- myFICO® Forums

- Types of Credit

- Credit Cards

- Sync PPMC to use Vantage 4.0 for CLI's

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sync PPMC to use Vantage 4.0 for CLI's

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

@K-in-Boston wrote:

@Jnbmom wrote:I don't know why this is such a surprise, they used TU FICO 8 which is the score they provided to us and based their CLIs on, now they switched to Vatage 4.0 which they provide to us , hence that is what they will be using..

It's a surprise (if the chat agent was not mistaken) because other lenders that provide Vantage scores do not actually use them for lending decisions. This would likely be a big boost for those with marginal FICO scores and hurt those with above average scores from the data points we have seen, at least with VS3.

For TU, my current FICO 08 score is 802, while my VS3 score is 754 (about the closest it has ever been; it's sometimes 100+ points lower) and my VS4 score is only 742.

Because of the way the VS algorithms work, there are probably a lot of people here with FICO scores in the mid-600s that might have an easier time getting approvals and CLIs due to inflated VS scores than some people with 770-800 or higher FICO scores.

I see your point![]()

Just with all the recent changes and talks regarding the Vantage 4.0 and who may start to use it, I just figured this was to happen down the road, and now with synch it may be ust a matter of time?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

I think it is most likely a cost savings things providing a vs4 score vs. FICO score online. I am pretty certain that CSR was confused as last letter I got from sync approx 1 week ago mentioned FICO TU score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

My TU Fico 8 and VS 4.0 scores are identical, so the change I suppose doesn't matter to me.

Interesting though is that my VS 4.0 runs 12-13 points higher than my VS 3.0. I wonder if the VS 4.0 model gives a little more weight to thick/aged files or something. I started a thread on this a month or so back, but no one really knew any of the differences for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

@K-in-Boston wrote:

@Jnbmom wrote:I don't know why this is such a surprise, they used TU FICO 8 which is the score they provided to us and based their CLIs on, now they switched to Vatage 4.0 which they provide to us , hence that is what they will be using..

It's a surprise (if the chat agent was not mistaken) because other lenders that provide Vantage scores do not actually use them for lending decisions. This would likely be a big boost for those with marginal FICO scores and hurt those with above average scores from the data points we have seen, at least with VS3.

For TU, my current FICO 08 score is 802, while my VS3 score is 754 (about the closest it has ever been; it's sometimes 100+ points lower) and my VS4 score is only 742.

Because of the way the VS algorithms work, there are probably a lot of people here with FICO scores in the mid-600s that might have an easier time getting approvals and CLIs due to inflated VS scores than some people with 770-800 or higher FICO scores.

Exactly. We also tend to forget that the majority of people don't live within this community and are unaware of the many different scoring models. So, if my mom sees her new credit score under her Amazon account, she's going to think that's the score that matters. If they offer one score (VS) and use another for credit decisions (FICO), it could be misleading. I'm repeating myself from my previous post, but that's why I don't understand why Chase and Cap One offer Credit Journey or Creditwise and promote the heck out of it, but they don't use those for their credit decisions. That's almost like an athlete doing Nike commercials, but wearing Adidas in reality (breach of contract aside).

I personally don't care what score they use. I just hope that the switch to VS is not just to offer a cheaper benefit with no real value.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

@Anonymous wrote:My TU Fico 8 and VS 4.0 scores are identical, so the change I suppose doesn't matter to me.

Interesting though is that my VS 4.0 runs 12-13 points higher than my VS 3.0. I wonder if the VS 4.0 model gives a little more weight to thick/aged files or something. I started a thread on this a month or so back, but no one really knew any of the differences for sure.

I don't know the real differences either, but from I've noticed over time, VS 3 doesn't like baddies regardless of how old; it's very sensitive to changes in utilization per account, and it doesn't seem to take into account closed tradelines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

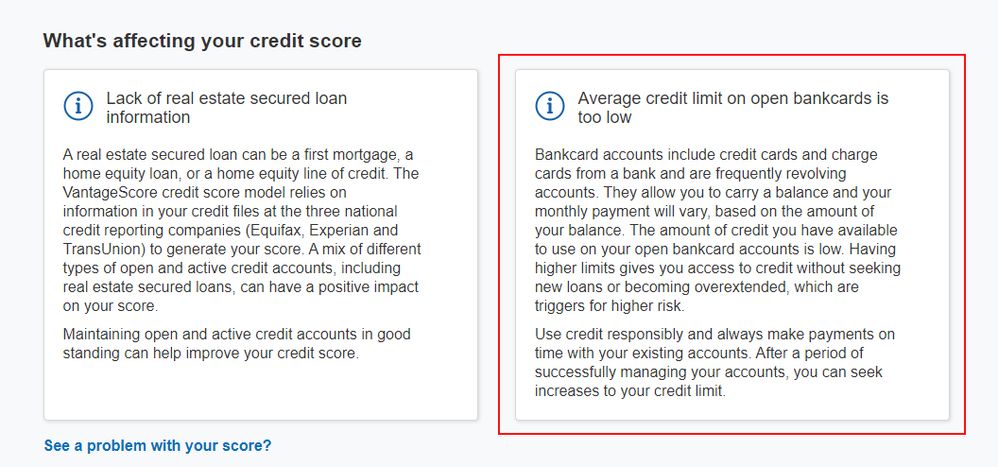

I'm thinking VS 4.0 doesn't penalize paid collections - I have one CO from 2016 and my VS 4.0 is a 790 per the PPMC site. That's awfully close to my EX Fico 9, which is an 801 as of today. TU and EX Fico 8 scores are in the low 700s, understandably.

Interestingly, negative reason code 2 of 2 (after lack of mortgage accts) is that my average credit limits are too low. Didn't think that stuff mattered for scoring purposes.

Chase Freedom Flex $13.7K | Discover IT $13.5K

WF Propel $8000 | WF Cash Wise $1500 | USB Cash+ 5000

Amex Business Prime $20K | Amex ED $4800 | Amex Gold | Uber Visa $1500

FICO 8 Scores (2/21/21): 767 TU, 770 EQ, 771 EX

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

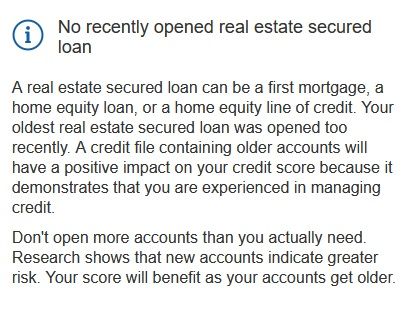

Vantage 4 sure seems to like cryptic messages about mortgage loans and/or lack thereof. Here's my message:

Notice the heading "no recently opened real estate loan" and then it the body it tells me my oldest real estate loan was opened "too recently". Um, so which is it: I have too recently opened RE loans or I have none at all??? ![]()

Answer: Actually, neither. I have a Home Equity LOC opened Aug. 2017 with Penfed. But both TU & EX lump it in with revolving accounts, only EQ lists it separately as a Real Estate loan.

And as opposed to Fico detailing items affecting your score as a percentage:

Payment History 35%

Amount you owe 30%

Length of credit history 15%

New credit 10%

Types of credit 10%

Vantage 4 gives you much more vague impacts:

Total Credit Usage, Balance and Available Credit - "Exremely Influential", also noting "Focus on keeping revolving balance low, under 30%"

Credit Mix and Experience - "Highly Influential"

Payment History - "Moderately Influential"

Age of Credit History - "Less Influential"

New Accounts - "Less Influential"

On my PPMC VS4 score I get dinged for "Too many bankcards with a high balance", I am committing the mortal sin of having a couple CCs in the 40-48% util. They're 0% APR and not large balances, so my attitude is "get over it".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

@DaveInAZ wrote:

On my PPMC VS4 score I get dinged for "Too many bankcards with a high balance", I am committing the mortal sin of having a couple CCs in the 40-48% util. They're 0% APR and not large balances, so my attitude is "get over it".

Right, but that attitude changes the score, um, not at all!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sync PPMC to use Vantage 4.0 for CLI's

@longtimelurker wrote:

@DaveInAZ wrote:

On my PPMC VS4 score I get dinged for "Too many bankcards with a high balance", I am committing the mortal sin of having a couple CCs in the 40-48% util. They're 0% APR and not large balances, so my attitude is "get over it".

Right, but that attitude changes the score, um, not at all!

Well yes, of course. But I don't need my score changed, my scores are good enough to get what I want, if I wanted anything which I don't, so I'm just saying I don't care about the scoring models' endless nitpics.