- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: So this happened.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

So this happened.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So this happened.

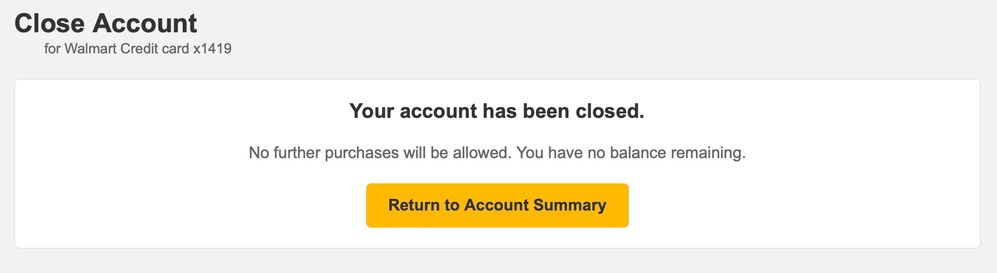

I had forgotten to pay my balance and was about 10 days past due. I got the late fee, but they also CLD'd me from $6,000 to $330.

So I paid it off, told them they turned me off to any synch product ever (which is pretty true), and closed it out. ¯\_(ツ)_/¯ The lower limit already reported so what's the harm at this point, right?

Total Rev: $182,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

Edit: I see. On mobile and Walmart was tiny.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

This is typically what SYNCB would do [CLD] whenever late payments or NSF instances happen from several posts on these boards. From reading the OP, there didn't seem to be any system glitches or a SYNCB issue, correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

There’s plenty of other banks better than Sync, you probably won’t even notice they are gone in a year.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

@jl4 wrote:

I had forgotten to pay my balance and was about 10 days past due. I got the late fee, but they also CLD'd me from $6,000 to $330.

So I paid it off, told them they turned me off to any synch product ever (which is pretty true), and closed it out. ¯\_(ツ)_/¯ The lower limit already reported so what's the harm at this point, right?

Closing it was certainly your prerogative, but had you left it open the credit line most likely would have eventually bounced back.

Years ago my Lowe's card was CLD to just over $570, and it now sits at $20k and is my oldest credit card.

If you didn't have any use for it anyway closing it was the right move, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

Sorry that happened! You seem to have a good attitude about it though lol

Amex Cash Magnet: 18k

Fidelity Visa: 16.5k

Apple Card: 4.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

The easiest way to prevent this is use that nifty thing called auto pay. It will save you a lot of headaches and heartaches. 😉

At least set it for the minimum balance. $10 missed payment can cost a 7 year ding. Just not worth it IMHO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

@Gmood1 wrote:

In all honesty, it's tough to blame them for our mistakes. Capital One, Chase and many others would have closed it for you. Not CLD'd after no payment 10 days out.

The easiest way to prevent this is use that nifty thing called auto pay. It will save you a lot of headaches and heartaches. 😉

At least set it for the minimum balance. $10 missed payment can cost a 7 year ding. Just not worth it IMHO.

+1 trillion. This is something I constantly preach to everybody. You can set multiple reminders and make multiple payments, but having auto-pay is sort of a backup system. The risk is, the day you forget or put it off, is the day you may miss the payment due date. IMHO, it's not worth taking the risk. Set the MP or if you know what your balance is every month, set a consistent payment or just set it to pay the statement balance, something is better then nothing. I rather pay an MP then get a late payment. Most of us make multiple payments so, there's no harm in making an MP and another payment. I don't know why people still don't use auto-pay.

Scores - All bureaus 770 +

TCL - Est. $410K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: So this happened.

I never understand why people respond emotionally to a lenders action that was caused by improper financial management by the user. You never know when a lender will suddenly show up with 'the next big thing' or at least with something that could financially benefit you in the future, so writing them off due to failing to meet your obligation seems a bit excessive.

And yeah, it's Synch, but we read these sorts of posts about most all lenders. You made a mistake and seem to think that your decision causes them some sort of heartache while they're just greatful that a red flag just removed itself from their books.