- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Sometimes the churner does the burning...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sometimes the churner does the burning...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sometimes the churner does the burning...

...other times, the churner gets burned

Opened a Chase Business Checking for the promo. They said I was pre-approved for all INK CC. Sure, why not, what's another inquiry. App'd. Under review. Call up, they need EIN IRS form. I send it over. I follow up everyday, before it finally lands with a UW. Took over a week for verification/documents dept. Called status line. Still 30 days. Next day, boom, 7-10 days. Yup, declined. Looks like it went to FR not an UW and they did a deep dive into my history since they dropped me entirely and closed my other Chase CC's. Slight bumber since one of them was a couple years old with a decent SL. But neither of them had usage from being churned. Email got blown up with documents saying declined and something about a previous chargeoff... over 10 years ago with the recession. Weird.

So one of my churned CC's 0% finally ended and they didn't do an auto CLI, so I closed it.

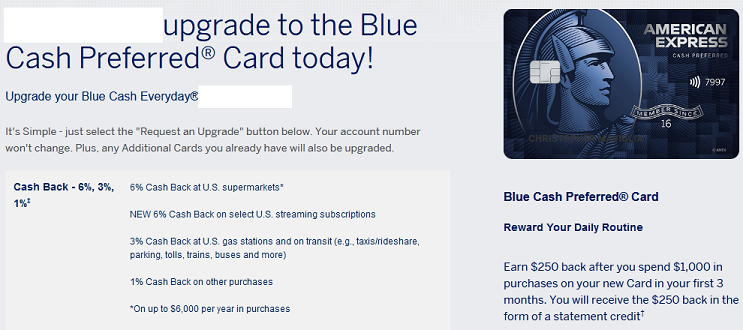

Log in to AMEX and come to find them soliciting me to upgrade my card, looks like it's just a few weeks shy from my anniversary. May consider in near future.

And finally, I come across an old email from Penfed wanted me to expand my relationship with them. So I roll the dice again and apply for the Pathfinder. Call up to this am to follow up, sure enough, approved for $15K @ 17.99%, decent SL but high APR. I also should have done more research on what the value of the points are though; 25K on $2,500 spend. But no AF and they are offering $100 annual travel credit + $100 PreCheck credit as well. If the points are worth less than a penny, it'll be churned. No DP other than still "excessive inquiries" and "too many cards opened within 24 months"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

Did your Chaae bank account get closed too?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

Maybe I’m reading your post wrong, but are you saying they closed all your Chase accounts after the FR? It also sounds like you closed that FU yourself, and they just reviewed your past accounts with Chase that were closed a long time ago, and that was the reason for the denial of your Ink card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

@FinStar wrote:

The Chase AA is not surprising. Ouchies for sure. So, how many CCs did you have with Chase that were closed as a result of the AA?

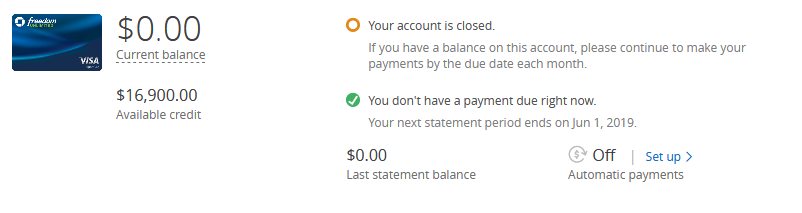

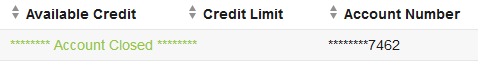

What does AA stand for? It was 1 INK and 1 FU (pictured). Only "ouchie" will be closed by creditor on CR, other than that, no real loss as it was not a DD, it was literally at the bottom of the drawer collecting dust since the 1.5% is nothing compared to other cards lately.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

@longtimelurker wrote:Did your Chaae bank account get closed too?

I thought so too, but they said just the CC's. Guess I'll find out when I do my 5 transactions on debit for the SUB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

@Anonymous wrote:...other times, the churner gets burned

Opened a Chase Business Checking for the promo. They said I was pre-approved for all INK CC. Sure, why not, what's another inquiry. App'd. Under review. Call up, they need EIN IRS form. I send it over. I follow up everyday, before it finally lands with a UW. Took over a week for verification/documents dept. Called status line. Still 30 days. Next day, boom, 7-10 days. Yup, declined. Looks like it went to FR not an UW and they did a deep dive into my history since they dropped me entirely and closed my other Chase CC's. Slight bumber since one of them was a couple years old with a decent SL. But neither of them had usage from being churned. Email got blown up with documents saying declined and something about a previous chargeoff... over 10 years ago with the recession. Weird.

So one of my churned CC's 0% finally ended and they didn't do an auto CLI, so I closed it.

Log in to AMEX and come to find them soliciting me to upgrade my card, looks like it's just a few weeks shy from my anniversary. May consider in near future.

And finally, I come across an old email from Penfed wanted me to expand my relationship with them. So I roll the dice again and apply for the Pathfinder. Call up to this am to follow up, sure enough, approved for $15K @ 17.99%, decent SL but high APR. I also should have done more research on what the value of the points are though; 25K on $2,500 spend. But no AF and they are offering $100 annual travel credit + $100 PreCheck credit as well. If the points are worth less than a penny, it'll be churned. No DP other than still "excessive inquiries" and "too many cards opened within 24 months"

One of the reason I don’t do business with Chase. I still have their checking account but I will be closing it in 5 months so I can keep the $600 bonus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

@imaximous wrote:Maybe I’m reading your post wrong, but are you saying they closed all your Chase accounts after the FR? It also sounds like you closed that FU yourself, and they just reviewed your past accounts with Chase that were closed a long time ago, and that was the reason for the denial of your Ink card.

Nope, they closed the FU, INK, and declined the pre-approved in branch app all on the same day. When I called they said there's a 12 year old charge off. Here's the verbage:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sometimes the churner does the burning...

Did you burn chase in the past or possibly a bank that they purchased such as WAMU, Providian, etc? Strange, but it does happen. Sorry to hear