- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Strategizing my next move

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strategizing my next move

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategizing my next move

Congrats on the $7500 w/ a TU pull!

Treat it right and put some spend on it to grow it!! -- my example was 12-18 months of what I call minimal use but consistent use to keep the computer happy with the requests... doesn't take much but activity counts when asking for more spending ability.

If you list out more of your cards we can do a deep dive on them to see where the fat can be trimmed and optimized a bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategizing my next move

@Anonymous wrote:Congrats on the $7500 w/ a TU pull!

Treat it right and put some spend on it to grow it!! -- my example was 12-18 months of what I call minimal use but consistent use to keep the computer happy with the requests... doesn't take much but activity counts when asking for more spending ability.

If you list out more of your cards we can do a deep dive on them to see where the fat can be trimmed and optimized a bit.

Thanks for the feedback. Will give it some daily use over the next 3 months and see how it goes.

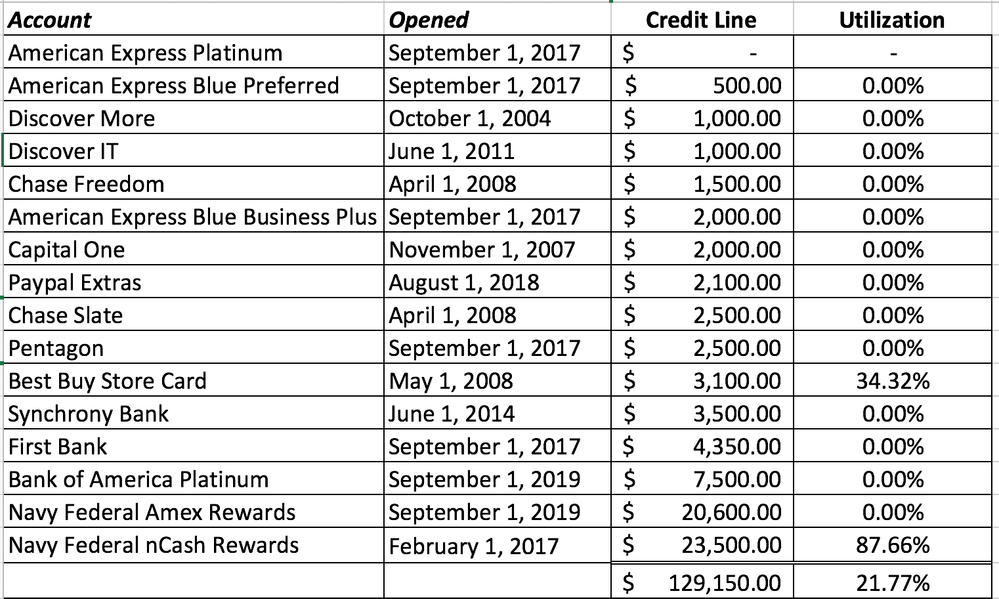

Here is my card profile as of today:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategizing my next move

@Anonymous wrote:Thanks for the feedback. Will give it some daily use over the next 3 months and see how it goes. I wouldn't say daily unless there's incentive to do so like Disco Miles 3% first year... Just needs to be active every month if you want to grow it quickly every 90 days if they remove the flag from your account of course w/ consistent use.

Ok...

Amex.... do you use the Platinum benefits enough to offest the AF? If not, close it or downgrade at least to Gold if you eat out a bit for less than 1/2 the AF Is there any overlap in benefits w/ BBP??

Disco.... we know

Chase... Slate is useless after the initial perk of $0/0%... Either swap it for a CFU for 1.5% or if you're thinking about another Chase card it could be that card w/o a bonus or combine them into a single card..

PP EX.... not familiar but, unless it's really providing some value....

PF - HP CLI's usually... kind of a 50/50 split on opinion around here depending on who you ask about keeping a card with them

BBSC - good for a discount but, with premium cards in your pocket you might offset them with offers unless you're using it for extended financing on appliances or something...

Sync... older card but.... where can you use it and what benefit is it providing?

FB... gussing this is FNBO co-brand for somewhere?

NFCU.... combine them unless they're offering a hidden value by having 2 accounts... this will give you your mega CL to bring the other up to though not all will see them as an equal for lending since they give out CL's like candy... but it's a start to showing you can manage a 50K CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategizing my next move

@Anonymous wrote:

@Anonymous wrote:Thanks for the feedback. Will give it some daily use over the next 3 months and see how it goes. I wouldn't say daily unless there's incentive to do so like Disco Miles 3% first year... Just needs to be active every month if you want to grow it quickly every 90 days if they remove the flag from your account of course w/ consistent use.

Ok...

Amex.... do you use the Platinum benefits enough to offest the AF? If not, close it or downgrade at least to Gold if you eat out a bit for less than 1/2 the AF Is there any overlap in benefits w/ BBP?? Im a frequent traveler plus the uber credit, flight credit etc it pays for itself. It's my daily. The BBP I just got and will be using for business expenses exclusively.

Disco.... we know

Chase... Slate is useless after the initial perk of $0/0%... Either swap it for a CFU for 1.5% or if you're thinking about another Chase card it could be that card w/o a bonus or combine them into a single card.. I'm thinking about calling in and combining these two and do a PC into the FU. What happends to the old tradelines when you combine them?

PP EX.... not familiar but, unless it's really providing some value.... Useless. Got it when I thought I needed it. 28% APR and zero perks. Close it?

PF - HP CLI's usually... kind of a 50/50 split on opinion around here depending on who you ask about keeping a card with themTheir products have been good I'm thinking about growing this one with them.

BBSC - good for a discount but, with premium cards in your pocket you might offset them with offers unless you're using it for extended financing on appliances or something... I enjoy the 0% APR for 18 months. That's the only reason It's still alive.

Sync... older card but.... where can you use it and what benefit is it providing?Zero benefits other than a relationship with Zynchrony and account age.

FB... gussing this is FNBO co-brand for somewhere?Yes. This is the FNBO.

NFCU.... combine them unless they're offering a hidden value by having 2 accounts... this will give you your mega CL to bring the other up to though not all will see them as an equal for lending since they give out CL's like candy... but it's a start to showing you can manage a 50K CL I can combine them into the new Amex rewards which provides 3X in categories I can benefit from. Not a bad idea to combine them to a $44K credit line, and apply down the road for second CC with them. If I combine it into the new Amex rewards one would it keep the older account age?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategizing my next move

Chase - pick the oldest and fold the CL into that one and then PC it to the one you want to keep the age.

-- I do it online so there's a paper trail if they mess things up.

-- move the CL into the older card (new messaage)

-- convert the older card (new messaage)

PP - it's an age thing for now... if you don't use it they'll close it for you eventually

NFCU - some of the nuances are you might have to push them a bit to combine them as it's not their policy to do it normally... if you want age then you move the CL into the older account similar to Chase above.... then you can try to convert it later on to the Amex version for the increased earnings.

-- since one of them is new... wait it out a bit before you try to combine them into a single card... I know there some 3/90 thing that gets mentioned around here for AR's and CLI's.... they might shoot it down for a combination/conversion if you do it too soon... maybe swing all but 5K over to the Amex for the time being to report the higher limit in the meantime. Not sure how shifting the limit will affect any potential CLI in the near term but, the increased CL is nice to have so you're not shooting up to 87% like your SS shows right now.