- myFICO® Forums

- Types of Credit

- Credit Cards

- PSA: PenFed if you ever need to dispute

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PSA: PenFed if you ever need to dispute

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PSA: PenFed if you ever need to dispute

So I needed to dispute two charges on my PF card. The two charges are not fraud but rather a dispute.

[I decided to opt out of a term life policy within the alloted timeframe but the insurance company has ignored my notice via certified letter and is charging me a monthly premium.]

Most issuers let you file a dispute via telephone or via app.

PF doesn't offer either. PF doesn't offer the nice feature to LOCK one's card either....

I tried to goto the full website but didn't see a way to do a dispute. Thus, I had to email them.

This was the reply:

Thank you for contacting PenFed.

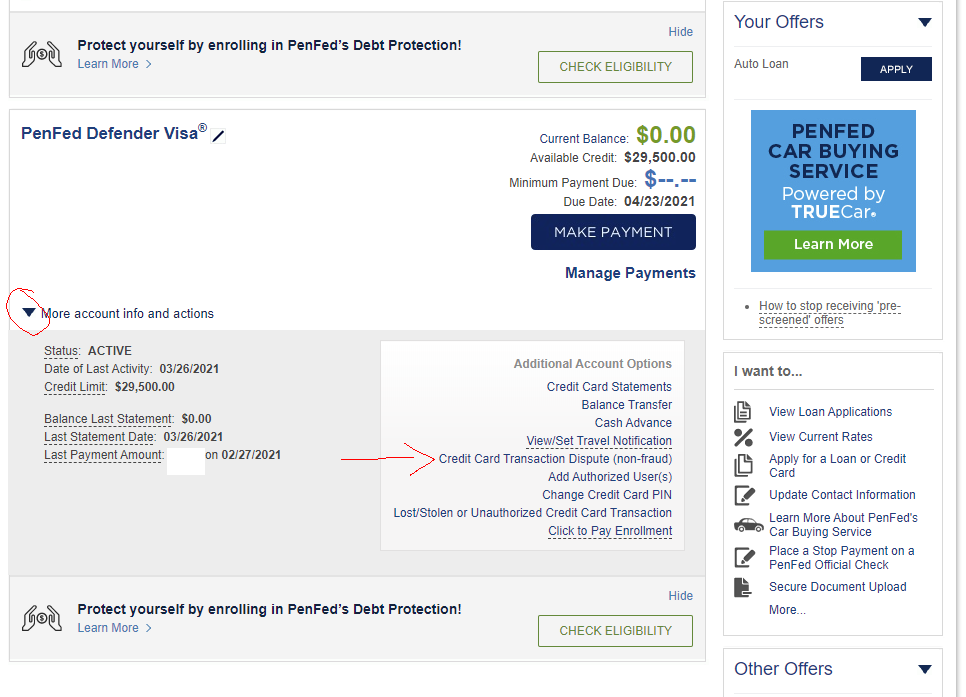

You can submit a dispute through PenFed Online. First log onto PenFed online from https://www.penfed.org/.

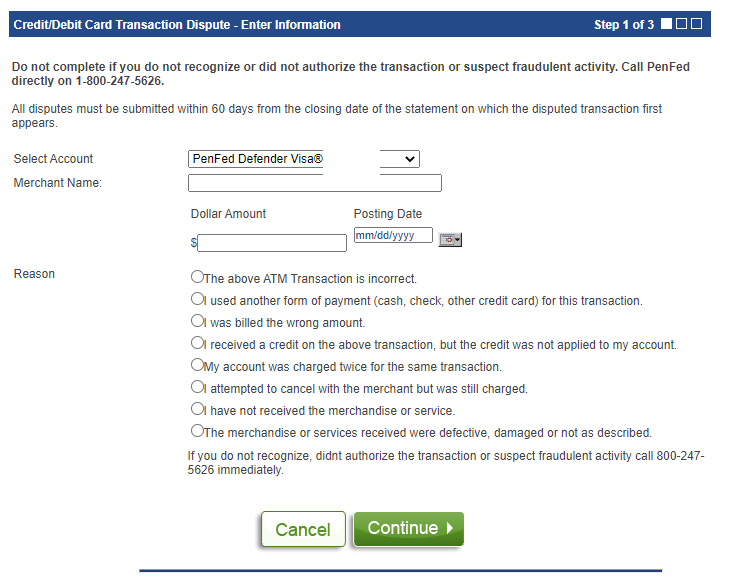

The dispute form is available in ‘+more account info and actions’ area for each credit card account, in the ‘I want to’ section, on the ‘Account Actions’ page, and on the Credit Card/Consolidated statements. Accessing the form from any of these areas allows you to enter necessary information to create a dispute.

After entering the dispute information and clicking ‘continue,’ the form is provided in PDF format with the information you entered.

Certain disputes require you to provide additional documents. These can be uploaded through PenFed Online, or faxed in using the provided fax cover sheet.

Once the form is complete, you will be given the opportunity to e-sign. The information will then be delivered to the PenFed Card Dispute Department and the dispute process initiated.

So I was able to follow these instructions and submit my dispute and docs , BUT I will say that just finding this referred Link is not obvious.

Not that you would ever want to charge something with the thought of disputing purpossely, the PSA here is just do not use your PF card if the slightest possbility of a dispute may be present.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

I'm not sure I understand, starting with the title

How would anyone know which charge might get disputed? That would mean never use Penfed since all charges have potential to be disputed.

Also it's making it sound like there is no way to dispute them, and obviously as you found out, there is.

May not the the most convinient way, but each lender has their own dispute policy, and CUs like doing things their own way

Are you upset dispute is in PDF format or that you didn't know where to find it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

I'm not sure why you would caution against using PenFed to file a chargeback, but the mechanism to do so seems straightforward and right where one would expect it to be - it's literally on the home page when you log in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

Thanks for the perspective. I edited the title. Most issuers will accept a phone call to initiate the dispute. PF IMHO, is not a as consumer friendly with this facet of service.

Their dispute process requires an attachment in order to submit. I gladly uploaded a pic of my cancellation request and the corresponding certified slip but I bet a lot of times, many won't have an "attachment."

Ultimately, it went through but the lack of 'Report an Issue' feature from their app is an annoyance from my point of view.

@Remedios wrote:I'm not sure I understand, starting with the title

How would anyone know which charge might get disputed? That would mean never use Penfed since all charges has potential to be disputed.

Also it's making it sound like there is no way to dispute them, and obviously as you found out, there is.

May not the the most convinient way, but each lender has their own dispute policy, and CUs like doing things their own way

Are you upset dispute is in PDF format or that you didn't know where to find it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

@NoMoreE46 wrote:Thanks for the perspective. I edited the title. Most issuers will accept a phone call to initiate the dispute. PF IMHO, is not a as consumer friendly with this facet of service.

Their dispute process required an attachment in order to submit. I gladly uploaded a pic of my cancellation request and the corresponding certified slip.

Ultimately, it went through but the lack of 'Report an Issue' feature from their app is an annoyance from my point of view.

@Remedios wrote:I'm not sure I understand, starting with the title

How would anyone know which charge might get disputed? That would mean never use Penfed since all charges has potential to be disputed.

Also it's making it sound like there is no way to dispute them, and obviously as you found out, there is.

May not the the most convinient way, but each lender has their own dispute policy, and CUs like doing things their own way

Are you upset dispute is in PDF format or that you didn't know where to find it?

That's fine, but when you go edit after the fact, it makes those who respond seem nutty for addressing something that doesn't exist, or even worse putting words in your keyboard.

A separate post like this one is sufficient to clear it up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

Yes desktop, but not available via their App.

To me, this is a large deficiency for a CU wirh over 2 million members.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

Oops. True. My apologies and duly noted.

I am used to other forums that lock down the title.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

@NoMoreE46 wrote:Yes desktop, but not available via their App.

To me, this is a large deficiency for a CU wirh over 2 million members.

That seems perfectly reasonable for a small card issuer like PenFed. They have one of the best apps and websites as far as credit unions go. Credit unions don't have the budget for apps and industry-leading front-ends for cardholders like Chase or Amex, for example. PenFed has hundreds of thousands of cardholders. Citi has 78 million in the US alone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

@NoMoreE46 wrote:Thanks for the perspective. I edited the title. Most issuers will accept a phone call to initiate the dispute. PF IMHO, is not a as consumer friendly with this facet of service.

Their dispute process required an attachment in order to submit. I gladly uploaded a pic of my cancellation request and the corresponding certified slip.

Ultimately, it went through but the lack of 'Report an Issue' feature from their app is an annoyance from my point of view.

@Remedios wrote:I'm not sure I understand, starting with the title

How would anyone know which charge might get disputed? That would mean never use Penfed since all charges has potential to be disputed.

Also it's making it sound like there is no way to dispute them, and obviously as you found out, there is.

May not the the most convinient way, but each lender has their own dispute policy, and CUs like doing things their own way

Are you upset dispute is in PDF format or that you didn't know where to find it?

But, that can be said for a variety of other lenders who may not have the intuitive placement of some forms, no? PenFed isn't alone in that regard, I can list a plethora of CUs and other lenders. Some even won't entertain a convo over the phone for specific disputes (other than fraud) as a matter of preserving your billing rights.

And, while it may have been a challenging experience with navigating/locating the desired information (a valid annoyance as you mentioned); I, on the other hand, had no issue locating the form that K-in-Boston pointed out when I had to submit a couple of disputed transactions about a year ago.

The cautionary 'PSA' of "dont't use PenFed if you ever need to dispute" in your op can be perceived as misleading as if a process for disputing a transaction was non-existent.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PSA: dont't use PenFed if you ever need to dispute

@NoMoreE46 wrote:Thanks for the perspective. I edited the title. Most issuers will accept a phone call to initiate the dispute. PF IMHO, is not a as consumer friendly with this facet of service.

Their dispute process requires an attachment in order to submit. I gladly uploaded a pic of my cancellation request and the corresponding certified slip but I bet a lot of times, many won't have an "attachment."

Ultimately, it went through but the lack of 'Report an Issue' feature from their app is an annoyance from my point of view.

@Remedios wrote:I'm not sure I understand, starting with the title

How would anyone know which charge might get disputed? That would mean never use Penfed since all charges has potential to be disputed.

Also it's making it sound like there is no way to dispute them, and obviously as you found out, there is.

May not the the most convinient way, but each lender has their own dispute policy, and CUs like doing things their own way

Are you upset dispute is in PDF format or that you didn't know where to find it?

Honestly I would prefer an online form to having to call and speak to a rep. The chances of them getting something documented incorrectly and delaying the resolution of your dispute are quite high whereas doing it yourself, you know what is important to include, which means you'll very likely get it done right.