- myFICO® Forums

- Types of Credit

- Credit Cards

- Question about meeting SUB spend requirements

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question about meeting SUB spend requirements

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about meeting SUB spend requirements

So I'm getting ready to pull the trigger on a pre-qual offer for a Chase Sapphire Preferred (thanks to this wonderful community helping me get my credit on track). That card has a 4K in 90 days SUB requirement. I could hit that no problem by paying my student loans and mortgage over the next 3 months... but of course, neither Wells Fargo nor my student loan holders accept credit card payments. I don't spend much on groceries or travel (certainly not enough to hit 4K in 90 days). Someone told me about this Plastiq website where you can pay them using your credit card and they will pay any bill for you for a 2.5% fee (this would wind up being $100). The math works out for me. If I do that, does anyone know if those transactions will count as "purchases" for the purposes of hitting the SUB requirement? Anyone on here ever done anything like that before successfully? Or have a better idea? Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

Plastiq = purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

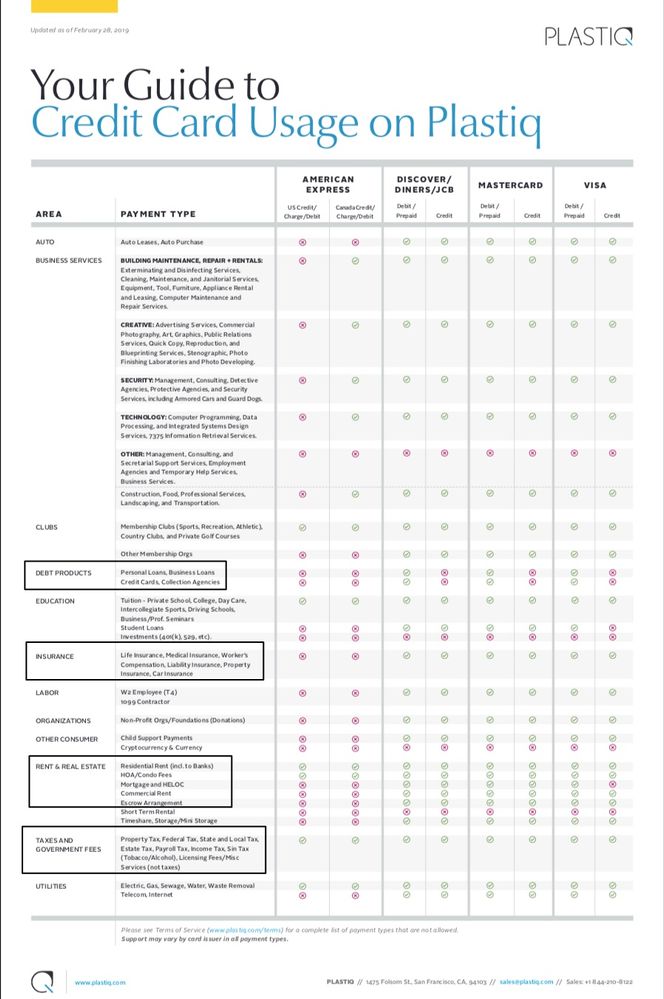

Unfortuntately, for the two payees in question, this may not work on the Visa network with Plastiq. Perhaps @Anonymous can leverage some clarity in the event there's been any recent changes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

The website says you can pay any bill though, so I guess I'm confused...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

@Anonymous wrote:The website says you can pay any bill though, so I guess I'm confused...

The tuition might work, the mortgage will likely not. Reference link below:

https://ficoforums.myfico.com/t5/Credit-Cards/Handy-Plastiq-Chart/m-p/5530982

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

^^^ This.

But be aware that Sapphire cards typically don't offer 0% APR on purchases so interest starts accumulating after the first month. Unless you plan to pay the large balance immediately, its wise to have a BT card where you can transfer the spend and pay off at your own pace.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

Thanks everyone! I totally forgot that I plan on buying a new car in the next 45 days, and I plan on putting 30K down. I can just put some of it on the CSP and pay that off immediately with the cash.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question about meeting SUB spend requirements

@Anonymous wrote:Thanks everyone! I totally forgot that I plan on buying a new car in the next 45 days, and I plan on putting 30K down. I can just put some of it on the CSP and pay that off immediately with the cash.

That's awesome. Put as large a deposit as possible on your CSP to get the UR points for the purchase in addition to meeting the SUB. Just make sure you call Chase to get the purchase authorized before going to the dealer. I met the SUB on my CSR by making a down payment on a new truck.