- myFICO® Forums

- Types of Credit

- Credit Cards

- Parting Ways with Capital One

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Parting Ways with Capital One

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Parting Ways with Capital One

Since I'm gardening only about a week, I'm wondering if I should app for one more card and reboot the garden for two years.

I was turned down a few years ago by Chase due to old baddies and I know they like to see reports squeaky clean. Not sure if I want to take the chance on wasting an inquiry.

Who should I try? I pay off every month:

1. Barclaycard

2. Citi

3. Other/suggestion

I've read a lot of good things about Barclaycard and helped a family friend sign up for one and they seemed great.

Any recommendations? The Barclaycard seems like it has decent point rewards - the APR is a stinker but I won't be carrying a balance of any magnitude and typically pay before the statement cuts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

What cards do you already have?

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

@KneelBeforeZod wrote:

Well...it seems that the EO didn't help out much with trying to get a CLI on my card. I contacted them due to the limit being low and haven't had a CLI in a while. They denied me again for "Card has already received limit increase recently". This was many months ago (more than 6). And they would not remove the AF either. They wanted to convert me to their QS1 product. I honestly think is spend more on the yearly fee than what I would get back for cash. AMEX and Discover have done such a better job with their rewards that cater to me personally for my needs.

Since I'm gardening only about a week, I'm wondering if I should app for one more card and reboot the garden for two years.

I was turned down a few years ago by Chase due to old baddies and I know they like to see reports squeaky clean. Not sure if I want to take the chance on wasting an inquiry.

Who should I try? I pay off every month:

1. Barclaycard

2. Citi

3. Other/suggestion

I've read a lot of good things about Barclaycard and helped a family friend sign up for one and they seemed great.

Any recommendations? The Barclaycard seems like it has decent point rewards - the APR is a stinker but I won't be carrying a balance of any magnitude and typically pay before the statement cuts.

If they won't grow with you, then, yes, time to move on. What cards do you currently have? What's your spend like?

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

Amex Blue - $5000 limit

Discover IT - $10000 limit

Cap One (not closed yet) - $1000 limit

I use Amex for work related expenses and work pays the bill. It easily sees $1000 every month.

I use Discover to pay utilities and groceries in advance and pay it off bi weekly. I'd say they get about $600 a month. It's completely a cash exchange of things.

I'd just like to have a MC backup that has more than a grand so I don't find myself at a place not accepting either two above.

It happened at a hotel I stayed at and CapOne got declined because the hold plus stay was too large for the limit. I was able to get out of the jam with my secondary bank account and moved money from savings. But I'd really not like to have a hotel hold $1,000 for a week until after I check out.

Maybe I should just cool it with apps and not worry about it? I just hate the AF from CapOne and the fact I got stuck in a decline because the limit wasn't high enough (shame on me for not good planning too)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

@KneelBeforeZod wrote:

I have:

Amex Blue - $5000 limit

Discover IT - $10000 limit

Cap One (not closed yet) - $1000 limit

I use Amex for work related expenses and work pays the bill. It easily sees $1000 every month.

I use Discover to pay utilities and groceries in advance and pay it off bi weekly. I'd say they get about $600 a month. It's completely a cash exchange of things.

I'd just like to have a MC backup that has more than a grand so I don't find myself at a place not accepting either two above.

It happened at a hotel I stayed at and CapOne got declined because the hold plus stay was too large for the limit. I was able to get out of the jam with my secondary bank account and moved money from savings. But I'd really not like to have a hotel hold $1,000 for a week until after I check out.

Maybe I should just cool it with apps and not worry about it? I just hate the AF from CapOne and the fact I got stuck in a decline because the limit wasn't high enough (shame on me for not good planning too)

Since your TU score is good, Barclay could be a good move. Barclay Rewards MC does have 2% for utilities. Of course, there's always the Sallie Mae that everyone around here seems to love, for 5% groceries up to $250 spend.

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

Assuming you want Cash Back cards, I suggest the Fidelity American Express for 2% cash back on everything. Also Sallie Mae mastercard for the 5% Grocery store, 5% Gas Station, 5% Book store (amazon.com) capped at $250/$250/$750 per month. After 6 months apply for another Sallie Mae provided you need a bigger monthly cap and have been using the first one well.

Other than that, if there is a US Bank in your area, its never too soon to try getting a Cash+ card, sometimes it takes a while...

Those would make for a good basic set of cash back cards. You can always add a few more later if you choose. Especially if you have a Huntington bank or Citizens bank in your area.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

Depending on what you want, if you want cash back I could also consider US Bank Cash Plus where you get to pick your 5% and 2% categories. I agree that if they won't waive the AF then I would move on. I would however, keep the card until before the fee is due.

@KneelBeforeZod wrote:

Well...it seems that the EO didn't help out much with trying to get a CLI on my card. I contacted them due to the limit being low and haven't had a CLI in a while. They denied me again for "Card has already received limit increase recently". This was many months ago (more than 6). And they would not remove the AF either. They wanted to convert me to their QS1 product. I honestly think is spend more on the yearly fee than what I would get back for cash. AMEX and Discover have done such a better job with their rewards that cater to me personally for my needs.

Since I'm gardening only about a week, I'm wondering if I should app for one more card and reboot the garden for two years.

I was turned down a few years ago by Chase due to old baddies and I know they like to see reports squeaky clean. Not sure if I want to take the chance on wasting an inquiry.

Who should I try? I pay off every month:

1. Barclaycard

2. Citi

3. Other/suggestion

I've read a lot of good things about Barclaycard and helped a family friend sign up for one and they seemed great.

Any recommendations? The Barclaycard seems like it has decent point rewards - the APR is a stinker but I won't be carrying a balance of any magnitude and typically pay before the statement cuts.

Gardening Since 4/3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

@Themanwhocan wrote:Assuming you want Cash Back cards, I suggest the Fidelity American Express for 2% cash back on everything. Also Sallie Mae mastercard for the 5% Grocery store, 5% Gas Station, 5% Book store (amazon.com) capped at $250/$250/$750 per month. After 6 months apply for another Sallie Mae provided you need a bigger monthly cap and have been using the first one well.

Other than that, if there is a US Bank in your area, its never too soon to try getting a Cash+ card, sometimes it takes a while...

Those would make for a good basic set of cash back cards. You can always add a few more later if you choose. Especially if you have a Huntington bank or Citizens bank in your area.

Just looked over at Citizens Bank. A random chat message popped up, so I asked what their service footprint was. They operate under the Citizens Bank brand in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont, and the Charter One brand in Illinois, Michigan, and Ohio.

Their Cashback MC is incredible for the first 90 days, but very lackluster after that. I don't think I'd bite for that, even if I was in their footprint (I'm in SoCal)

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

Id go for Sallie Mae with Barclay and Fidelity would be great option!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Parting Ways with Capital One

@SunriseEarth wrote:

@Themanwhocan wrote:Assuming you want Cash Back cards, I suggest the Fidelity American Express for 2% cash back on everything. Also Sallie Mae mastercard for the 5% Grocery store, 5% Gas Station, 5% Book store (amazon.com) capped at $250/$250/$750 per month. After 6 months apply for another Sallie Mae provided you need a bigger monthly cap and have been using the first one well.

Other than that, if there is a US Bank in your area, its never too soon to try getting a Cash+ card, sometimes it takes a while...

Those would make for a good basic set of cash back cards. You can always add a few more later if you choose. Especially if you have a Huntington bank or Citizens bank in your area.

Just looked over at Citizens Bank. A random chat message popped up, so I asked what their service footprint was. They operate under the Citizens Bank brand in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont, and the Charter One brand in Illinois, Michigan, and Ohio.

Their Cashback MC is incredible for the first 90 days, but very lackluster after that. I don't think I'd bite for that, even if I was in their footprint (I'm in SoCal)

Its the Citizens Bank Green$ense card that interests me. If you can charge a lot of inexpensive transactions, that one can be quite valuable. It would become my CVS card ![]() CVS has become my convenience store.

CVS has become my convenience store.

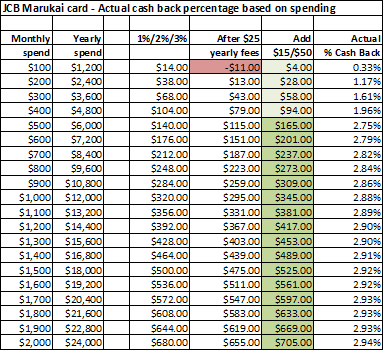

You're right though, it doesn't make sense in Southern California. You would probably want the Marukai JCB card.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800