- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Should I close one of several smaller limits c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I close one of several smaller limits cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I close one of several smaller limits cards?

Hello, I currently have 3 capital one cards ( 2 personal and 1 business) the quicksilver is 700$ platinum is 600 and the business spark is 700$. I also have a credit one that has limit of 950$. I revolt was approved for an Achieva CU card for 3000 limit. The credit one and capital one cards are all around 2-3 years old and everything is paid off. I recently asked for increases but since they increased within last 6 months I was denied. I also asked cap one if they could merge my two personal cards for a larger limit but they said they couldn't. My question is this, should I continue to pay annual fee for credit one card, and keep all 3 cap one cards or should I start closing 1 or 2 of them in hopes that they may be more lenient for an increase. I don't use all 5 cards and really just want 2 or 3 but don't want to damage my open revolving trade lines. Any input is appreciated my scores are all around 650 which is about 100+ improvement from where they were 12 months ago. Also have auto loan with cap one for new vehicle at 10% interest. I'll make my 12th payment in June and my credit union said that they could refinance after 12 month history ( since it was my first loan other than student) any advice is greatly appreciated. I'm 28 and basically ruined my credit in early 20s but am now rebuilding. I want to get to the 760-800 score. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

Are you looking for new cards? Having multiple cards only helps your age of accounts and total overall utilization. Without knowing too much about your situation, if I was you, I would app for the new cards I want before I close the old ones. I don't know what's valuable to you, so I'll stop short of recommending any cards. I would definitely try to get rid of any card with a fee that I'm not getting a reward from. I would look into cash back cards with no annual fee, and once I get one of those, I would close that Credit One account. But maybe you don't want cash back. Maybe you're into traveling. Maybe you just want a discount at Lowe's. I'm not sure what you're looking for....

Set a goal for yourself. Tell us what it is. And we can help you get there. If you simply just want to increase your credit scores, keep paying your bills on time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

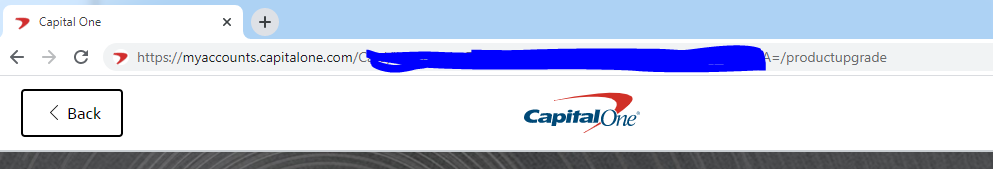

@Hutchman92 Is it a QuicksilverOne or Quicksilver? If it's a QuicksilverOne, try to product upgrade that to a non AF. Also, while you're at it, you can see if you can product change the Platinum to a better card. From what I'm seeing, these cards that you have are starter cards with no room for CLI. To get higher ceilings, you have to switch to a different product. To get the backdoor access to a product chage, log into your Capital One account. Click on any of the cards, and at the address bar at the top add "/productupgrade" and it will let you know if there's a hidden product upgrade available. The terms of the card won't change, the limit won't change, but it will have a higher ceiling for CLI's. Of course, rinse and repeat on the other card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

Congrats on the $3k line...moving up!

Without knowing more, I would say to close the credit one acct (there are cards worth paying a fee for, but they usually aren't from credit one) and keep the cap 1s. Decide whether you like the quicksilver or spark better and concentrate spending on that card. Don't carry a balance, just spend and pay. Cap 1 seems to focus on usage when deciding whether to approve limit increases. Try cap 1 again in 6 months or so, and take it from there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

Credit One should be closed the second you can get near a phone. It has done its job. Continue to check your online account for a few months as they will definitely add interest/fees after the fact. Just pay them and move on. If they offer to waive the fees, let it stay on for another year. Congratulations on your progress.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

@Hutchman92 wrote:Hello, I currently have 3 capital one cards ( 2 personal and 1 business) the quicksilver is 700$ platinum is 600 and the business spark is 700$. I also have a credit one that has limit of 950$. I revolt was approved for an Achieva CU card for 3000 limit. The credit one and capital one cards are all around 2-3 years old and everything is paid off. I recently asked for increases but since they increased within last 6 months I was denied. I also asked cap one if they could merge my two personal cards for a larger limit but they said they couldn't. My question is this, should I continue to pay annual fee for credit one card, and keep all 3 cap one cards or should I start closing 1 or 2 of them in hopes that they may be more lenient for an increase. I don't use all 5 cards and really just want 2 or 3 but don't want to damage my open revolving trade lines. Any input is appreciated my scores are all around 650 which is about 100+ improvement from where they were 12 months ago. Also have auto loan with cap one for new vehicle at 10% interest. I'll make my 12th payment in June and my credit union said that they could refinance after 12 month history ( since it was my first loan other than student) any advice is greatly appreciated. I'm 28 and basically ruined my credit in early 20s but am now rebuilding. I want to get to the 760-800 score. Thank you.

I recently closed my Credit One because I got tired of paying them a monthly fee for a card I never ever used. I was willing to take any credit drop in doing so for a useless card I never used. I have plenty other cards and my limit with them was only about $1000 but I already have 3 Navy cards totalling over 70K so a $1000 in credit limit total is a drop in the bucket.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close one of several smaller limits cards?

Thank you for the information. Strangely I haven't heard that explaination before about the wrong products. I've attempted to do the /productupgrade but unsure of where to put on address bar. If I type in address bar it takes me back to google, if I type in the search query under specific card nothing is found and if I keep my account.capitalone.com/card/productupgrade nothing shows up. Please advise. I believe I'm not eligible. In which case should I close some of my cards?? Again all revolving debt I have is cap one plat 700$ cap one quicksilverONE 700 cap1spark 700 credit one 950$ Achieva credit $3000 care credit $3000 and all balance are 0 or 1%. I just want to get out of the financial slavery and be able to breath again. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cap 1 Credit Card Bucketing: When to Close?

Hello, I have the following cards and age of cards:

Cap one plat : 2 years increase by a big $100 every 6 months when requested now 600 limit denies for additional increase due to lack of activity

cap one QS One: same as above two years and now 700$ limit. Denied for any more due to recent credit limit increase

cap one spark: business card but under personal SS# currently 2 years old and 700$ limit

credit one : 2 years old $950 limit started at $700 denied for increase

acheiva CU: 3 months $3000 no fee plus rewards

care credit : 1 and half years $3500

discover : auth user $2500 2 years

ive recently been reading into the bucketing and I believe that's what happened. I'm stuck in these subprime cards. Is it time to close them out and just keep my $3000 card and try and get another larger limit or should I stick it out with these tiny limit cards that I don't use. Score are 656-660-662 i was recently denied by discover a few months ago. Not sure why I think I just spur of the moment inquires. Will it help me to close cards and then apply for larger limit card or should I apply now while I still have these cards? I just can't help but wondering if a lender was looking at sees credit one subprime card and small cap one cards maybe that isn't helping my case for 3000+ limits. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 Credit Card Bucketing: When to Close?

@Hutchman92 when you log into your Capital One, click on any of the cards and just add /productupgrade to the URL. Don't replace the actual URL with just that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 Credit Card Bucketing: When to Close?

Holy smokes! I upgrade my platinum to quicksilver! What are the benefits of this change? Will I be eligible for higher increases? I also tried to upgrade my quicksilver One card but it wouldn't allow it.