- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: The end to Amex Airline GC workaround ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The end to Amex Airline GC workaround ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

It will definitely be a lot harder to use the credit going forward which would probably steer many people away from the airline fee credit cards. Looking on the bright side, this would give me no reason to keep my AA Plat going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

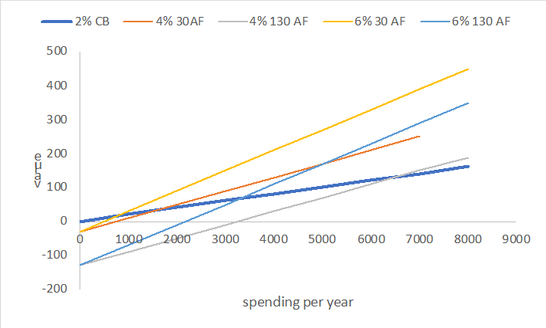

I will assess this after a year and see where my spending it. For the gold, depending on how much you value the MR points, one needs to spend 2k to 5k more to beat a 2% card if the AF is changed from 30 to 130.

If my spending won't support this, I will just close it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

1. Find flight ticket, let's say it costs A.

2. Buy gift card worth B, ensure A-B is around 100 or less (amex reimbursement mechanism seems to be number based)

3. Apply the gift card, put the remainder balance on amex and it will then be credited for the amount of A-B.

Some DP at flyer talk seems to suggest this will work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

So basically you buy a gift card then use it as a partial payment towards a flight and it should trigger the credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

Is anyone really shocked if they did plug the loophole? Bloggers, such as TPG, basically did it in. Obviously the credit was never meant to cover GC purchases. I wouldn't be surprised at all if Amex's RAT team has simply decided enough is enough. They want people who are going to use the card for travel purchases (not gift cards), and they of course want some amount of breakage. With the gift card thing, there is no (or very reduced) breakage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

@Anonymous wrote:

It's hard to imagine amex doesn't know this method.

Amex also needs to know, and I bet they do, that shutting down this will lead to loss of many business as well.

Yes, it's a loophole, but amex is a beneficiary of it too.

The thing is that on some level they want to lose that business. Amex doesn't want people who are exploiting loopholes. They want to advertise travel credits and pay them out to legitimate users and/or pay out as little as possible. This loophole makes it too easy for anyone to use, meaning people who really cannot justify the card are justifying it, coming ahead against the AF, and Amex is losing money.

It sucks, but I don't think they will lose any business they really are concerned about

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

I'm hoping this will make the Centurion Lounges less crowded.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

@Anonymous wrote:

Yea it sucks because I literally just got the BBP to compliment my gold. My AF is due in October so I will go from there.

So basically you buy a gift card then use it as a partial payment towards a flight and it should trigger the credit?

idea is that amex will reimburse anything around 100 or less coming from an airline, because it thinks that much amount cannot be a ticket, so it must be a fee.

this seems to be the case at least with delta, as people has reported amex credit 100 or more even if its ticket cost.

this has not been tested with AA, at least I don't think it has been tested. But if AA GC is out of the window, this may just worth a try.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

Like most people, I never buy anything while in flight so that credit being limited to that would be pretty useless. I don’t like having to go out of my way to purchase something I normally wouldn’t.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The end to Amex Airline GC workaround ?

@kdm31091 wrote:

@Anonymous wrote:

It's hard to imagine amex doesn't know this method.

Amex also needs to know, and I bet they do, that shutting down this will lead to loss of many business as well.

Yes, it's a loophole, but amex is a beneficiary of it too.The thing is that on some level they want to lose that business. Amex doesn't want people who are exploiting loopholes. They want to advertise travel credits and pay them out to legitimate users and/or pay out as little as possible. This loophole makes it too easy for anyone to use, meaning people who really cannot justify the card are justifying it, coming ahead against the AF, and Amex is losing money.

It sucks, but I don't think they will lose any business they really are concerned about

I completely agree with you on this.

The only small caveat is that when you fly premium cabin and/or have airline status you already get all these things for "free" that the credit covers, so the GC trick was a nice way for those people to utilize the credits.

As someone that has $550 a year in Amex Airline credits. It won't make me run to cancel my cards but if this pans out it will make me focus on the earning potential of the cards more as I will have to offset those AF's somehow.

Thankfully I've already used all $550 of the airline credits for this year.

Here's to hoping that Delta GC's dont change, as that will be my stratergy for next year. Will be stockpiling these for a rainy day when my AA flying will be over.

Total Revolving Limits $254,800