- myFICO® Forums

- Types of Credit

- Credit Cards

- Questions about the BBVA ClearPoints credit card.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Questions about the BBVA ClearPoints credit card.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@TyRacing wrote:what are the maintenance and business categories good for?

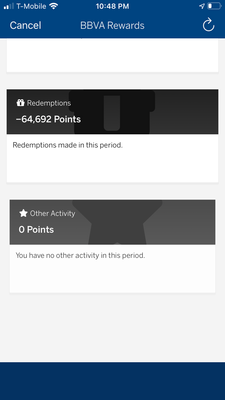

I've never used those categories. 3% Utilities, bills, tv/internet, cell phone bill, and car insurance is what we use it for. We also use it for the targeted 5 - 7% bonus offers and 10% simple cash offers they have at times. We've earned $646 on this card from Dec last year until now.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

Wow, that's crazy bro! I need to start putting my spend on that card then!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@TheBoondockswrote:

Wow, that's crazy bro! I need to start putting my spend on that card then!

The bill and utilities category pretty awesome. I have the AOD card now which is flat 3%, but I left all utility spend on the BBVA card in hope of them continuing to send the targeted offers. I've earned quite a bit of cash back through targeted offers in combination with the 3% on bills.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@JNA1 wrote:

@TheBoondockswrote:

Wow, that's crazy bro! I need to start putting my spend on that card then!

The bill and utilities category pretty awesome. I have the AOD card now which is flat 3%, but I left all utility spend on the BBVA card in hope of them continuing to send the targeted offers. I've earned quite a bit of cash back through targeted offers in combination with the 3% on bills.

The thing is when it comes to finally choose the categories, do you wait until you get targeted and then choose it or do you wait until the last minute and if you don't get targeted then you just choose the categories that you know you're gonna spend money at?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

What do you think you're going to do with the BBVA card, and paypal 2% credit card now that you have the AOD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

I leave the 3% category on bills and utilities. I have all my bills on autopay and they charge the card and I pay it off every month. I always leave 2% category set on groceries and when I get the targeted offers, the points on top of whatever the card is already earning. IOW, if the targeted off is 4X for groceries, I'd get 6%. If it was 4X gas or restaurants, I'd get the 4X on top of the base 1%.

Because it seems like I get the targeted offers because of spend, I'm going to leave my the 3% utilities spend on the ClearPoints card, and use my AOD card for all other non categorized spend. I made my daughter an AU on my PayPal card and she's running $300-$400 month through it and making the PIF payment. I'm letting her keep the rewards and it's (hopefully) keeping me in good graces with Sync.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@JNA1 wrote:

@TheBoondockswrote:

Wow, that's crazy bro! I need to start putting my spend on that card then!

The bill and utilities category pretty awesome. I have the AOD card now which is flat 3%, but I left all utility spend on the BBVA card in hope of them continuing to send the targeted offers. I've earned quite a bit of cash back through targeted offers in combination with the 3% on bills.

Just got my card 👏👏🤩👏👏 I am so excited to start seeing emails like this!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@PandaGirl77 wrote:

@JNA1 wrote:

@TheBoondockswrote:

Wow, that's crazy bro! I need to start putting my spend on that card then!

The bill and utilities category pretty awesome. I have the AOD card now which is flat 3%, but I left all utility spend on the BBVA card in hope of them continuing to send the targeted offers. I've earned quite a bit of cash back through targeted offers in combination with the 3% on bills.

Just got my card 👏👏🤩👏👏 I am so excited to start seeing emails like this!

It took a few months to get the targeted offers rolling on both of our cards, but now we both get them frequently.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@JNA1It took a few months to get the targeted offers rolling on both of our cards, but now we both get them frequently.

where do you check for the targeted offers? in the BBVA app? Email? or website login dashboard? or all?

Thanks for sharing!

Have the Following:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

CashBack Cards Goals: Citi Rewards+

Status: Doing my Homework before I App

Note to Self: Focus on the Abundance of Love and you shall have more!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Questions about the BBVA ClearPoints credit card.

@TyRacing wrote:

@JNA1It took a few months to get the targeted offers rolling on both of our cards, but now we both get them frequently.

where do you check for the targeted offers? in the BBVA app? Email? or website login dashboard? or all?

Thanks for sharing!

They come via email.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards: