. Now one would hope a company doesn't do that but those pennies do add up.

Well I could have sworn this is what WF was doing to me for years, because no matter what I could never match what they showed in my acount. It was always off by a few cents and could never track it down, they were simply missing. So I do see how millions of pennies could add up significantly, and the possiblity if it happening by a large company. Which many probably think it will go unoticed.

I've never concerened myself with differences under a nickel, it's just not that bif of an issue to hold up the line etc. it also doesn't happen very often to me so I can write it off here an there. Now if it were happening at every place I shopped then I'd see an issue than needed to be dealt with. Besides this type of mistake is done by Human at most likelt busy times, not purposesly don't by the company so i can let it slide as a mistake. Once we go to robots doing everything then there shouldn't be anymore mistakes, right? lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

@chiefone4u wrote:

@Aim_High wrote:

@Anonymous wrote:Most of my cards would have waived such a small amount. I paid it obviously but I got a chuckle out of a 12 cent bill and thought I would share the smallest credit card bill I have ever had. 😂

@chiefone4u wrote:

Capital One charged me $2.00 interest on a $0.10 balance (I miscalculated remaining balance after cashing in rewards). If I knew then what I know now I would have called and complained-- instead I just paid it ($2.10 bill)

@Remedios wrote:I just want to make sure I read this right...you'd call Capital One and complain about two dollars in interest because you didn't pay bill in full due to miscalculation?

How does that even work?

@gdale6 wrote:

So does BoA, a few year ago they sent me a bill for 6 cents....

Lol ... amateurs. I've got you all beat!

How about 0.03 cents!?!

I had $4.74 in rewards on my PenFed Power Cash Rewards card to redeem. My other cash back cards have usually allowed me to reduce my balance due when I went to make a payment by redeeming the cash back. So a few days before payment was due, I redeemed the $4.74 and paid the remainder. I checked a few times and was a little puzzled how my balance didn't reduce below the $4.74 but I gave it more than 48 hours to post. After the statement cut, they credited the $4.74 but also charged me $0.03 cents interest! I actually thought it was a mistake and yes, even over just three cents, emailed to ask what had happened. It turns out, they credit the cash back differently from other lenders I've had. Any redeemed cash back always goes on AFTER the statement cut, so the full balance is always due. As a courtesy, they refunded the $0.03 cents and then I ended up with a $0.03 cent credit balance.

Hey, three cents is three cents. But it was more the principle of the thing and wanting to understand how to prevent it in the future, so now I know how they do things.

*And yes, the Credit Limit did increase from $25K to $41.7K in between the statement and screenshot. They had offered me $16.7K in additional credit line or on a new card back in June but were then slow to implement it since they are officially capping each card at $25K. I had to appeal to Customer Service Manager to complete the offer.

Good DP on PCR, thank you for sharing CB posts after statement cuts... could save myself and possibly other's the headache you experienced.

Would've been interesting to see the block of text if you do not pay in full how much interest accrues over time and the total amount that you will pay.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

@Anonymous wrote:Most of my cards would have waived such a small amount. I paid it obviously but I got a chuckle out of a 12 cent bill and thought I would share the smallest credit card bill I have ever had. 😂

Ask if they'd mail you a paper statement! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

If you had redeemed those cash rewards as a deposit to your PenFed checking account, they would have been available the next morning, and you could have used them toward your credit card payment. That's one of the reasons why I don't use statement credits at PenFed.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

@UpperNwGuy wrote:If you had redeemed those cash rewards as a deposit to your PenFed checking account, they would have been available the next morning, and you could have used them toward your credit card payment. That's one of the reasons why I don't use statement credits at PenFed.

Thanks for the tip, @UpperNwGuy! I'm used to redeeming for statement credit so I just have to remember to do it a little differently with PenFed.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

Easy, Capital One gave me a full credit for 2.68 due to an error I made. Just called and asked. The girl laughed and said 'done'.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

As a NFCU member, and by default a shareholder, I demand my money! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU wants every single penny

That's hilarious! Thanks for the share