- myFICO® Forums

- Types of Credit

- Credit Cards

- Someone school me on the Paypal 2% card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Someone school me on the Paypal 2% card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@Anonymous wrote:

@Jnbmom wrote:

I was hoping to be able to grow this card however recently found out I have 100K with synchrony and they denied a recent CLI for my Walmart card which sits at 10K. They wanted me to reduce another synchrony account by 14K in order to give me 1OK CLI on the walmart card. ( I would be losing 4K and umm NO ), so i kept my walmart at 10K.

What is that $100k exposure with Synchrony if expressed as a percentage against your income? It sounds to me like they definitely allow quite a bit of exposure relative to income, as evidenced by Saeren's 87.4% reference above.

Sync doesn't seem to be very concerned about total exposure... there are plenty of people far beyond 100% exposure. That's probably why Sync is so quick to take AA when your profile changes. Other lenders may take a few months to decide that you're too risky, Sync will slash all of your accounts at the first sign of trouble. I started my relationship with Sync in December with an $1800 Amazon Store Card, turned around less than two weeks later in January and got the $8K PayPal, then early last month I applied for the B&H Payboo, put in a $400 purchase request and they gave me a $5K limit and the Amazon card has grown to $3K from two CLIs, both of which I just didn't ask for enough and left money on the table.

The PayPal card has tossed out plenty of <$1K approvals as well. I've seen $300, $500, and $700 figures pretty regularly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

I can't edit posts right now because of iOS beta issues but to answer your question about what they pull, they pulled TU for Amazon and PayPal, EX for B&H, they also SP'd EQ for my PayPal approval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@Anonymous wrote:All I know is that it's 2% CB on everything with no redemption restrictions and that it's through Synchrony. What else is good to know about this card, or is that about it?

Some things I'd like to know are:

1 - What is the typical SL range that we see on this card / what is the highest SLs?

2 - Growth potential? What are the highest CLs we've seen this card go to?

3 - Are there CLI restrictions like X months between requests, or is it like some other Synchrony cards where you can request a CLI right after approval and significantly bump up your limit? (Lowe's always comes to mind for me).

4 - Those with multiple Synchrony cards, any idea what sort of total exposure they may allow relative to income?

5 - Promos/Perks? I've read a couple of threads recently about targeted offers, like 5% CB for up to $75. Are promos/perks common or is that a relatively rare thing with this card?

Thanks for any feedback in advance. I've been reading through approval threads and trying to find info on this card, but I'm just getting bits and pieces here and there with no threads being all inclusive to what I'm looking for.

1. I don't think there's a typical SL. I've seen them all over the place from like $200 to $15k. I started at $10k

2. After the $10k SL, I got denied multiple times for CLIs during the first 6 months. Then I learned that the majority of approvals over $10k required a call to Credit Solutions. I wish I'd bothered to search to avoid the hassle and gazillion denials. I called after a luv button denial and asked for $25k and got it approved. However, I do remember asking one member and he said he got bumped to $20k or $25k using the luv button.

3. Unsure about CLI restrictions as I've only got one from $10k to $25k, and I don't need more. This card does seem to be much more restrictive than Lowe's. I needed to increase the limit because I was running up to 80%+ UTIL some months.

Actually, I just remembered I hit the luv button once to go from $25k to $30k and got denied.

4. Only got 3 cards with SYNCB. I'm at $75k exposure with them. Not sure how much more I can get, but they don't have any other card I'm interested in getting at the moment.

5. Never received a SUB or promo offer. Ever. And I've put a good amount of spend on it. Mostly when they used to have the 3% combo/loophole with the business debit card. At least $4k to over $8k some months. Majority through Plastiq. I kinda stopped using the card when the combo died.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@FireMedic1 wrote:

I'll follow this also. Approved in April. Took almost 2 months to finally post a statement. SL 7200. 3 and a half years post BK. Pulled TU @740. CB showed at statment date like Disco does. Website is clunky thru PP. Mobile app is nothing to write home about. But hey its 2% CB. Thats the selling point. I believe @Jnbmom has some great DP's your looking for @Anonymous

I was approved 6/19 with a 750 TU score, Temp SL $200, real limit $800, which was a bit of a let down. Card arrived this past Saturday 6/29. I was going to call credit solutions when the card arrived to try & up my limit, but decided to hold off until my 4th statement when a increase becomes available (or I hopefully get an auto increase) to see if I could get a decent increase from them. I like using the card so far, but haven't used it for online purchases as Disco has that taken care of for the next 3 months with 5% back on Paypal.

But I have question statement though, so far I have no min payment due, & since I use the Paypal app no due date either. I had to click on make payment & it took me to the Sync site to find out my payment due date which is July 12 (I'm assuming the 12 of every month is my official due date) Right now I have $40 in charges posted, so if it goes take as long as 2 months to see my statement, is it best to pay the current balance down to 0 by the 12th because I don't want to risk missing my first payment or will the min payment be generated in a few more days? Also how soon does payments report to the CRAs after the due date?

Cap One QS: $4811

CFU: $8,000

PPMC: $12,000

US Bank Cash+: $13,000

Penfed Powercash Rewards: $7,500

AAOA: 3.5 yrs

Experian (Fico 8) 756

Transunion (Fico 8) 757

Equifax (Fico 8) 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@Anonymous wrote:Great feedback thus far and thank you to everyone that's replied.

So interesting in looking at the tiny sample size contained in this thread, but it seems there were 3-4 people with $8000 SLs and two with $15,000 SLs with nothing in between. Those with the $8k SLs seemed to have scores averaging 745 or so, give or take. Those with the $15k SLs (LTL and TB I believe) can you guys provide any data such as your scores at the time you were approved?

I think just about all of my questions from the original post have been answered thus far, other than perhaps someone chiming in with the highest limit they've seen this card capable of?

Also, does Synchrony still use TU Fico 8 the majority of the time for account apps? I believe that's what they used on me for Lowe's.

Been between 830-850 for a decade. Currently 850 for several months, but I don't remember exact score when applied.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@imaximous wrote:

Then I learned that the majority of approvals over $10k required a call to Credit Solutions. I wish I'd bothered to search to avoid the hassle and gazillion denials. I called after a luv button denial and asked for $25k and got it approved. However, I do remember asking one member and he said he got bumped to $20k or $25k using the luv button.

Thanks for the reply. Your CLI from $10k to $25k didn't require a HP, correct? Also I saw you said you don't use the card much any longer since the death of the 2% + 1% loophole. Out of curiousity, what do you use for your general spend (non-category) card now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@Anonymous wrote:

@imaximous wrote:

Then I learned that the majority of approvals over $10k required a call to Credit Solutions. I wish I'd bothered to search to avoid the hassle and gazillion denials. I called after a luv button denial and asked for $25k and got it approved. However, I do remember asking one member and he said he got bumped to $20k or $25k using the luv button.

Thanks for the reply. Your CLI from $10k to $25k didn't require a HP, correct? Also I saw you said you don't use the card much any longer since the death of the 2% + 1% loophole. Out of curiousity, what do you use for your general spend (non-category) card now?

No HP. Just like every other SYNCB acccount. I never would’ve requested a CLI so many times if they’d HPed me for every denial. HPs don’t bother me, but more than 10 would’ve been pretty demoralizing 😅

To be clear, I used the combo mostly for things that I couldn’t use a credit card for, so all my spend was through Plastiq. It wasn’t really my general spend card. I used it for mortgages, car payments, verizon bills that required auto-pay with a debit card for discount, kids tuition/activities, etc.

My general spend card has been the USB Altitude Reserve for about the past year and a half. I get 4.5% with mobile wallet. If I can’t use the AR, then lately, I pick between BBP or BofA PR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@Anonymous wrote:

@frugal47374 wrote:

I had a targeted e-mail offering $50 statement credit after spending $1000 in 90 days.

Were you targeted with that email before applying for the card, or was it something they targeted you with after getting it?

Targeted before applying. The bonus was only if I applied from the link in the e-mail.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

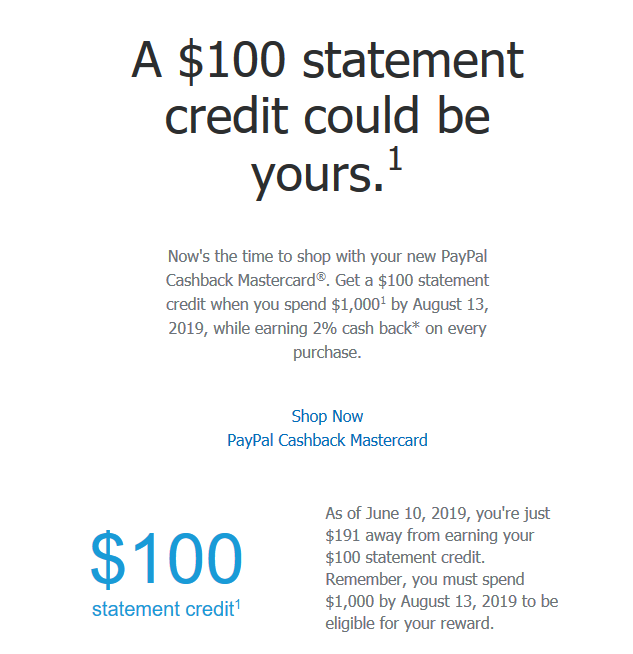

I had a $100 SUB via email invite.

The 2% cash back has to go to your PayPal account and cannot be used as statement credit.

Living through Darwinism is so much worse than learning about about it in school.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone school me on the Paypal 2% card

@mikesonthemend wrote:

The 2% cash back has to go to your PayPal account and cannot be used as statement credit.

Really? That's kind of a bummer. While I have a Paypal account, I don't think I've used it since 2017.