- myFICO® Forums

- Types of Credit

- Credit Cards

- Synovus offering 0% for 12 mos on purchases and BT...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synovus offering 0% for 12 mos on purchases and BTs with no BT fee.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Synovus offering 0% for 12 mos on purchases and BTs with no BT fee.

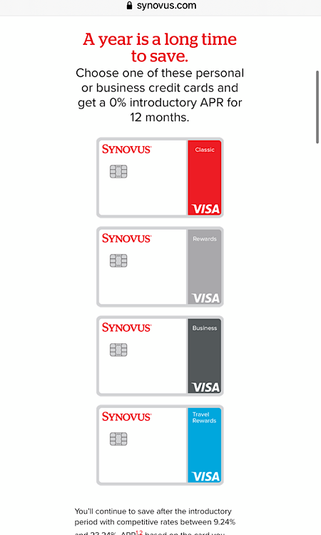

Normally Synovus only offers the 0% for 12 months for purchases and BTs offers on their Classic card, but they are offering it on their Rewards card, their Business card, and the Travel Rewards card until the end of the year. They also do not charge a BT fee.

For those that don't know, their Rewards card is very similar to the now discontinued BBVA ClearPoints card. It has the selectable 3% and 2% category that has the same awesomely broad categories as the ClearPoints card did. The Travel Rewards card is like also like the ClearPoints card with a selectable 3% and 2% category, but also with a 5% up to $5K per year travel category.

They also have a Cash Rewards card that has a selectable 3% and 2% category, but also has 3% unlimited on dining, but it is not included in the 0% for 12mos category.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus offering 0% for 12 mos on purchases and BTs with no BT fee.

DW took the bait this evening and was approved for $13K SL. You do have to open a checking account to apply online.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus offering 0% for 12 mos on purchases and BTs with no BT fee.

@JNA1 wrote:Normally Synovus only offers the 0% for 12 months for purchases and BTs offers on their Classic card, but they are offering it on their Rewards card, their Business card, and the Travel Rewards card until the end of the year. They also do not charge a BT fee.

For those that don't know, their Rewards card is very similar to the now discontinued BBVA ClearPoints card. It has the selectable 3% and 2% category that has the same awesomely broad categories as the ClearPoints card did. The Travel Rewards card is like also like the ClearPoints card with a selectable 3% and 2% category, but also with a 5% up to $5K per year travel category.

They also have a Cash Rewards card that has a selectable 3% and 2% category, but also has 3% unlimited on dining, but it is not included in the 0% for 12mos category.

Thanks JNA. You mentioned before that this is a similar replacement for the BBVA Clear Points. I am torn on breaking out the shovel for this Or the Custom Cash from Citi....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus offering 0% for 12 mos on purchases and BTs with no BT fee.

@NoMoreE46 wrote:

@JNA1 wrote:Normally Synovus only offers the 0% for 12 months for purchases and BTs offers on their Classic card, but they are offering it on their Rewards card, their Business card, and the Travel Rewards card until the end of the year. They also do not charge a BT fee.

For those that don't know, their Rewards card is very similar to the now discontinued BBVA ClearPoints card. It has the selectable 3% and 2% category that has the same awesomely broad categories as the ClearPoints card did. The Travel Rewards card is like also like the ClearPoints card with a selectable 3% and 2% category, but also with a 5% up to $5K per year travel category.

They also have a Cash Rewards card that has a selectable 3% and 2% category, but also has 3% unlimited on dining, but it is not included in the 0% for 12mos category.

Thanks JNA. You mentioned before that this is a similar replacement for the BBVA Clear Points. I am torn on breaking out the shovel for this Or the Custom Cash from Citi....

I guess it comes down what benefits you the most. Until I got my AOD card, I ran all my utilities, cell phone, internet/cable, and car insurance through my BBVA card. That monthly spend was around $1000 per month, which is the max on the Synovus card per month (the 3% category is capped at $3K per quarter). This comes out to be $360 per year. The Citi CC card would yield a max of $300 per year.

We are eventually going to get the Citi CC as well, but it's kind of a narrow, hole filling card with $500 per month cap.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards: