- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Question re: my AMEX Gold “limit”

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Question re: my AMEX Gold “limit”

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question re: my AMEX Gold “limit”

I’d love to hear your DP’s, opinions, thoughts, etc.

I was approved for the Bonvoy 8 months ago (CL $3,100). I was pre-approved for the gold and applied for that this wknd.

I was able to use the electronic card information right away and the physical card didn’t arrive until Wednesday. The paperwork with the card says that my POT amount is $15K. This is my first charge card so I thought that this meant that this if this is the maximum balance that I can revolve, I can charge this amount (because I have to spend it in order to carry the balance). I’m not sure if this is correct, it’s just what I thought.

I spent approximately $2,500 in about 10 minutes using the electronic card. I paid tuition, camp fees, and aftercare for the summer since school is already over. After charging this amount, I used the check my spending button the next daybto see if I could spend $1K on a bill. It was declined. I lowered the amount to $900 and that was also rejected.

I intend to pay half of my balance before the statement closes next month and then the other half by the due date.

I’m guess I’m just looking for more insight regarding the no preset spending limit and how it relates to the pot amount. I was surprised that the $1K was rejected since it wasn’t near the pot amount.

Sorry if this isn’t making much sense. I’m typing on my phone and I’m sleepy.

Thanks in advance for your help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

It's going to take a couple of cycles to figure out what your true limit is.

Charge cards work a bit differently. As you put money through them you build a history w/ AMEX. The computer evaluates your NPSL spending habits and approves per charge. As your pattern of spend goes up your limit goes up. Of course if you were to change something drastically on your CR's it would take that into account too in reducing your limit accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

My DP’s are as follows:

Approved at FICo 670’s

Amex CO just paid off, not reflected on credit yet.

9 inq

4 other CO accounts from 2016, all paid.

In rebuilding mode with the limits shown in my siggy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

When I was working on my Platinum SUB a few months ago, I had about $1k of various charges. I have a history with AMEX from 2013, going through a number of cards, adding high AF cards, and about a $50k overall limit on my revolvers.

I was trying to get a $7k tax payment made on the Platinum, and it kept rejecting. I called AMEX and the CSR told me the available limit was at about $9k total, but he upped it a bit more just in case. That still didn't work, so the issue was with the tax payment site. I ended up calling the tax payment site, and did the tax payment over the phone, which went through no problem.

The point being, if you really want to know the current limit, a CSR should be able to tell you. Over the course of time, as your charge / payment patterns become known, the NPSL situation may lift the available charges in any one monthly cycle. As it is, running up $2,500 in a few hours is probably pushing the envelope for a new charge card.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

@Anonymous wrote:

Hello Everyone,

I’d love to hear your DP’s, opinions, thoughts, etc.

I was approved for the Bonvoy 8 months ago (CL $3,100). I was pre-approved for the gold and applied for that this wknd.

I was able to use the electronic card information right away and the physical card didn’t arrive until Wednesday. The paperwork with the card says that my POT amount is $15K. This is my first charge card so I thought that this meant that this if this is the maximum balance that I can revolve, I can charge this amount (because I have to spend it in order to carry the balance). I’m not sure if this is correct, it’s just what I thought.

I spent approximately $2,500 in about 10 minutes using the electronic card. I paid tuition, camp fees, and aftercare for the summer since school is already over. After charging this amount, I used the check my spending button the next daybto see if I could spend $1K on a bill. It was declined. I lowered the amount to $900 and that was also rejected.

I intend to pay half of my balance before the statement closes next month and then the other half by the due date.

I’m guess I’m just looking for more insight regarding the no preset spending limit and how it relates to the pot amount. I was surprised that the $1K was rejected since it wasn’t near the pot amount.

Sorry if this isn’t making much sense. I’m typing on my phone and I’m sleepy.

Thanks in advance for your help.

Right now AmX doesn’t know you or your good intentions; but what they see is a new card holder who is spending, spending, spending in 10 minutes. So, IMO, if you push a large payment before the due date and another large payment on the due date, AmX will also see a card holder who can also pay off big spends.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

@Anonymous wrote:

Hello Everyone,

I’d love to hear your DP’s, opinions, thoughts, etc.

I was approved for the Bonvoy 8 months ago (CL $3,100). I was pre-approved for the gold and applied for that this wknd.

I was able to use the electronic card information right away and the physical card didn’t arrive until Wednesday. The paperwork with the card says that my POT amount is $15K. This is my first charge card so I thought that this meant that this if this is the maximum balance that I can revolve, I can charge this amount (because I have to spend it in order to carry the balance). I’m not sure if this is correct, it’s just what I thought.

I spent approximately $2,500 in about 10 minutes using the electronic card. I paid tuition, camp fees, and aftercare for the summer since school is already over. After charging this amount, I used the check my spending button the next daybto see if I could spend $1K on a bill. It was declined. I lowered the amount to $900 and that was also rejected.

I intend to pay half of my balance before the statement closes next month and then the other half by the due date.

I’m guess I’m just looking for more insight regarding the no preset spending limit and how it relates to the pot amount. I was surprised that the $1K was rejected since it wasn’t near the pot amount.

Sorry if this isn’t making much sense. I’m typing on my phone and I’m sleepy.

Thanks in advance for your help.

You spooked them. Assuming your only other card with them is that Bonvoy, you basically matched that limit in 10 min. Long term, the gold will grant you more month to month spending power than you’ll ever realistically need, but probably not in the first 10 min. They want to see that you’re going to pay regularly first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

At the risk of sounding like a broken record, the POT limit doesn't have much to do with your spending limit.

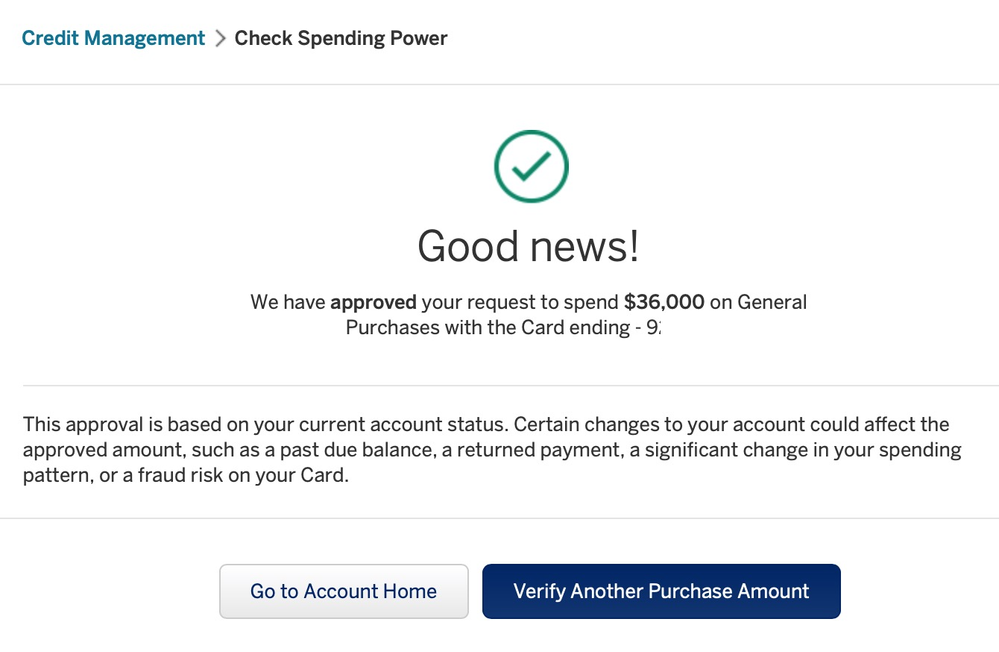

I'm a light user of my Gold card, and they have assigned me a POT limit of $35k yet when I check the 'Spending Power" tool it indicates I would be approved for a purchase up to $4500 (which for my spend level and profile is usually more than adequate):

While in theory I should be allowed to revolve up to $35k via Pay Over Time (POT), I'm sure they would cut me off well before I got to that point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

I'm approved for the same $35K, and I'm not sure what my spending limit is, but I just checked and they're fine with $36,000. I've had the card since Sept. 2018 and the highest balance was $5,000.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Question re: my AMEX Gold “limit”

@UncleB wrote:At the risk of sounding like a broken record, the POT limit doesn't have much to do with your spending limit.

I'm a light user of my Gold card, and they have assigned me a POT limit of $35k yet when I check the 'Spending Power" tool it indicates I would be approved for a purchase up to $4500 (which for my spend level and profile is usually more than adequate):

While in theory I should be allowed to revolve up to $35k via Pay Over Time (POT), I'm sure they would cut me off well before I got to that point.

+1

Well said and spot on

Total Revolving Limits $254,800