- myFICO® Forums

- Types of Credit

- Credit Cards

- Seeking advice! AMEX Gold usage don’t justifies $2...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

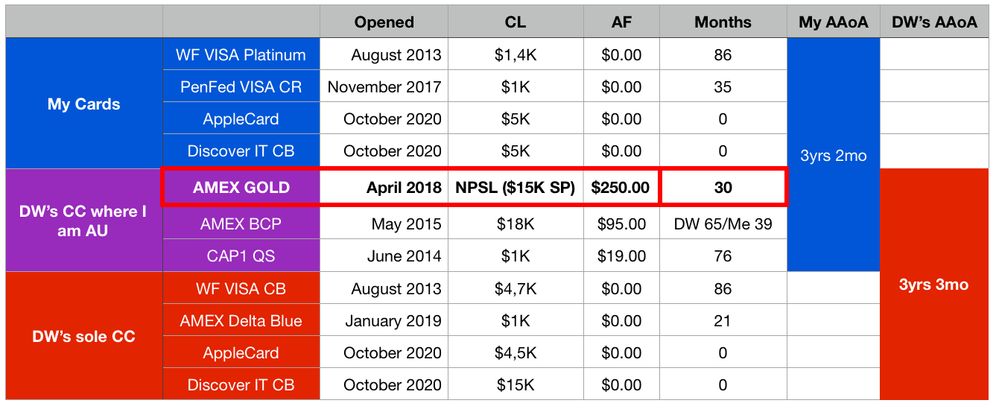

DW got app'd for the Amex Gold NPSL on Apr 2018 after researching SUBs within AMEX products.

She got approved, we used the SUB to purchase a fridge for our new house in July 2019, and then it got pushed as a fall back for the AMEX BCP.

We heavily use the BCP in all of its CB categories, and often reach the $6k in supermarket purchases for its 6% CB. We would use the Gold for the remaining of the year with 4x MR on supermarkets, and sporadic eat-outs.

However, we both just got approved for the Discover IT with 5% CB on supermarkets, one quarter per year. Basically substituting the Gold as a fallback for the BCP, with a better return on rewards.

There is no value left on the Amex Gold that could justify its $250 AF.

Now, the options are:

- Cancel it, which would actually help both of our AAoA (me: from 3yrs-2mo, to 3yrs-3mo / DW: from 3yrs-3mo, to 3yrs-5mo if I didn't miscalculated. Please, correct me if I did).

- Request a downgrade (if there is such option available from AMEX) to a no-AF revolver, (((if, and big IF))) AMEX backdates the new card's age to the Gold's age. This will leave us in the same place in terms of AAoA, but it will increase our CL ceiling for whatever amount approved. And, it would help in agg util, even if its a bit, given that the Gold does not help one bit being NPSL.

- A third option may be a downgrade, and accept the card with a new age, just because I do not know if closing the Gold could damage our relationship with AMEX.

Now, who has been in this situation, what did you ended up doing, and how did it turned out?

To those who have not been in this situation, but have the technical knowledge, what would you advice?

Is there anything else I am missing?

Big thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@CreditBones wrote:

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

Just to chime in here to be safe because of the language used. You'll have to apply for the Everyday card and be approved to have the MR rewards "stored" on there first before you close your Gold card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@simplynoir wrote:

@CreditBones wrote:

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

Just to chime in here to be safe because of the language used. You'll have to apply for the Everyday card and be approved to have the MR rewards "stored" on there first before you close your Gold card

Yes, basically charge cards can be only upgraded/downgraded to other charge cards, all of which have some (non-trivial) AF. The point about the ED is that it is free way to store MRs, but, as @simplynoir says, you would have to apply for it, and if you only have 6.5K MR, this is not worthwhile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@longtimelurker wrote:

@simplynoir wrote:

@CreditBones wrote:

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

Just to chime in here to be safe because of the language used. You'll have to apply for the Everyday card and be approved to have the MR rewards "stored" on there first before you close your Gold card

Yes, basically charge cards can be only upgraded/downgraded to other charge cards, all of which have some (non-trivial) AF. The point about the ED is that it is free way to store MRs, but, as @simplynoir says, you would have to apply for it, and if you only have 6.5K MR, this is not worthwhile.

If they can manage to snag the SUB with it then I think it can be worth that if they decide to push forward. Shame OP doesn't have his own AMEX card because I would have recommended he use a referral link for his DW to get the card to make it an easier decision

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@simplynoir wrote:

@CreditBones wrote:

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

Just to chime in here to be safe because of the language used. You'll have to apply for the Everyday card and be approved to have the MR rewards "stored" on there first before you close your Gold card

We have no interest on storing the current MR, even less if it will require a HP.

I would still prefer a SP on DW's file when downgrading.

Thank you for bringing that point up, because the question my wife has to ask to the AMEX CSR now should be "I am thinking of closing my AMEX Gold. Do you have any offer on a no-AF product, that wont require a HP, that could substitute my AMEX Gold, in order to avoid closing it for lack of use?"... or something along those lines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@CreditBones wrote:

@simplynoir wrote:

@CreditBones wrote:

@Anonymous wrote:The age of your accounts are the same regardless of closed/open status, so it won't help or hurt you to close it

You should've/could've asked for retention offers each year/renewal date. You can still ask now, but you'd lock yourself in for another year or have the offer clawed back.

There's no cheaper/free downgrade besides a $150/year Green card. To hold MRs, there's the free ED/BBP, the BBP is a hidden tradeline, the ED is not.

Down/upgrades don't affect account age since it's the same account, just with different benefits

Very valuable information!

We currently have 6,5k MR. We are planning on a $50 HomeDepot Gift Card with 5k MR, and redeem the remaining 1,5k MR for $10.xx bill credit.

ED sounds like a good downgrade. Thanks for your input!

Just to chime in here to be safe because of the language used. You'll have to apply for the Everyday card and be approved to have the MR rewards "stored" on there first before you close your Gold card

We have no interest on storing the current MR, even less if it will require a HP.

I would still prefer a SP on DW's file when downgrading.

Thank you for bringing that point up, because the question my wife has to ask to the AMEX CSR now should be "I am thinking of closing my AMEX Gold. Do you have any offer on a no-AF product, that wont require a HP, that could substitute my AMEX Gold, in order to avoid closing it for lack of use?"... or something along those lines.

PCs don't involve a HP.

Your problem is that Amex cards can only be PCed to a few other cards within the same "family" of cards. For example, Delta cards can only be PCed to other Delta cards.

There are ZERO cards within Gold's family without an annual fee. You can only PC to other cards that have some sort of annual fee.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

@CreditBones wrote:Thank you for bringing that point up, because the question my wife has to ask to the AMEX CSR now should be "I am thinking of closing my AMEX Gold. Do you have any offer on a no-AF product, that wont require a HP, that could substitute my AMEX Gold, in order to avoid closing it for lack of use?"... or something along those lines.

Your DW might as well try to seek a retention offer that might off-set the AF because what you and her are going to ask for is impossible as several people have already explained. That or close the card so the DW doesn't have to worry about it anymore since card will report up to 10 yrs after closure

Good luck on whichever route you two decide on

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice! AMEX Gold usage don’t justifies $250 AF anymore.

OP, your options with the card are close it, keep it, downgrade it to Green, or upgrade it to Platinum. There are no other options, and none require any type of credit pull.

If you can't justify keeping the card, and based on the redemptions you have mentioned, I would suggest closing the card and not pursuing any other Amex cards earning Membership Rewards.