- myFICO® Forums

- Types of Credit

- Credit Cards

- Synchrony bank nsf returned payments

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synchrony bank nsf returned payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Synchrony bank nsf returned payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

@Anonymous wrote:

Does synchrony bank attempt to resubmit the returned payments?

Hi and welcome to myFICO

I'm not 100% sure but banks operate way differently now than in the old days where a bank would resubmit a check 2-3 times before returning to the bank marked NSF.

Since you know it's a possibility, I suggest getting out in front of it by calling Synchrony and alerting them. And, if you have the funds in your account, send another payment ASAP so it's covered quickly. I'm not saying that this would prevent AA but it's possible.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

@Anonymous wrote:

Only reason I ask is I just recently switched banks and I forgot to turn off my auto pay I never closed out the bank the auto pay came out of, I’m just going to add the payment x2 I guess it wouldn’t hurt to do a double payment if they resubmit. I was mainly curious.

Great advice given by CreditInspired , I would also call in and explain what happened,

and ask what would they suggest to be the best thing to do at this point.

I have found calling lenders when there is a problem and being pro active can help.

Head it off at the pass type thing. Good Luck OP!

Post back with results if you can?, as this almost always helps others![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

@Anonymous wrote:

So I called and the operator wasn’t very informative he just said that everything was paid and he had nothing on his screen... so I told him I’d like to make another payment for the same amount I suppose wait and see? Was a very odd conversation he just said my balance was zero maybe they haven’t gotten the bounce back?

Thanks for posting back and I forgot, Welcome to The Forum!

I would probably follow up with another phone call maybe in a day or two. Just to keep eyes on this.

Also if you ever feel like the Rep is not knowledgeable, or you are not getting anywhere, you can always "HUCA"

Hang up call again. And speak to another Rep.

Wishing you a good outcome!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

If there really is no way for you to keep the ACH auto draft from bouncing then I suggest doing a "Push" payment from your new acct Right Away as maybe, just maybe it might beat the bounced one. Doesn't guarantee avoiding AA from them but better than doing nothing! GL!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

@JR_TX wrote:If there really is no way for you to keep the ACH auto draft from bouncing then I suggest doing a "Push" payment from your new acct Right Away as maybe, just maybe it might beat the bounced one. Doesn't guarantee avoiding AA from them but better than doing nothing! GL!

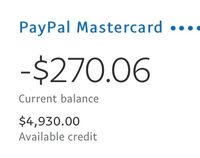

Neither of my banks (TD and BMO) are able to push payments to the Paypal MasterCard.

In December, my bill was around 1850. I forgot about another payment coming out and my $1500 payment bounced. Payment was Dec 18th (a day or two after statement generated). I came back on the 24th, noticed it on my bank account and immediately made another payment for as much as it would allow (about 469 remaining balance and new purchase). And did the same the next day, before it was applied.

On the 30th they submitted the original payment, so I ended up with a $469 credit on the account. - nothing about the NSF shows on my Synchrony account, only at BMO.

And for anyone who ever wants to over pay in order to have extra credit available - nope. It stays the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank nsf returned payments

@Anonymous wrote:

@JR_TX wrote:If there really is no way for you to keep the ACH auto draft from bouncing then I suggest doing a "Push" payment from your new acct Right Away as maybe, just maybe it might beat the bounced one. Doesn't guarantee avoiding AA from them but better than doing nothing! GL!

Neither of my banks (TD and BMO) are able to push payments to the Paypal MasterCard.

In December, my bill was around 1850. I forgot about another payment coming out and my $1500 payment bounced. Payment was Dec 18th (a day or two after statement generated). I came back on the 24th, noticed it on my bank account and immediately made another payment for as much as it would allow (about 469 remaining balance and new purchase). And did the same the next day, before it was applied.

On the 30th they submitted the original payment, so I ended up with a $469 credit on the account. - nothing about the NSF shows on my Synchrony account, only at BMO.

And for anyone who ever wants to over pay in order to have extra credit available - nope. It stays the same.

Hmmm... you can't do it to Synchrony instead? The account numbers should route through the system where they're supposed to go. My bank didn't have an entry for B&H so I chose Synchrony Bank instead and did a test push of $1 and it went through, paid the full balance the next day and that went through.