- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Quicksilver => Venture X

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Quicksilver => Venture X

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Quicksilver => Venture X

Hi guys, I am considering product changing my QS for the Venture X but have some concerns. Firstly, I have a lot of HP, maybe 11 last one being July 22 but none since. I saw somewhere that for Venture X CapOne is sensitive to inquiries so I wanted to get yall to weigh in on my changes of doing a product change to it instead of new app. Second concern is my QS has a CL of 500. I have been bucketed since I opened this card and have never been able to get a CLI. All other cards at at least 1000 CI, max being 12k CI. More info on signature. TYIA!

- Total Revolving Limits $24,100

Gross Income - ~$70,000

4 Settled CO. Paid for settlement in January 2020~

(Update: December 2022):

AAoA - 2 Years 2 Months

Oldest Card: Discover IT - 2 Year 2 Month

Youngest Card: American Express Gold - Opened February 2023

Current FICO 8 scores:

Experian: 700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

I'd be cautious. If you have an upgrade available it will be listed in your account and there would be no underwriting. Otherwise plan on three hard pulls. The Visa. Infinite card has a minimum credit line and based on your profile I think going from $500 to $10K is reaching.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

Good afternoon @onepeace25 !

I've never had an HP for product changing a Capital One card. Of course as soon as I say that it will have been their policy all along. My thought is that your credit limit is the bigger barrier. The Venture X is a Visa Infinite card and has a minimum credit limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

Thanks for the response! I have tried in the past getting a higher limit on this card, but have been denied everytime. I also have a savor one card that I use more frequently with a 1000 CL. Should I continue to try to get a CLI on QA (pretty sure im bucketed)? I've also considered just closing this QS since I no longer use it (Citi Double cash is my catch all) and later applying for venture x (or sooner)

- Total Revolving Limits $24,100

Gross Income - ~$70,000

4 Settled CO. Paid for settlement in January 2020~

(Update: December 2022):

AAoA - 2 Years 2 Months

Oldest Card: Discover IT - 2 Year 2 Month

Youngest Card: American Express Gold - Opened February 2023

Current FICO 8 scores:

Experian: 700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

@onepeace25 wrote:Hi guys, I am considering product changing my QS for the Venture X but have some concerns. Firstly, I have a lot of HP, maybe 11 last one being July 22 but none since. I saw somewhere that for Venture X CapOne is sensitive to inquiries so I wanted to get yall to weigh in on my changes of doing a product change to it instead of new app. Second concern is my QS has a CL of 500. I have been bucketed since I opened this card and have never been able to get a CLI. All other cards at at least 1000 CI, max being 12k CI. More info on signature. TYIA!

are you being offered a product change?

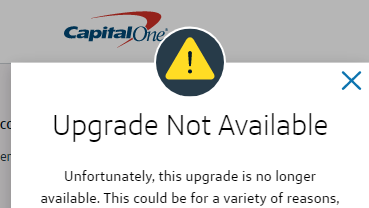

add /productupgrade to the end of the link for your QS account on desktop to see if they are willing to PC your QS to anything. It checks, and there's no HP for looking or accepting a PC from that screen. If you do it right, you'l see a list of options or this:

Considering it has a 500 CL, I highly, highly doubt they're going to offer you a venture x PC.

You would probably have to do a new app if you wanted one.

3/6, 5/12, 14/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

I'm not sure PCs to a VX are even an option to be honest. I don't know that I've heard of any. But even if they are, as others have said, the minimum SL on a VX is $10k, so your QS would definitely not qualify based on that alone. And if it's bucketed, I don't think it'll *ever* reach $10k.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

This is why its best to move on:

4 Settled CO. Paid for settlement in January 2020~

(Update: July 2022):

AAoA - 2 Years 2 Months

Oldest Card: Discover IT - 1 Year 8 Months

Youngest Card: Affinity FCU Cash Rewards - Opened July 29, 2022

Current FICO 8 scores:

Transunion: 694

From your siggy. You'll need a thick clean older file and hardly any inq's. 11 is a bit too much. The CO's need to fall off. And your oldest card is the one that's still reporting even if its one of the CO's. Keep on rebuilding. Cant grab the top spot just yet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

@OmarGB9 wrote:I'm not sure PCs to a VX are even an option to be honest. I don't know that I've heard of any. But even if they are, as others have said, the minimum SL on a VX is $10k, so your QS would definitely not qualify based on that alone. And if it's bucketed, I don't think it'll *ever* reach $10k.

Yes, PCs to Venture X are an option for select cardholders, much the same way when PC'ing from QS>Venture or viceversa, for example. However, in the OP's case, that would be unlikely based on the type of account + CL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quicksilver => Venture X

@onepeace25 I agree with others seems bit of a reach, you can however do a "tippy-toe" test by doing the Cap1 prequal site. If you see all Venture card options along with all the "excellent/good credit cards on the page" on your prequalification then that could be a good sign. Possibly even Credit Karma could also give a warm-fuzzy (but don't rely on CK either), it's just for pulse rating. However, YMMV - if you decide to eat the 3x HPs for the exploration.