- myFICO® Forums

- Types of Credit

- Credit Cards

- Reward Structure of new Williams Sonoma card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reward Structure of new Williams Sonoma card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reward Structure of new Williams Sonoma card

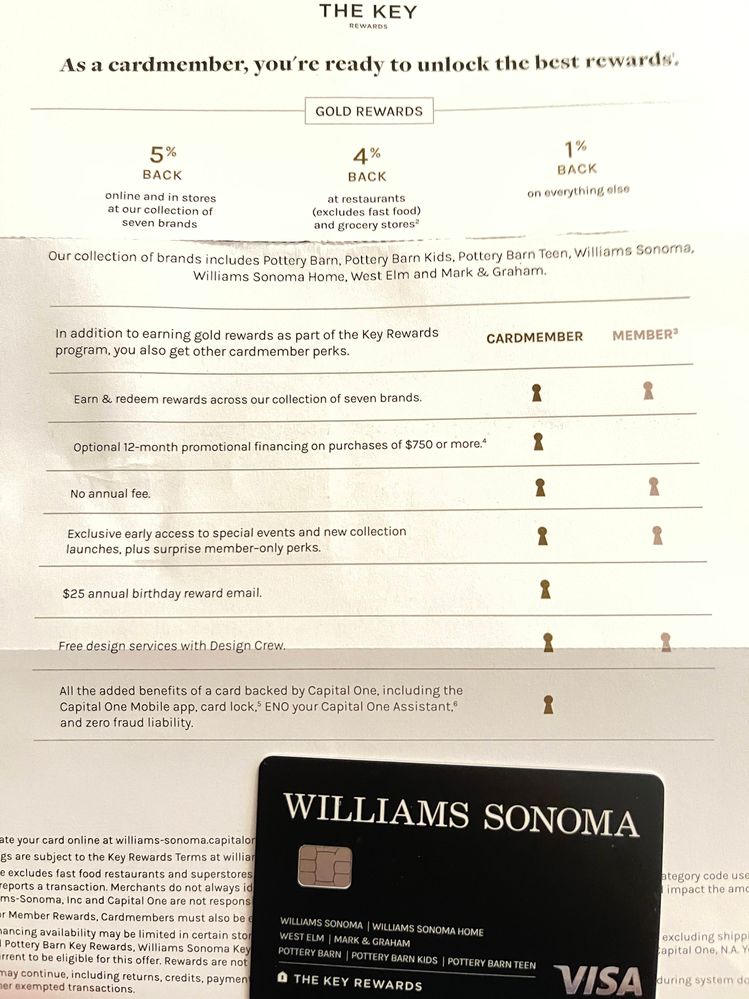

I just received my new Cap1 Wiliams Sonoma Visa. It was a visa before the comenity-->capital one switch, so nothing new there. CL still $1000 despite my best efforts with Comenity. However, i noted a new reward structure (see pic). If you are looking for a good restaurant/take out (but not fast food!) card, this is offering 4% back (it used to be 2%). And 5% cash back on WS purchases (and west elm etc..). Still trying to figure out if I will get these same rewards from the store versions of the PB and west elm cards i have, that have larger CLs, like will I get 5% back using my west elm card at west elm, or do i have to use my WS card??

I just thought I'd share this new reward structure, which looks far better than what was offered previously on this card (and may give Savor a run for its money)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

4% on groceries is kind of a big deal. only citi custom cash with 5% cash back but with a quarterly max spending limit would beat it in some scenarios. What does the asterisk at the end of the 4% on groceries sentence say? Are there any annual/quarterly spending limits to the 4% on groceries?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

@batsy71 wrote:4% on groceries is kind of a big deal. only citi custom cash with 5% cash back but with a quarterly max spending limit would beat it in some scenarios. What does the asterisk at the end of the 4% on groceries sentence say? Are there any annual/quarterly spending limits to the 4% on groceries?

Amex Blue Cash Preferred is 6%, but it has an annual fee. Amex Gold is 4MRs/dollar, which may or may not be better than 4% depending how you use them, but again, it has an annual fee. Amex Blue Cash Everyday is 3%. So yes, this is an interesting option.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

@KJinNC wrote:

@batsy71 wrote:4% on groceries is kind of a big deal. only citi custom cash with 5% cash back but with a quarterly max spending limit would beat it in some scenarios. What does the asterisk at the end of the 4% on groceries sentence say? Are there any annual/quarterly spending limits to the 4% on groceries?

Amex Blue Cash Preferred is 6%, but it has an annual fee. Amex Gold is 4MRs/dollar, which may or may not be better than 4% depending how you use them, but again, it has an annual fee. Amex Blue Cash Everyday is 3%. So yes, this is an interesting option.

Certainly seems interesting, a little like the Verizon card, unusually good rewards outside of the co-brand. So, now I wonder if it is more like that! "Earn and redeem rewards across our seven brands" Could rewards not be pure cash back

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

@batsy71 you can't use the grocery 4% for places like Costco and Walmart, nor at gas stations that sell food.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

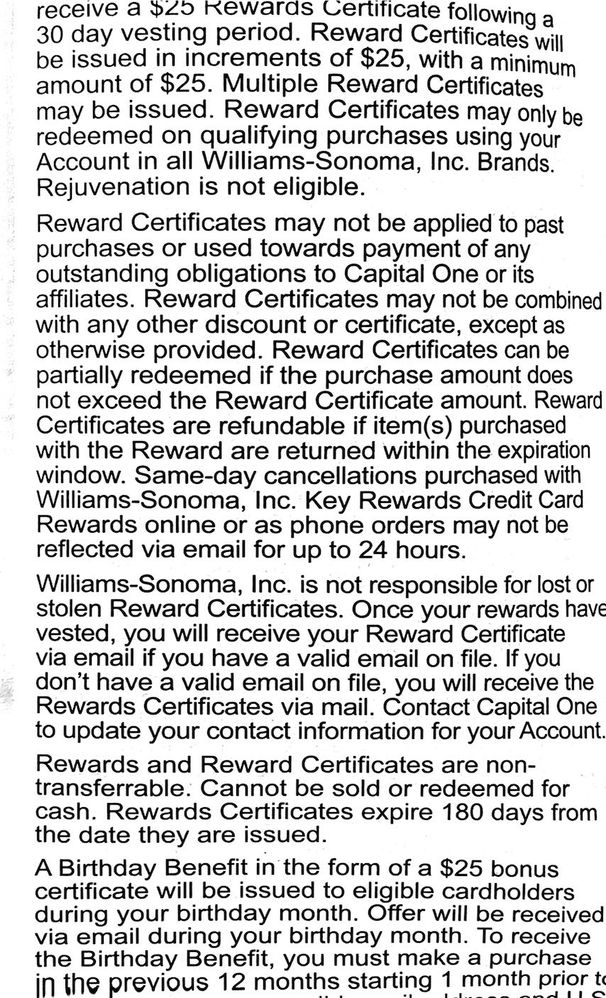

@longtimelurker rewards are divvied out in $25 increments (you can't cash in $10 for example) and seem to be offered after a vesting period of 30 days.

also: you don't get cash back, you get rewards dollars, "certificates" for use in Williams Sonoma stores. Not sure how it works if I can earn rewards across all 7 brands but can only get certificates to shop at one brand?

i think this severely limits the interest in using this card for "cash back" lol

@batsy71 No caps on the rewards that I can see

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reward Structure of new Williams Sonoma card

Maybe you can use WS gift cards at related brands or stores?

This does reduce the card's appeal, unless you are a dedicated WS shopper (or a dedicated shopper of one of the other brands, if you can use the rewards on those as well).

I'd say not worth getting unless you fit that description.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan