- myFICO® Forums

- Types of Credit

- Credit Cards

- Paid off cards, now what?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paid off cards, now what?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paid off cards, now what?

Hello everyone,

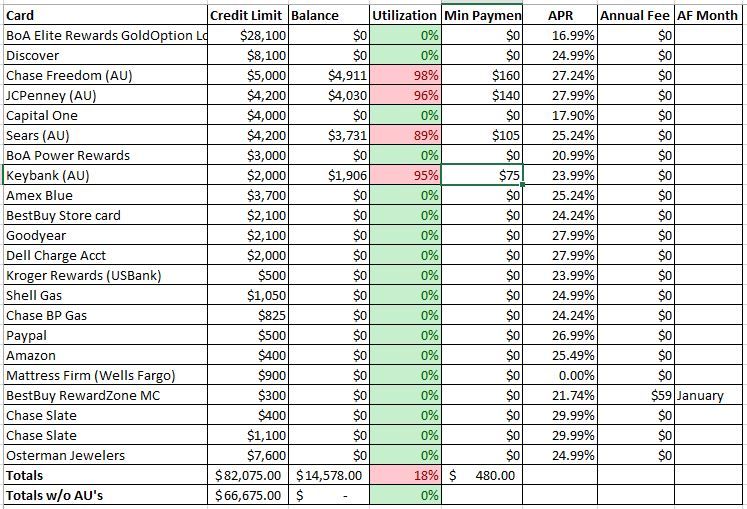

Some of you saw my journey to zero balances thread where I revealed my massive (34k) amount of CC debt to the world. I was able to secure a loan from Lending Club for the full amount and now all thats left are DW's balances (another 14k). I think its safe to start closing some of these cards down so I can focus just on a few cards. The ones I would like to keep are Discover IT, Capital One QS, Chase BP, and Osterman though the last two I'm definitely flexible on if you think they aren't worth keeping. I was thinking I wanted to keep them because they are two of my oldest TL's (both approx 15 years) and the Osterman card has a pretty high limit.

Ready for input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

EX819 1HP|TU797 1HP| EQ(Fico8 BankCard)841

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

For my personal preference, I'd keep open any cards with long history or high limits. I'd start cutting down on the Store cards that you never use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

I agree with the above posts. Store cards for sure. Unless you actually have a store you like where you can gain benefits from the card and can PIF.

I only have one store card because I enjoy shopping at VS and I make sure I don't go crazy in there because I know I want to PIF. They send me coupons and rewards so for me it's a benefit.

I Chase FU: 4,000 I US Bank: 500.00 I Fidelity: 5,000 I

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

@noobody wrote:

do not forget combine limit with chase accounts

One of the Chase Slate cards is already closed, it was closed by Chase 3-4 years ago. Am I able to combine a $400 card into the $5k card that doesn't belong to me but to my wife?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

So am I seeing this right if you just remove yourself as AU on the 4 cards you will have ZERO credit card debt and 1 loan??

REMOVE YOURSELF!

Then get a new Balance Transfer card probably from capital one the way they are handing those things out and Balance transfer ALL of those store cards to it... those balances and those interest rates are killing both of you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

@Creditaddict wrote:So am I seeing this right if you just remove yourself as AU on the 4 cards you will have ZERO credit card debt and 1 loan??

REMOVE YOURSELF!

Then get a new Balance Transfer card probably from capital one the way they are handing those things out and Balance transfer ALL of those store cards to it... those balances and those interest rates are killing both of you!

Zero credit card debt, 4 loans. Lending Club, my car and student loans, and my mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

@Creditaddict wrote:So am I seeing this right if you just remove yourself as AU on the 4 cards you will have ZERO credit card debt and 1 loan??

REMOVE YOURSELF!

Then get a new Balance Transfer card probably from capital one the way they are handing those things out and Balance transfer ALL of those store cards to it... those balances and those interest rates are killing both of you!

^+1 your scores will sky rocket... Keep a few dollars or less then <10% on one major CC, remove yourself as an AU for now until you get her Utilization under control as well.

BTW awesome job!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paid off cards, now what?

++ drop your AU cards (you'll get a big score jump)

Chase Slate (this depends on your short term strategy):

drop your Slate for a possible future strategy for $0fee-0% balance transfer

or

keep your Slate for a near-term 2%fee-0% balance transfer, add the Chase BP Gas climit (and keep a chase product because you dopped the Chase Freedom AU),

or

Product Change to a Freedom (for better rewards) with both your slate and bpgas

BestBuy RewardZone (annual fee)

unless you're a fatwallet/slickdeals ninja and have been churning massive rewards, drop this -- you'll still have credit power with your other cards and will save the AF.

as far as the other cards, unless you have a personal preference (or somebody has definitive proof that fewer cards raises credit scores), i can't see an active need to close them.

Osterman at 7.6k is a sizeable chunk of your total available credit. -- keeping this available credit lets you carry an additional 700 while maintaining a near 10% utilization for max score.

Kroger rewards (depending on how/where you shop) is your best grocery/fuel card now and a possible USBANK Product Change later .

Amazon and Paypal have occasional specials that might be worth keeping them sock-drawered (although you could close them now, and re-apply for them later to get future promotional benefits).

Chase BP Gas - combine with Chase Slate (since you will have dropped the AU Chase Freedom)

And bigtime congrats on the comeback!

s¢

Current Score: ex-850 eq-836 tu-844

Goal : maintain

Take the FICO Fitness Challenge