- myFICO® Forums

- Types of Credit

- Credit Cards

- Strategy to get to 21 cards...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strategy to get to 21 cards...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

My situation is a little different, but I feel your pain. I applied for the Plat on 6/2019 and was approved for a $200 limit with a $99 deposit. On 1/2020 I received an auto CLI to $500. I'm not 100% sure when it was graduated to unsecured but it was long ago. Since then I've been unable to get a limit increase and the same goes for a product change. I've tried calling by phone and using the Cap1 PC link. I'm still holding out for them to relent on this, they helped me out when my credit was in bad shape and I'm loyal. If nothing else, sock drawer for the oldest account.

I applied for the QS card back in 11/2020 after getting frustrated with the lack of progress on the Plat, it was approved for a $500 CL. A few days ago I requested CLI and got $600. I have been in repair mode the whole time and I really should have waited to make this request because my scores were still depressed by an unexpected medical collection account that has since been removed and by high revolving utilization (88%) which has also since been paid down to under 20% both overall and individually, but not yet reported. I only did the Cap1 CLI because I got a wild hair and took a shot at a CLI on my Discover, becoming emboldened by the huge increase from $1300 > $4500.

You have 2 great NAVY cards that have the capacity to grow big time. my cash rewards went from 3700 to 15700 in 11 months, ymmv.

I grew that card with low income 36k and scores in the high 600's.

Take some time and read through the navy fed master thread for tips.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos in the 680 - 690 range, the 9's slightly higher than the 8's

My vantage scores 708 - 711

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SUPERSQUID wrote:

@dytch2220 wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

My situation is a little different, but I feel your pain. I applied for the Plat on 6/2019 and was approved for a $200 limit with a $99 deposit. On 1/2020 I received an auto CLI to $500. I'm not 100% sure when it was graduated to unsecured but it was long ago. Since then I've been unable to get a limit increase and the same goes for a product change. I've tried calling by phone and using the Cap1 PC link. I'm still holding out for them to relent on this, they helped me out when my credit was in bad shape and I'm loyal. If nothing else, sock drawer for the oldest account.

I applied for the QS card back in 11/2020 after getting frustrated with the lack of progress on the Plat, it was approved for a $500 CL. A few days ago I requested CLI and got $600. I have been in repair mode the whole time and I really should have waited to make this request because my scores were still depressed by an unexpected medical collection account that has since been removed and by high revolving utilization (88%) which has also since been paid down to under 20% both overall and individually, but not yet reported. I only did the Cap1 CLI because I got a wild hair and took a shot at a CLI on my Discover, becoming emboldened by the huge increase from $1300 > $4500.

You have 2 great NAVY cards that have the capacity to grow big time. my cash rewards went from 3700 to 15700 in 11 months, ymmv.

I grew that card with low income 36k and scores in the high 600's.

Take some time and read through the navy fed master thread for tips.

Honestly i been so fed up with the whole credit repair journey because it seems as if every few steps ahead i took theres no rewards at one point i payed all my credit cards down to zero, i got one of those self credit builder loans,and my scores moved up slightly maybe 20-30 points and i was 588 and i went to 617 and it pretty much sat there the whole time and so i honestly gave up its as if they are very biased on who gets a high score and who doesnt i recently decided to give it another try i had some collections from when i was in the hospital come around and a att bill and a sprint bill from when i hit a rough patch at my last job. So im going to retry and see if maybe this time they will give me a higher score. Where can i find the Navy Fed Master Thread?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

In several places this thread touches on the adage "Credit repair is a marathon, not a sprint". For folks working through the repair process, until the remaining bad marks on your credit report have aged out and fallen off, your scores will continue to get dinged, often harshly so. Speaking strictly for myself, during my repair journey, which took over 7 years, the best my scores ever got were about 715 (and even that score was often fleeting), however, as soon as I bounced over to a clean score card my scores rocketed up into the realm of 800 and above, yes, literally every FICO score was above 800 in one shot. What was interesting is most of my FICO scores had never even reached 700, and then in one day, 800+.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 wrote:

Putting the chart aside and acknowledging the concerns about his bias due to being sponsored, are there any threads that go into examples of what he is saying that's wrong? I watch his channel casually but enjoy it. I'd like to get some facts about falsehoods he is perpetuating before I start changing my opinion on the guy.

There probably was a bit of hyperbole from regulars here. It's likely that Sebby is say 80% right (so a lot of what he says is true). In the past, he has been wrong about some critical features about Amex cards and probably Chase, the trackers here can probably provide more examples and details. It's often some small points that won't matter to many, until they do, so the general dislike is of someone acting as an expert (and now considered one because "He's a big Youtuber!") who gets some stuff significantly wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Horseshoez wrote:In several places this thread touches on the adage "Credit repair is a marathon, not a sprint". For folks working through the repair process, until the remaining bad marks on your credit report have aged out and fallen off, your scores will continue to get dinged, often harshly so. Speaking strictly for myself, during my repair journey, which took over 7 years, the best my scores ever got were about 715 (and even that score was often fleeting), however, as soon as I bounced over to a clean score card my scores rocketed up into the realm of 800 and above, yes, literally every FICO score was above 800 in one shot. What was interesting is most of my FICO scores had never even reached 700, and then in one day, 800+.

Mine sat in the 640s with low utilization and 620s with high utilization the entire time I was in repair mode. As soon as the derogatory items aged off it was a 70 pt increase across the board. Utilization has been paid to under 20% about 2 days ago but I will not know where that lands me until the cards report. C'mon 720s!

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Herb8108 wrote:

@SUPERSQUID wrote:

@dytch2220 wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

My situation is a little different, but I feel your pain. I applied for the Plat on 6/2019 and was approved for a $200 limit with a $99 deposit. On 1/2020 I received an auto CLI to $500. I'm not 100% sure when it was graduated to unsecured but it was long ago. Since then I've been unable to get a limit increase and the same goes for a product change. I've tried calling by phone and using the Cap1 PC link. I'm still holding out for them to relent on this, they helped me out when my credit was in bad shape and I'm loyal. If nothing else, sock drawer for the oldest account.

I applied for the QS card back in 11/2020 after getting frustrated with the lack of progress on the Plat, it was approved for a $500 CL. A few days ago I requested CLI and got $600. I have been in repair mode the whole time and I really should have waited to make this request because my scores were still depressed by an unexpected medical collection account that has since been removed and by high revolving utilization (88%) which has also since been paid down to under 20% both overall and individually, but not yet reported. I only did the Cap1 CLI because I got a wild hair and took a shot at a CLI on my Discover, becoming emboldened by the huge increase from $1300 > $4500.

You have 2 great NAVY cards that have the capacity to grow big time. my cash rewards went from 3700 to 15700 in 11 months, ymmv.

I grew that card with low income 36k and scores in the high 600's.

Take some time and read through the navy fed master thread for tips.

Honestly i been so fed up with the whole credit repair journey because it seems as if every few steps ahead i took theres no rewards at one point i payed all my credit cards down to zero, i got one of those self credit builder loans,and my scores moved up slightly maybe 20-30 points and i was 588 and i went to 617 and it pretty much sat there the whole time and so i honestly gave up its as if they are very biased on who gets a high score and who doesnt i recently decided to give it another try i had some collections from when i was in the hospital come around and a att bill and a sprint bill from when i hit a rough patch at my last job. So im going to retry and see if maybe this time they will give me a higher score. Where can i find the Navy Fed Master Thread?

here is the master thread https://ficoforums.myfico.com/t5/Credit-Card-Applications/Navy-Federal-Datapoints-Thread-for-Members...

Scores are a very long term issue. My scores have been relatively the same for a year.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos in the 680 - 690 range, the 9's slightly higher than the 8's

My vantage scores 708 - 711

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

My strategy to get to 21 cards ...I'd have to close a big amount of them.

Is the magical 21# like playing blackjack or something?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 wrote:

@Remedios wrote:

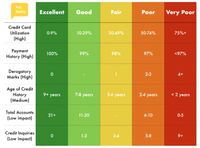

@dytch2220 wrote:The root source of the information may well be Credit Karma, however, I got it from a YouTube channel called "Ask Sebby". See chart below.

As far as Sebby goes, he's like those people on Ancient Aliens, he doesn't believe 💩 he's saying but he's getting paid to say it.

I'm asking this to anyone including Remedios, because a few have commented about Sebby.

It sounds like the chart is not inaccurate, from what some have said, but easy to misinterpret because it is a representation of what people in that score range tend to have and not what one needs to have. Is this right?

Putting the chart aside and acknowledging the concerns about his bias due to being sponsored, are there any threads that go into examples of what he is saying that's wrong? I watch his channel casually but enjoy it. I'd like to get some facts about falsehoods he is perpetuating before I start changing my opinion on the guy.

Okay, so aggregate utilization thresholds are correct in terms of scoring.

Payment history doesn't have excellent, good etc percentages. You either have a clean profile or you don't.

Derogatory marks, sure one late isn't that much of a big deal after couple of years but once you get to 60 days late you take a huge hit, then another one when that same late goes 90, 120, then status becomes charged off. So the penalty is now assessed on that last late that led to charge off. Getting another charge off wouldn't move the needle too much.

Chart is correct that those with perfect score do not have any derogatory info, but it is not correct in how it describes payment history and how negatives are scored.

About AAoA, I'm not sure if Fico algorithm thinks 9 years is good stuff, but scoring wise, higher is better. You'd need to wait and see if others whose average age is below 9 achieved perfect score.

Number of accounts, pick any number between 1 and infinity, you can still get to 850, it's just going to take longer.

Also, as stated multiple times upthread, that's including all accounts, student loans, personal and auto loans, mortgages, and credit cards. Those would have been acquired over a long period of time because if they weren't, it would conflict with numbers thrown in for AAoA. To get to 9 years, one has to have lengthy history and non itchy finger.

Inquiries, chart over simplifies. Sometimes you lose points, there are times when you don't lose points because of binning. Find some older posts by in scoring forum and you'll see. I'd agree that a lot of HPs look gnarly, but without applying for a year, no scoring effect. It isn't something that's going to prevent you from perfect score longer than a year if everything else is perfect.

You can watch whichever channel you wish, you just need to be aware that if something is being sold, someone is benefiting from it.

Let's say you didn't ask and decided you were going for 21 cards. You might have had some success with first few cards, then a few toy limits, then denial upon denial.

So, you would have ruined AAoA, you'd get inquiries, you'd be moving away from your goal in negative direction for considerable amount of time while being weighted down with cards you don't need/use, but they are yours because Sebby

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

May I propose a simple action - go to the comment section and Ask Sebby (pun totally intended) what is the scoring difference between 3 and 4 derogs.

Then, you can ask what's the difference between 8 and 9 hard pulls.

Also, ask why 21.

Maybe ask how can something be "good" payment history when "good" involves multiple derogs.

I get it, he didn't make the chart, but if he's using the chart to make money, he's putting his weight behind it, so surely he knows those answers.

Then, you can repeat process in other videos, ask questions that pertain to you and your situation. If he talks you out of applying for a card he's peddling at the moment (complete with referral link), believe him.

My dislike has nothing to do with him being wrong about Amex at some point, it's more along the lines of instagram influencer selling you weight loss tea.

You're either going to laugh and walk away, or if you're desperate, you'll drink tea (which is typically a mild laxative). Sure, one lost weight but fat is still there. So, they didn't lie but they were ways away from being right.

That's Sebby's channel, he sells tea. How much faith you put behind his tea, that's up to you.

Basically what I'm saying is, it should be up to Sebby to break it down and tell you (and the rest of his audience) why/how he knows it's right instead of some members here telling you why it's wrong.

If he bothers with answering and has some insider knowledge, good for him and people who watch.

If he doesn't, still good for him, he made his money by making that video and will continue making it with each click.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SUPERSQUID wrote:

@dytch2220 wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

My situation is a little different, but I feel your pain. I applied for the Plat on 6/2019 and was approved for a $200 limit with a $99 deposit. On 1/2020 I received an auto CLI to $500. I'm not 100% sure when it was graduated to unsecured but it was long ago. Since then I've been unable to get a limit increase and the same goes for a product change. I've tried calling by phone and using the Cap1 PC link. I'm still holding out for them to relent on this, they helped me out when my credit was in bad shape and I'm loyal. If nothing else, sock drawer for the oldest account.

I applied for the QS card back in 11/2020 after getting frustrated with the lack of progress on the Plat, it was approved for a $500 CL. A few days ago I requested CLI and got $600. I have been in repair mode the whole time and I really should have waited to make this request because my scores were still depressed by an unexpected medical collection account that has since been removed and by high revolving utilization (88%) which has also since been paid down to under 20% both overall and individually, but not yet reported. I only did the Cap1 CLI because I got a wild hair and took a shot at a CLI on my Discover, becoming emboldened by the huge increase from $1300 > $4500.

You have 2 great NAVY cards that have the capacity to grow big time. my cash rewards went from 3700 to 15700 in 11 months, ymmv.

I grew that card with low income 36k and scores in the high 600's.

Take some time and read through the navy fed master thread for tips.

I'm very happy with the Navy cards, they've been a great bank. I'll read through the thread, thanks.

Revolving Accounts