- myFICO® Forums

- Types of Credit

- Credit Cards

- Should I pay before the due date?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I pay before the due date?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

@Anonymous wrote:

I hadn't considered that. So I guess that it will only show up that I charged that much IF the card reports at around a time that i have actually that much charged, can it not report before the closing date?

I just got approved for the barclays and did a BT which i was then advised on this board ot be careful with so in light of what you had said I guess I hadn't thought about that. Its not like im looking to get any loans now or apply for more credit so I guess for the next 6 months my score wont matter much.

I had been keeping my BOA at $0 by doing that and you are right, my CR showed the $0 the whole time and I was pleased with the low Utli but I guess since this is a new card, maybe going your route for a while might be more advisable!

This is why I love these forums, im learning so much and its nice to get different perspective on things. This particular account says my next payment due date will be 12/19, so I guess it will sit there for a bit, it currenlty doesnt state my closing date yet.

Most banks will report what is on your statement, because they report a few days after the statement. The exception is US Bank, who reports all accounts as of the end of the calendar month a few days after the month end, regardless of statement date. My 3 US Bank cards all report same day, each month end.

Barclays seems to be more likely to not like balance changes, although this is only from reports that are posted here. There is no certainty that balance fluctuations will cause Barclays or any other lender to directly panic, but it is possible. I let all my cards always report balances, and even with actual balances and $25k of total open balances, the scores are 757 - 773 right now. My scores would be higher if I had lower utilization, and it is true that one gets a slightly better score if all but one card reports zero, I just don't think it's enough points to be worth the effort. If you allow cards that were reporting zero to start reporting balances, you could try to track those changes in score, and let us know in the Understanding FICO Scoring forum.

If your next payment due date is 12/19, then I would guess your next statement closing date will be around November 22-23.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

I second the opinion that you should let your balances report on your statement. It seems like all of the people who experience CLD or AA for having a high balance are the 0% min/maxers. I'm sure there are others, but I don't recall any at the moment. I also think that it is much less effort to have everything autopay.

I've only had autopay not trigger once, and that may have been my fault by not paying attention to whether it activated for the first month or not. I found the CSR to be reasonable in reversing the late charge. If it is a one-time event, it isn't worth it for them to risk losing a customer over something like autopay not triggering (or being set up correctly), when the CCC can see that it is set up and should have gone through. I noticed it because one of my statements didn't show the payment for the previous month and I called right away, because I didn't want to be 30 days late.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

@Anonymous wrote:The way I do it might sound weird for some people but it works for me. I make a payment twice in each card, every statement period. I pay at the beginning, more than the amount due. The 2nd payment is a week before the due date and I pay the full amount unless the 0%apr introductory still applies.

Reason why I do this.

1st payment is for my comfort level, I dont have to worry about being late or forgetting to pay.

The 2nd payment is to keep my utilization low.

I couldn't have said it better, my sentiments exactly! Wow brilliant minds think alike, lol!👏🏼👏🏼👏🏼👏🏼👏🏼👏🏼

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

I do auto-pay, but most auto-pays I see are default on the due date. Does anyone know if this ok?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

@Anonymous wrote:I do auto-pay, but most auto-pays I see are default on the due date. Does anyone know if this ok?

It is OK, however my experience is that most Autopayments give you options to select earlier days. The days that are available to select for AMEX, for example, end well before the Due Date of the payment, in other words you cannot select an AMEX Autopayment for the Due Date.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

@Anonymous wrote:Does it really matter if I let the charges on my CC sit thru to the date the accoutn closes and pay right after or can I pay as I charge. Is it frowned upon to pay down the card even tho it hasnt closed for the month?

Example: I just got my Chase IHG card and I need to do the 1000k spen so i just paid all my bills through it and a couple of charges while I was out today. The CL is ok its not like i'm goign to ru out before the bill closes but since normally I would have just used my debit card, the money is sitting in my bank account. Is it better to just hold that money till the bill is actually due or can I just pay once the charges post (they are pending since they are all from today). Wasn't really sure if one way was bad as opposed to the other or if they frown upon this too much, so figured i'd ask. I typicall tend to just wait but like I said, money is there and just want to take care of it. (ok yes i have zero patience lol)

I gather your question is really whether to pay before the statement cuts... and the answer is yes. Pay everything down to zero as fast as you can.

It will only help your credit limit increases, because each bank is looking at its internal numbers and knows what your average and high balances are internally. They know how much you are running through your account (and consequently how much revenue they are making from you), and they appreciate your paying it down fast.

And it will help your credit scores, because those are based on how low your utilization percentage is based on reported balances... and the lower the better.

There are many who say that you get a few extra points by keeping 1 account reporting more than zero balance but less than 9%; but I haven't found that to be the case.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

I don't stress paying before the cut date until i'm about to apply for credit. I keep my spend on a few cards each month and knock it down if it's greater than 30% on a single card that cycle. I think it creates a "regular spend" for me and doesn't panic my lenders when i need to spend some $$$.

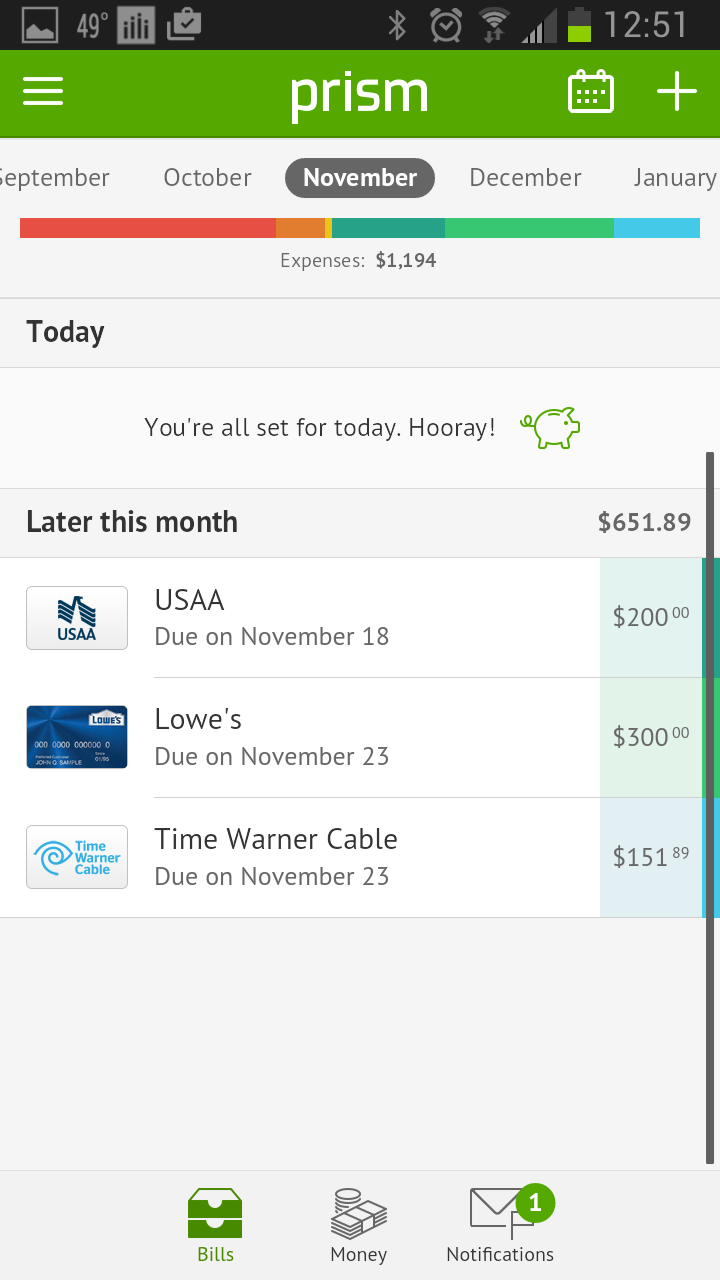

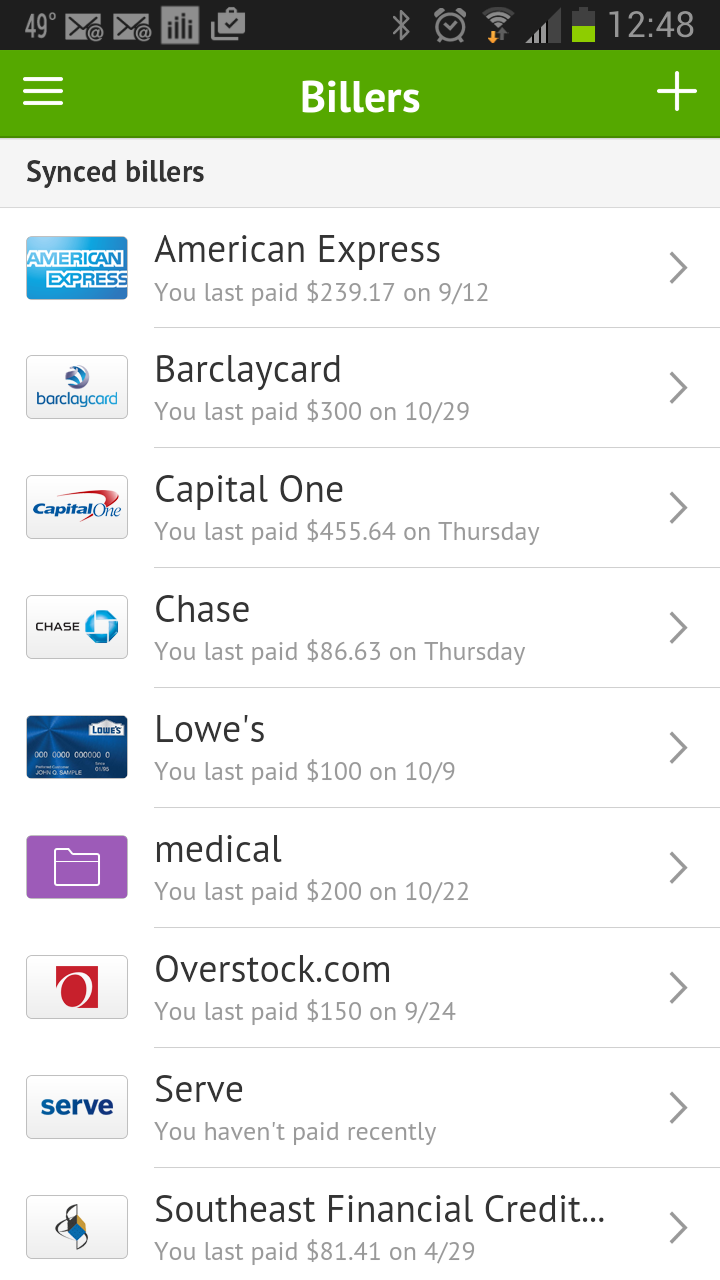

This is a simple task each month with today's apps (I use prism to monitor and pay, I use an app i wrote for budget)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

I think I will just let it post the first couple months and then start paying right away, I mean im in no rush with the credit scores so it wouold be only fo rmy own sanity to keep everythign down, but since its a new card I think i will let it report a balance and then go from there.

The prism app looks cool but I am not adding another thing to my life! LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

I personally don't get the sentiment of this thread (and I guess the board in general). I pay my bills on their due date (with a few exceptions like my SL). That's when the lender/biller says that it's due, and that's when they get their money. Back when I had CCs, my scores were great and I never saw any AA/CLD (hell I didn't even know what these terms meant until I came to this board), so I'm not sure why members feel that it's necessary to pay before the due date. And I certainly don't understand the desire of so many on the board to have all but one card reporting 0. I understand that some have been raised to hate debt, but IMO, you're losing one of the benefits of having CCs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I pay before the due date?

@SouthJamaica wrote:

There are many who say that you get a few extra points by keeping 1 account reporting more than zero balance but less than 9%; but I haven't found that to be the case.

If you are saying that you can let all revolving credit cards report zero balances at the same time and NOT see a score decline, I would like to see your results when all cards report zero at the same time. Many others in the Understanding FICO forum have other things to say about their experience when they paid everything off. Namely, Big declines in score.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765