- myFICO® Forums

- Types of Credit

- Credit Cards

- Shut down by comenity for adding ONE visa

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Shut down by comenity for adding ONE visa

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

Ever since I joined this forum, people have been trashing Comenity for the way it treats cardholders, yet people still apply for their cards. Why?

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

I believe it was a combination of BK in 2011 and co-branded card. If they took a risk with you they would at least like for their partners to make some money.

You could have charged on the card at any store, not just the store whose name was on the card. Comenity needs to start looking out more for their business partners.

As for me, I once had 12 Comenity cards while 3 were co-branded. They never shut me down. I got rid of 10 of their cards, including Camping World Visa.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

I have 2 Comenity store cards and the Williams Sonoma Visa. All three were apped within a 1 week span and this was back in Oct. All three have grown, knock on wood.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

I agree that 2 inquiries is a lame reason to shut all your cards down. Synchrony handles it a lot better. At least you get a chance to keep the accounts open via their infamous blue envelopes. Comenity just reacts and that’s the end of it. In the long run maybe you’re better off, OP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

I only recently started reading the forum, but for me Comenity was the first creditor to give me the time of day with a thin credit file. With FICOs in the middle 700s and no negatives, I got turned down by Discover and a couple of others before Comenity gave me a MC which got the ball rolling for me. I've had nothing but positive experiences with them thus far, but I worry about how often I read posts where AA was taken for mixing store credit with Comenity MCs/Visas.

I'm not one to look my nose down on them, I appreciate their willingness to take a chance on me and even with my Penfed Cash Rewards and US Bank Cash+ cards, I still prefer my Ulta MC from Comenity. If you shop at Ulta and know how to work their rewards system, the card nets a lot of value. Not knocking them, just concerned.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

@UpperNwGuy wrote:Ever since I joined this forum, people have been trashing Comenity for the way it treats cardholders, yet people still apply for their cards. Why?

Because they are easy to get when you are rebuilding and they grow pretty quickly. Most everyone who has been shut down has gotten their visa/mastercard product after having store cards. I have 3 of their store cards and haven't had any issues. I got the J Crew and Pottery Barn to over 6k limits before I got bored with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

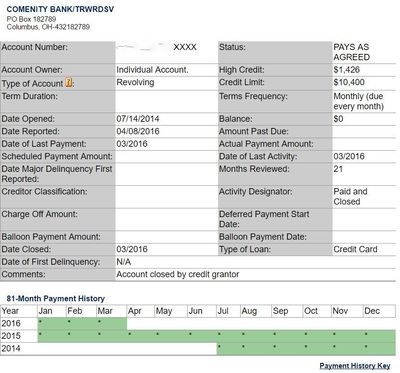

This was my one and only open account with Comenity (see picture) I have accounts will most all major lenders have not missed an on-time paying to any accounts since 2004-05 when my business closed, yet AFTER Comenity approved me for an APR rate reduction, they closed a perfect record account. No other lender follow suit nor has any lender AA'd me since 2005.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shut down by comenity for adding ONE visa

@AverageJoesCredit wrote:

No clue, just keep eye on your accounts. Paypal credit may soon become Synchrony so thatll be one less Comenity to worry about

That's a good thing, because I still need to get around to calling to have Comenity finish shutting down my old Bill Me Later account as I've been interested for a while in possibly applying for the Paypal Mastercard down the line and I can't do that until the records are cleaned up. (That being said, I'm much more interested in the Marvel MC because of its good rewards on bookstore purchases.) I only have one Comenity card - Overstock - and I see no reason to change that.