- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Should I get the Venture or the SPG card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I get the Venture or the SPG card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I get the Venture or the SPG card?

But the reason why I’m interested in the Venture is because they have pretty good point redemptions on your average hotels for domestic travel stays (I’m not planning on traveling internationally for the next 3-4 years). Though the SPG does have the annual free night just by keeping the card.

I’m debating because my salary is about 30k, unmarried. Both have the same annual fee. Also, I know the ventures waived for the first year. It has to be a keeper card as well. So I’m asking if either card is better for my budget point redemption and cost of hotel nights for future vacations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

@Anonymous wrote:

So I’m debating on wether or not I should get the cards listed in the title to keep as my “hotel” keeper card. I currently have a Amex BCE for groceries, Chase Freedom for categories, Capital One unsecured platinum(upgrading to quicksilver). I’m planning on applying for the freedom unlimited in 3 months for everyday spend and the sapphire preferred about 3-5 months after the unlimited for travel/airline transfers.

But the reason why I’m interested in the Venture is because they have pretty good point redemptions on your average hotels for domestic travel stays (I’m not planning on traveling internationally for the next 3-4 years). Though the SPG does have the annual free night just by keeping the card.

I’m debating because my salary is about 30k, unmarried. Both have the same annual fee. Also, I know the ventures waived for the first year. It has to be a keeper card as well. So I’m asking if either card is better for my budget point redemption and cost of hotel nights for future vacations.

Do you stay at marriott properties when you travel or you just stay wherever? How many nights are you really booking into hotels in a year?

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

Neither if the intent is these are keepers.

Your current income leads me to question what your annual spend will be on all these cards. You are building out a Chase Trifecta and once you have that the Freedom Unlimited is going to be your Everything Else card, with a return close to 2%. The CSP should have the ability to book your hotel stays for using points benefits that way.

SPG only earns two points, and you will find it challenging to find affordable hotels with a 1cpp redemption rate. The free night is very nice to have, but it is only one night a year. If you want to spend two or three nights in the same place as a mini vacation, you will need either 35,000 points each night or $200 to $300 cash each night. To have the 35,000 points times two available, you have to spend $35,000 on the card each year. In the case of the SPG, the free night is a very nice reward for the AF. It also gets you a bit of status if you stay at Marriott/SPG a few times a year for work travel.

The Venture earns a straight 2% on spend, but it has an AF of $95. A plain 1.5% Quicksilver has better earnings, because you have to spend about $7,000 on the Venture just to earn out of the $95 AF. QS can be “redeemed” on more types of charges than Venture.

You may decide you want to apply for each, get the SUB and enjoy the cards for a year or two, set up the TSA Precheck from Venture, but long term I suspect you will find they are diluting your Chase UR points gathering. The Venture in particular is a difficult card to justify. There is nothing wrong with getting the cards for this purpose, to see how they work for you, I am just suggesting you don’t tell yourself they are keepers until you have a chance to measure the real value of the rewards.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

@Anonymous wrote:

Thanks for the detailed reply. I think I’m gonna stick with the CSP for hotel redemptions too. Even if reviewers say that it’s point redemption on hotel is subpar compared to its travel redemptions. Reason why I would’ve wanted a dedicated hotel card was because I wanted to get the most out of my points ( or the best bang for my buck). When I reserve hotel stays while I’m on vacations. Typically I would stay in locations within the US for about two nights or three days. But ideally, it would be a 7 day trip.

You get 2 UR on those stays, regardless of brand. A co-brand hotel card accelerates earnings only on that brand, which is nice if you use that brand a lot.

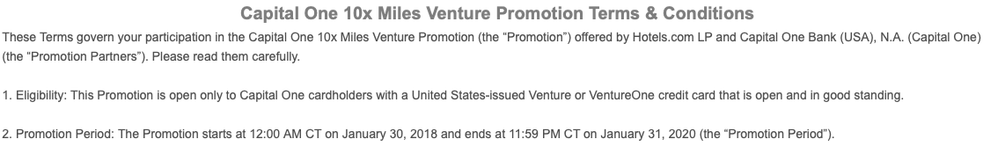

After Venture drops the 10x on Hotels dot com later this year, it reverts to 2% everywhere earnings.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

With that being said, SPG is more of a keeper card than the Venture given the annual free night. It’s easy to get a 200$+ hotel for 35k points. Venture only makes sense long term if you can make use of its transfer partners. Both cards definitely make sense at least for the 1st year.

I have both the SPG/Venture and my SPG has been SD since hitting SUB. I only keep the SPG for the free night. I will PC the Venture to the Venture One if my AF isn’t waived. However, I am currently using the Venture as my non category spend card until then.

When it comes to booking hotel stays, I use Venture for hotels.com and Premier for other hotels (even if I do have the co-branded card). My spend would never net me any meaningful hotel points so I’ll rather put those on my Premier.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

It doesn't sound like either of these would be keeper cards for you. You can get the cards for the SUB or whatever but beyond the signups I don't see AF cards working for you.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

Don’t get either of these cards. Build your travel portfolio around Chase. Your income is too low to diversify.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I get the Venture or the SPG card?

If you're not traveling or staying Marriott properties a lot then the SPG card is not very useful at all. I also don't care much for the Venture (even with their announcement of airline partners). Like it has been mentioned, it will take some spend on the Venture to match the $95 annual fee.

As for their 10x at Hotels.com, that's nice as long as the promo is running but just a quick check shows that the promo ends in about a year meaning unless something is renewed then no more love via that route. With that you've mentioned I don't believe either of these cards with benefit you that much.